Lenovo 2014 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199

|

|

158 Lenovo Group Limited 2013/14 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

9 Taxation

(continued)

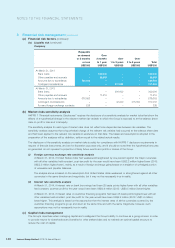

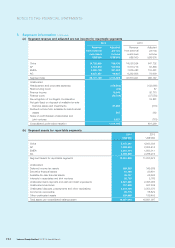

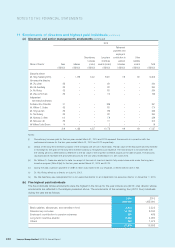

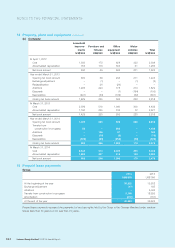

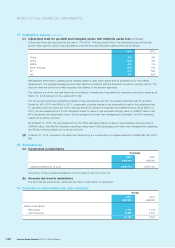

The tax credit/(charge) relating to components of other comprehensive income is as follows:

2014 2013

Before tax Tax credit After tax Before tax Tax charge After tax

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Fair value change on

available-for-sale financial

assets (2,288) –(2,288) (4,057) –(4,057)

Investment revaluation reserve

reclassified to consolidated

income statement on

disposal of an available-for-

sale financial asset (20,526) –(20,526) – – –

Fair value change on

cash flow hedges (41,389) 3,101 (38,288) 19,798 (26) 19,772

Remeasurements of post

employment benefit

obligations 3,988 189 4,177 (17,174) (1,632) (18,806)

Exchange reserve reclassified to

consolidated income

statement on disposal of

a subsidiary 1,250 –1,250 – – –

Currency translation differences (69,781) –(69,781) (118,602) –(118,602)

Other comprehensive income (128,746) 3,290 (125,456) (120,035) (1,658) (121,693)

Current tax ––

Deferred tax (Note 21) 3,290 (1,658)

3,290 (1,658)

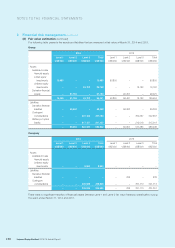

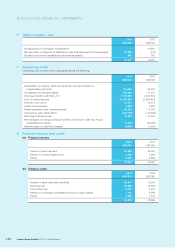

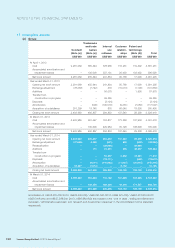

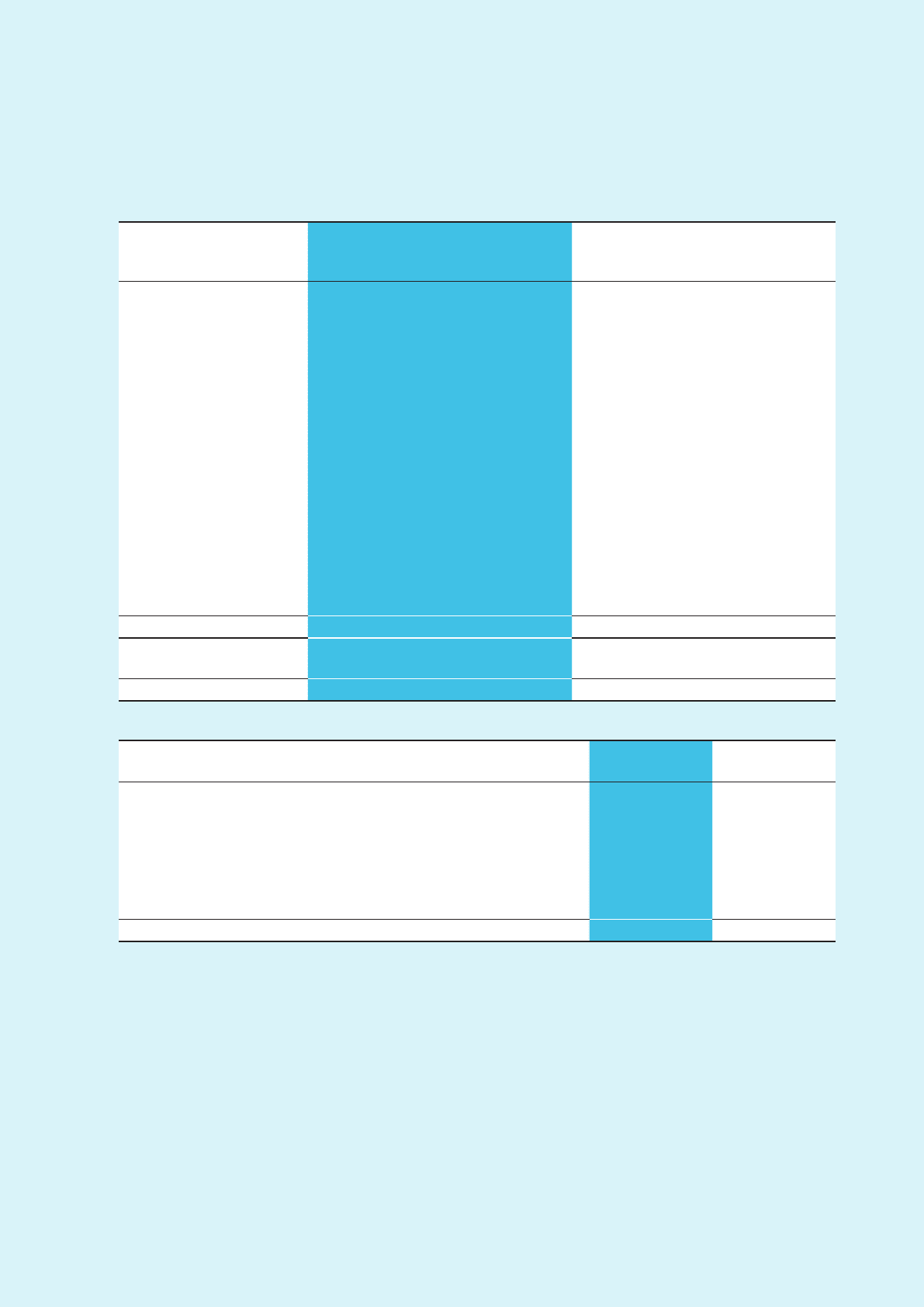

10 Employee benefit costs

2014 2013

US$’000 US$’000

Wages and salaries 1,868,018 1,665,223

Social security costs 152,371 148,311

Long-term incentive awards granted (Notes 30(a)) 80,274 77,724

Pension costs

– Defined contribution plans 129,813 107,847

– Defined benefit plans (Note 36) 21,799 46,601

Others 493,578 313,887

2,745,853 2,359,593

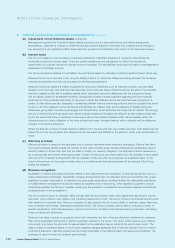

The Group contributes to respective local municipal government retirement schemes which are available to all qualified

employees in the Chinese Mainland. Contributions to these schemes are calculated with reference to the monthly average

salaries as set out by the local municipal government.

The Group participates in various defined contribution schemes, either voluntary or mandatory, for all qualified employees. The

assets of those defined contribution schemes are held separately from those of the Group in independently administered funds.

The Group also contributes to certain defined benefit pension schemes, details of which are set out in Note 36.