ComEd 2013 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

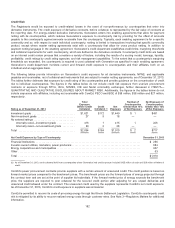

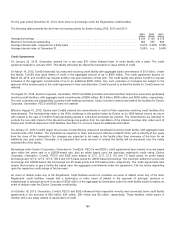

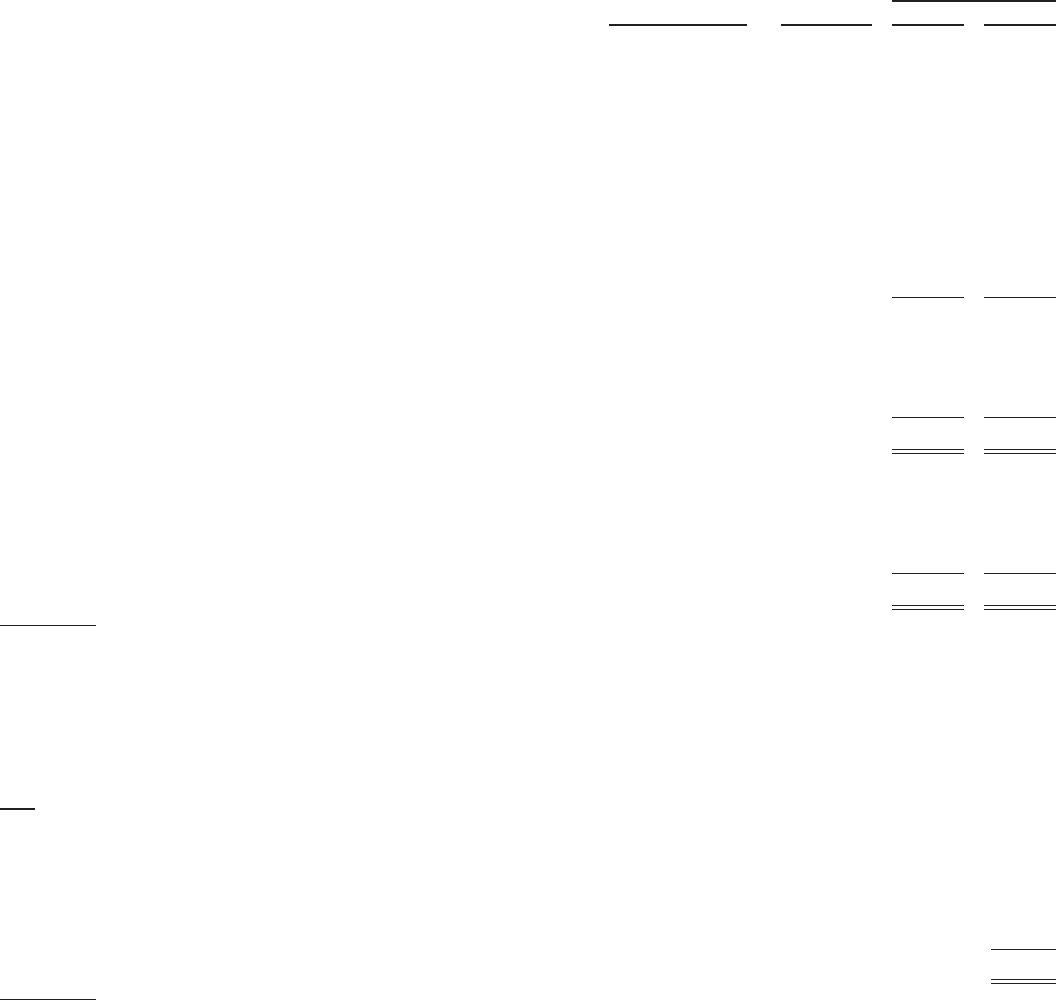

Long-Term Debt

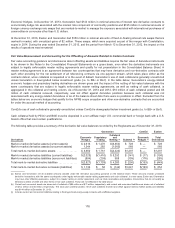

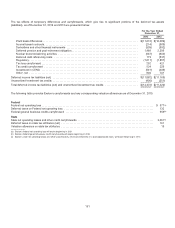

Thefollowingtable presentsthe outstandinglong-termdebtatExelon asofDecember 31,2013 and2012:

Maturity

Date

December 31,

Rates 2013 2012

Long-term debt

FirstMortgageBonds (a)(b) :

Fixedrates............................................. 1.20% — 7.63%2013-2043$ 7,746 $ 7,397

Unsecuredbonds ........................................... 2.80%—6.35% 2013-20361,7501,850

Rate stabilization bonds...................................... 5.68% — 5.82%2016-2017265 332

Senior unsecurednotes...................................... 2.00% — 7.60%2014-20427,5718,021

Pollution control notes:

Fixedrates ................................................ 4.10%201420 20

Non-recoursedebt:

Fixedrates ................................................ 2.33% — 5.50%2031-20371,077 238

Variable rates .......................................... 1.96% — 2.77% 2013-2053150262

Notespayable andother (c) ............................... 4.50% — 7.83%2014-2053181177

Total long-term debt ........................................... 18,76018,297

Unamortizeddebtdiscount andpremium, net .................... (19) (17)

Fairvalue adjustment ........................................ 384 448

Fairvalue hedgecarryingvalue adjustment,net .................. 7 17

Long-termdebtdue within one year ............................ (1,509) (1,047)

Long-term debt ................................................ $17,623 $17,698

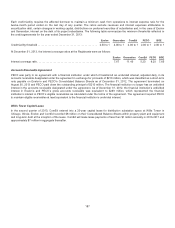

Long-term debt to financing trusts (d)

Subordinateddebenturesto ComEd FinancingIII................. 6.35% 2033 $206$ 206

Subordinateddebenturesto PECO TrustIII ..................... 7.38% 20288181

Subordinateddebenturesto PECO TrustIV ..................... 5.75% 2033 103 103

Subordinateddebenturesto BGE Trust......................... 6.20%2043258 258

Total long-term debt to financing trusts .......................... $ 648 $ 648

(a)Substantiallyall ofComEd’s assetsother than expresslyexceptedpropertyandsubstantiallyall of PECO’s assetsare subjecttotheliensoftheirrespectivemortgage

indentures.

(b) IncludesFirstMortgageBonds issuedunder theComEd and PECO mortgageindenturessecuringpollution control bonds andnotes.

(c) Includescapital leaseobligationsof$41million and$30 million at December 31,2013 and2012,respectively. Leasepaymentsof$4million,$4million,$4million,$5

million,$5million and$19million will bemadein 2014, 2015, 2016, 2017, 2018andthereafter,respectively.

(d) Amountsowedto thesefinancingtrustsare recordedasdebttofinancingtrustswithinExelon’s ConsolidatedBalanceSheets.

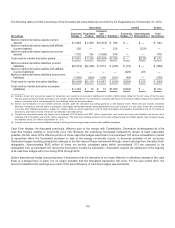

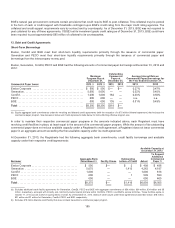

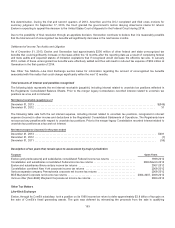

Long-termdebtmaturitiesat Exelon inthe periods 2014through 2018andthereafter are asfollows:

Year

2014.................................................................................................. $ 1,428

2015.................................................................................................. 1,615

2016.................................................................................................. 1,346

2017.................................................................................................. 1,396

2018.................................................................................................. 1,345

Thereafter ............................................................................................. 12,278(a)

Total .................................................................................................. $19,408

(a)Includes $648 million due to ComEd, PECO and BGE financingtrusts.

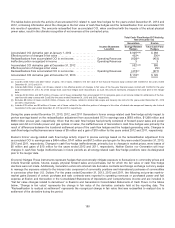

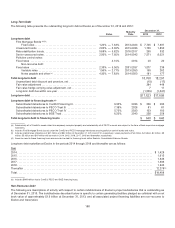

Non-Recourse Debt

Thefollowingare descriptionsofactivitywithrespecttocertainindebtedness ofExelon’s projectsubsidiariesthat is outstandingas

ofDecember 31,2013.Theindebtedness describedbelowisspecific to certaingeneratingfacilitiespledgedascollateral witha net

bookvalue ofapproximately$1.9 billion at December 31,2013,andall associatedprojectfinancingliabilitiesare non-recourseto

Exelon andGeneration.

188