ComEd 2013 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

decommissioningactivitieshavebeen transferredto a third-party(see Zion Station Decommissioningbelow). Generation has

recoursetocollectadditional amountsfrom PECO customersrelatedto a shortfall of NDT funds for theformer PECO units, subject

to certainlimitationsandthresholds, asprescribedbyan order fromthePAPUC. Generally, PECO, andlikewiseGeneration will not

be allowedto collectamountsassociatedwiththefirst$50million ofanyshortfall oftrustfunds, on an aggregate basis for all former

PECO units, comparedto decommissioningobligations, aswell as5%ofanyadditional shortfalls. Theinitial $50million andup to

5% ofanyadditional shortfallswouldbeborne by Generation.Norecourseexiststo collectadditional amountsfromComEd

customersfor theformer ComEd unitsor fromthe previousownersoftheformer AmerGen units. Withrespecttotheformer ComEd

and PECO units, anyfunds remainingintheNDTs after all decommissioninghasbeen completedare requiredto berefundedto

ComEd’s or PECO’s customers, subjecttocertainlimitationsthat allowsharingofexcess funds withGeneration relatedto theformer

PECO units. Withrespecttotheformer AmerGen units, Generation retainsanyfunds remaininginthefunds after decommissioning.

During2012,theNDT fixedincome portfoliocompleteditstransition fromsolelycore fixedincomeinvestmentsto a blendof

TreasuryInflation ProtectedSecurities (TIPS), investment-gradecorporate creditand middle market lending. There wasno change

intheequityinvestment strategy. At December 31,2013,approximately 48% ofthefunds were investedinequitysecuritiesand52%

were investedinfixedincomesecurities. At December 31,2012,approximately 47% ofthefunds were investedinequitysecurities

and53%were investedinfixedincomesecurities.

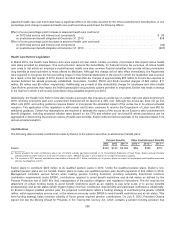

At December 31,2013,and2012,Exelon andGeneration had NDT fundinvestmentstotaling $8,071million and $7,248 million,

respectively.

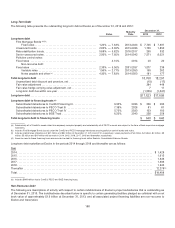

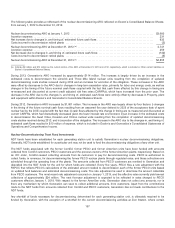

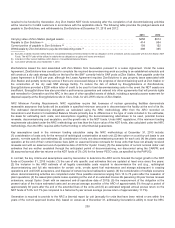

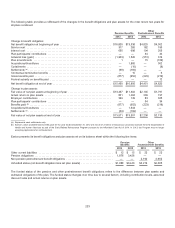

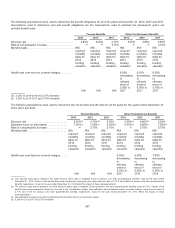

Thefollowingtable providesExelon’s unrealizedgains(losses) on NDT funds for 2013,2012 and2011:

For the Years Ended December 31,

2013 2012 2011

Net unrealizedgains(losses) on decommissioningtrust

funds—RegulatoryAgreement Units(a)............................................... $406$386 $(74)

Net unrealizedgains(losses) on decommissioningtrust

funds—Non-RegulatoryAgreement Units(b)(c) ......................................... 146 105 (4)

(a)Net unrealizedgains(losses) relatedto Generation’s NDT funds associatedwithRegulatoryAgreement Unitsare includedinRegulatoryliabilitieson Exelon’s

ConsolidatedBalanceSheets.

(b) Excludes$7million,$73million and $48 million ofnet unrealizedgainsrelatedto theZion Station pledgedassetsin 2013,2012 and2011,respectively. Net

unrealizedgainsrelatedto Zion Station pledgedassetsare includedinthePayable for Zion Station decommissioningon Exelon’s ConsolidatedBalanceSheets.

(c) Net unrealizedgains(losses) relatedto Generation’s NDT funds withNon-RegulatoryAgreement Unitsare includedwithinOther,net inExelon’s Consolidated

StatementsofOperationsandComprehensiveIncome.

Interestand dividends on NDT fundinvestmentsare recognizedwhen earnedandare includedinOther,net inExelon’s and

Generation’s ConsolidatedStatementsofOperationsandComprehensiveIncome.Interestand dividends earnedon theNDT fund

investmentsfor theRegulatoryAgreement Unitsare eliminatedwithinOther,net inExelon’s andGeneration’s Consolidated

Statement ofOperationsandComprehensiveIncome.

Accounting Implications of the Regulatory Agreements with ComEd and PECO.Basedon theregulatoryagreement withtheICC that

dictatesGeneration’s obligationsrelatedto theshortfall or excess of NDT funds necessaryfor decommissioningtheformer ComEd

unitson a unit-by-unitbasis, aslongasfunds heldintheNDT funds are expectedto exceedthe total estimateddecommissioning

obligation,decommissioning-relatedactivities, includingrealizedandunrealizedgainsandlosseson theNDT funds andaccretion of

thedecommissioningobligation,are generallyoffset withinExelon’s andGeneration’s ConsolidatedStatementsofOperationsand

ComprehensiveIncome.Theoffset ofdecommissioning-relatedactivitieswithintheConsolidatedStatement ofOperationsand

ComprehensiveIncomeresultsinanequal adjustment to the noncurrent payablesto affiliatesat Generation andan adjustment to

theregulatoryliabilitiesat Exelon. Likewise,ComEd hasrecordedan equal noncurrent affiliate receivable fromGeneration and

correspondingregulatoryliability. Shouldtheexpectedvalue oftheNDT fundfor anyformer ComEd unitfall belowtheamount ofthe

expecteddecommissioningobligation for that unit,theaccountingto offset decommissioning-relatedactivitiesintheConsolidated

Statement ofOperationsandComprehensiveIncomefor that unitwouldbediscontinued, thedecommissioning-relatedactivities

wouldberecognizedintheConsolidatedStatementsofOperationsandComprehensiveIncomeandtheadverseimpacttoExelon’s

andGeneration’s resultsofoperationsandfinancial position couldbematerial.AsofDecember 31,2013,theNDT funds ofeach of

theformer ComEd unitsare expectedto exceedthe relateddecommissioningobligation for each oftheunits. For the purposesof

makingthis determination,thedecommissioningobligation referredto is different,asdescribedbelow, fromthecalculation usedin

theNRCminimumfundingobligation filings basedon NRCguidelines.

198