Lenovo 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

2013/14 Annual Report Lenovo Group Limited

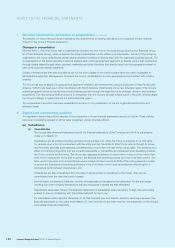

2 Significant accounting policies (continued)

(a) Subsidiaries (continued)

(ii) Business combinations

The Group applies the acquisition method to account for business combinations. The consideration transferred for

the acquisition of a subsidiary is the fair values of the assets transferred, the liabilities incurred to the former owners

of the acquiree and the equity interests issued by the Group. The consideration transferred includes the fair value

of any asset or liability resulting from a contingent consideration arrangement. Identifiable assets acquired and

liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values at the

acquisition date. The Group recognizes any non-controlling interest in the acquiree on an acquisition-by-acquisition

basis, either at fair value or at the non-controlling interest’s proportionate share of the recognized amounts of

acquiree’s identifiable net assets.

Acquisition-related costs are expensed as incurred.

If the business combination is achieved in stages, the acquirer’s previously held equity interest in the acquiree is re-

measured to fair value at the acquisition date; any gains or losses arising from such re-measurement are recognized

in profit or loss.

Any contingent consideration to be transferred by the Group is recognized at fair value at the acquisition date.

Subsequent changes to the fair value of the contingent consideration that is deemed to be an asset or liability

is recognized in the consolidated income statement or as a change to other comprehensive income. Contingent

consideration that is classified as equity is not re-measured, and its subsequent settlement is accounted for within

equity.

Goodwill is initially measured as the excess of the aggregate of the consideration transferred, the amount of any non-

controlling interest in the acquiree and, in a business combination achieved in stages the acquisition-date fair value of

any previous equity interest in the acquiree over the net identifiable assets acquired and liabilities assumed (Note 2(g)

(i)). If it is less than the fair value of the net assets of the subsidiary acquired, the difference is recognized directly in

the income statement.

(iii) Changes in ownership interests in subsidiaries without change of control

Transactions with non-controlling interests that do not result in loss of control are accounted for as equity

transactions – that is, as transactions with the owners in their capacity as owners. The difference between fair value

of any consideration paid and the relevant share acquired of the carrying value of net assets of the subsidiary is

recorded in equity. Gains or losses on disposals to non-controlling interests are also recorded in equity.

The potential cash payments related to put options issued by the Group over the equity of a subsidiary are accounted

for as financial liabilities when such options may only be settled other than by exchange of a fixed amount of cash or

another financial asset for a fixed number of shares in the subsidiary. The amount that may become payable under

the option on exercise is initially recognized at fair value as a written put option liability with a corresponding charge

directly to equity.

A written put option liability is subsequently re-measured at fair value as a result of the change in the expected

performance at each balance sheet date, with any resulting gain or loss recognized in the consolidated income

statement. In the event that the option expires unexercised, the written put option liability is derecognized with a

corresponding adjustment to equity.

(iv) Disposal of subsidiaries

When the Group ceases to have control, any retained interest in the entity is re-measured to its fair value at the

date when control is lost, with the change in carrying amount recognized in the consolidated income statement.

The fair value is the initial carrying amount for the purposes of subsequent accounting for the retained interest as an

associate, joint venture or financial asset. In addition, any amounts previously recognized as other comprehensive

income/expense in respect of that entity are accounted for as if the Group had directly disposed of the related

assets or liabilities. This may mean that amounts previously recognized as other comprehensive income/expense are

reclassified to the consolidated income statement.