ComEd 2013 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

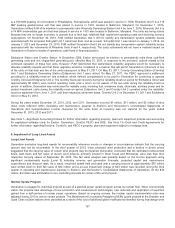

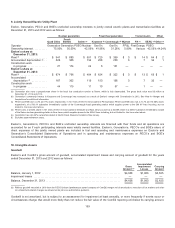

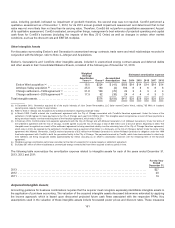

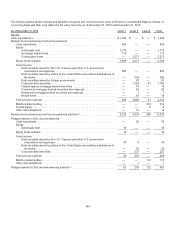

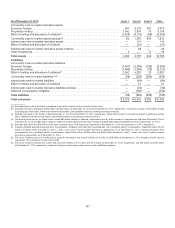

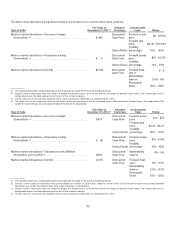

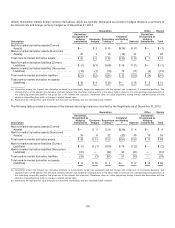

As of December 31, 2012 Level 1 Level 2 Level 3 Total

Commoditymark-to-market derivativeassets

Economic hedges .............................................................. 8613,1736414,675

Proprietarytrading ............................................................. 1,0422,078 733,193

Effectofnettingandallocation ofcollateral (f) ........................................ (1,823) (4,175) (58) (6,056)

Commoditymark-to-market assetssubtotal (g) ....................................... 801,076 656 1,812

Interest rate mark-to-market derivativeassets ....................................... — 114— 114

Effectofnettingandallocation ofcollateral ......................................... — (51)— (51)

Interest rate mark-to-market derivativeassetssubtotal ................................ — 63—63

Other Investments ............................................................. 2—1719

Total assets .................................................................. 4,0625,778 945 10,785

Liabilities

Commoditymark-to-market derivativeliabilities

Economic hedges .............................................................. (1,041)(2,289) (236) (3,566)

Proprietarytrading ............................................................. (1,084) (1,959) (78) (3,121)

Effectofnettingandallocation ofcollateral (f) ........................................ 2,0424,020 256,087

Commoditymark-to-market liabilities(g)(h) ........................................... (83)(228) (289) (600)

Interest rate mark-to-market liabilities.............................................. — (84) — (84)

Effectofnettingandallocation ofcollateral ......................................... — 51—51

Interest rate mark-to-market derivativeliabilitiessubtotal .............................. — (33)— (33)

Deferredcompensation obligation ................................................. — (102)— (102)

Total liabilities ................................................................ (83)(363)(289) (735)

Total net assets ............................................................... $3,979 $ 5,415 $ 656 $10,050

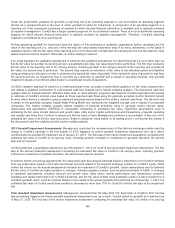

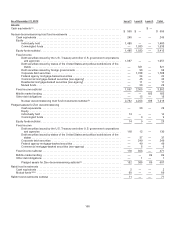

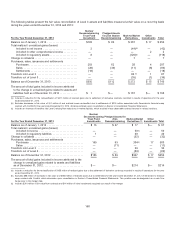

(a) Excludescertaincash equivalentsconsideredto beheld-to-maturityandnot reportedat fairvalue.

(b) Excludesnet assets(liabilities) of $(5) million and$30 million at December 31,2013 andDecember 31,2012,respectively. Theseitems consistofreceivablesrelated

to pendingsecuritiessales, interestand dividendreceivables, andpayablesrelatedto pendingsecuritiespurchases.

(c) Excludesnet assetsof$7million at bothDecember 31,2013 andDecember 31,2012,respectively. Theseitems consistofreceivablesrelatedto pendingsecurities

sales, interestand dividendreceivables, andpayablesrelatedto pendingsecuritiespurchases.

(d) Themutual funds heldbytheRabbi trustsinclude$53million relatedto deferredcompensation and$1million relatedto Supplemental Executive Retirement Plan at

December 31,2013,and$53million relatedto deferredcompensation and$16million relatedto Supplemental Executive Retirement Plan at December 31,2012.

(e) Excludes$32 million and$28million ofthecash surrender value oflifeinsuranceinvestmentsat December 31,2013 andDecember 31,2012,respectively.

(f) Includescollateral postings (received) fromcounterparties. Collateral (received) fromcounterparties, net ofcollateral paid to counterparties, totaled$6million,$(124)

million and$(26) million allocatedto Level 1,Level 2 andLevel 3 mark-to-market derivatives, respectively, asofDecember 31,2013.Collateral (received) from

counterparties, net ofcollateral paid to counterparties, totaled$219million,$(155) million and$(33)million allocatedto Level 1,Level 2 andLevel 3 mark-to-market

derivatives, respectively, asofDecember 31,2012.

(g) TheLevel 3 balancedoesnot includecurrent assetsfor Generation andcurrent liabilitiesfor ComEd of$226million at December 31,2012 relatedto thefairvalue of

Generation’s financial swap contractwithComEd.

(h) TheLevel 3 balanceincludesthecurrent andnoncurrent liabilityof$17million and$176 million at December 31,2013,respectively, and$18million and $49 million

at December 31,2012,respectively, relatedto floating-to-fixedenergy swap contractswithunaffiliatedsuppliers.

167