ComEd 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

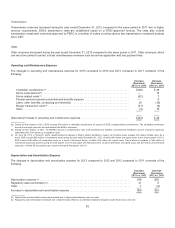

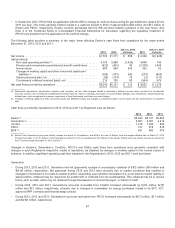

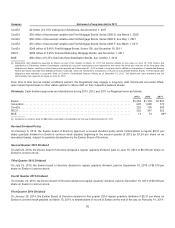

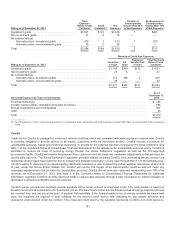

Short-Term Borrowings. Short-termborrowings incurred(repaid) during2013,2012 and2011 by Registrant were asfollows:

2013 2012 2011

Generation .................................................................................. $ 13 $(52)$—

ComEd ..................................................................................... 184 — —

BGE ....................................................................................... 135— —

Other (a).................................................................................... — (140)161

Exelon ..................................................................................... $332 $(192)$161

(a)Other primarilyconsistsofcorporate operationsand BSC.

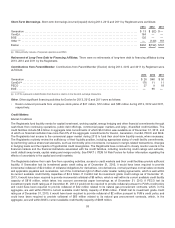

Retirement of Long-Term Debt to Financing Affiliates. There were no retirementsoflong-termdebttofinancingaffiliatesduring

2013,2012 and2011 by theRegistrants.

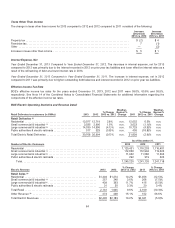

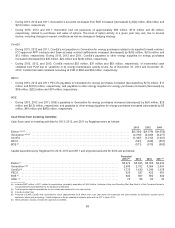

Contributions from Parent/Member. ContributionsfromParent/Member (Exelon)during2013,2012 and2011 by Registrant were

asfollows:

2013 2012 2011

Generation .................................................................................. $ 26 $48 $ 30

ComEd (a).................................................................................... 176 11 11

PECO ...................................................................................... 27918

BGE........................................................................................ — 66 —

(a)In 2013,representsindemnification fromExelon in relation to thelike-kindexchange transaction.

Other. Other significant financingactivitiesfor Exelon for 2013,2012 and2011 were asfollows:

•Exelon receivedproceeds fromemployee stock plansof $47 million,$72million and$38million during2013,2012 and2011,

respectively.

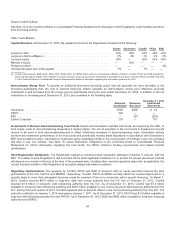

Credit Matters

Market Conditions

TheRegistrantsf

undliquidityneeds for capital investment,workingcapital,energy hedgingandother financial commitmentsthrough

cash flows fromcontinuingoperations, public debtofferings, commercial paper marketsandlarge, diversifiedcreditfacilities. The

creditfacilitiesinclude$8.4 billion inaggregate total commitmentsof which $6.6 billion wasavailable asofDecember 31,2013,and

of which no financial institution hasmore than 8% oftheaggregate commitmentsfor Exelon,Generation,ComEd, PECO and BGE.

TheRegistrantshadaccess to thecommercial paper market during2013 to fundtheirshort-termliquidityneeds, when necessary.

TheRegistrantsroutinelyreviewthesufficiency oftheirliquidityposition,includingappropriate sizingofcreditfacilitycommitments,

by performingvariousstress testscenarios, such ascommoditypricemovements, increasesinmargin-relatedtransactions, changes

inhedginglevelsandtheimpactsofhypothetical creditdowngrades. TheRegistrantshavecontinuedto closelymonitor eventsinthe

financial marketsandthefinancial institutionsassociatedwiththecreditfacilities, includingmonitoringcredit ratings andoutlooks,

creditdefault swap levels, capital raisingandmerger activity. See PART I. ITEM 1A Risk Factorsfor further information regardingthe

effectsofuncertaintyinthecapital andcreditmarkets.

TheRegistrantsbelievetheircash flowfromoperatingactivities, access to creditmarketsandtheircreditfacilitiesprovidesufficient

liquidity. If Generation lostitsinvestment gradecredit ratingasofDecember 31,2013,itwouldhavebeen requiredto provide

incremental collateral of$2.0billion ofcollateral obligationsfor derivatives, non-derivatives, normal purchase normal salescontracts

andapplicable payablesandreceivables, net ofthecontractual rightofoffset under master nettingagreements, which is well within

itscurrent available creditfacilitycapacitiesof $4.3billion.IfComEd lostitsinvestment gradecredit ratings asofDecember 31,

2013,itwouldhavebeen requiredto provideincremental collateral of$6million, which is well withinitscurrent available creditfacility

capacityof$816million, which takesinto account commercial paper borrowings asofDecember 31,2013. If PECO lostits

investment gradecredit ratingasofDecember 31,2013 itwouldnot berequiredto providecollateral pursuant to PJM’s credit policy

andcouldhavebeen requiredto providecollateral of$42million relatedto itsnatural gasprocurement contracts, which, inthe

aggregate,are well withinPECO’s current available creditfacilitycapacityof $599 million. If BGE lostitsinvestment gradecredit

ratingasofDecember 31,2013,itwouldhavebeen requiredto providecollateral of$2million pursuant to PJM’s credit policy and

couldhavebeen requiredto providecollateral of $85 million relatedto itsnatural gasprocurement contracts, which, inthe

aggregate,are well withinBGE’s current available creditfacilitycapacityof $465 million.

93