ComEd 2013 Annual Report Download - page 176

Download and view the complete annual report

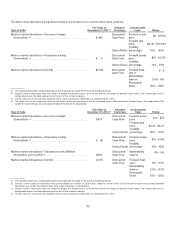

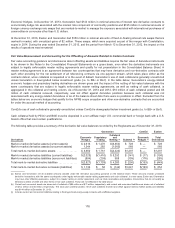

Please find page 176 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Equityand fixedincomecommingledfunds and fixedincomemutual funds are maintainedbyinvestment companiesandholdcertain

investmentsinaccordancewithastatedset offundobjectives. Thefairvaluesof fixedincomecommingledandmutual funds held

withinthe trustfunds, which generallyholdshort-term fixedincomesecuritiesandare not subjecttorestrictionsregardingthe

purchaseorsale ofshares, are derivedfromobservable prices. Theobjectivesoftheremainingequitycommingledfunds inwhich

Exelon andGeneration investprimarilyseekto track the performanceofcertainequityindicesbypurchasingequitysecuritiesto

replicate thecapitalization andcharacteristics oftheindices. Commingledandmutual funds are categorizedinLevel 2 becausethe

fairvalue ofthefunds are basedon NAVs per fundshare (theunitofaccount), primarilyderivedfromthequotedpricesinactive

marketson theunderlyingequitysecurities.

Middle market lendingare investmentsin loansor managedfunds which investinprivate companies. Generation electedthefair

value option for itsinvestmentsincertainlimitedpartnershipsthat investinmiddle market lendingmanagedfunds. Thefairvalue of

these loansisdeterminedusingacombination ofvaluation modelsincludingcostmodels, market models, andincomemodels.

Investmentsinmiddle market lendingare categorizedasLevel 3 becausethefairvalue ofthesesecuritiesisbasedlargelyon inputs

that are unobservable andutilizecomplexvaluation models. Investmentsinmiddle market lendingtypicallycannot beredeemeduntil

maturityofthe termloan.

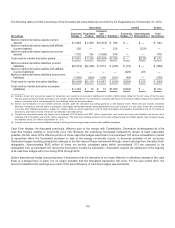

Rabbi Trust Investments TheRabbi trustswere establishedto holdassetsrelatedto deferredcompensation plansexistingfor certain

activeandretiredmembersofExelon’s executivemanagement anddirectors. TheinvestmentsintheRabbi trustsare includedin

investmentsintheRegistrants’ ConsolidatedBalanceSheetsandconsistprimarilyofmutual funds. Thesefunds are maintainedby

investment companiesandholdcertaininvestmentsinaccordancewithastatedset offundobjectives, which are consistent with

Exelon’s overall investment strategy. Mutual funds are publiclyquotedandhavebeen categorizedasLevel 1 given theclear

observabilityoftheprices.

Mark-to-Market Derivatives Derivativecontractsare tradedinbothexchange-basedandnon-exchange-basedmarkets. Exchange-

basedderivativesthat are valuedusingunadjustedquotedpricesinactivemarketsare categorizedinLevel 1 inthefairvalue

hierarchy. Certainderivatives’ pricingisverifiedusingindicativepricequotationsavailable through brokersor over-the-counter,on-

line exchangesandare categorizedinLevel 2.Thesepricequotationsreflecttheaverageofthebid-ask, mid-point pricesandare

obtainedfromsourcesthat theRegistrantsbelieve providethemostliquid market for thecommodity. Thepricequotationsare

reviewedandcorroboratedto ensure thepricesare observable andrepresentativeofan orderlytransaction between market

participants. This includesconsideration ofactual transaction volumes, market deliverypoints, bid-ask spreads andcontract

duration.Theremainder ofderivativecontractsare valuedusingtheBlack model,an industrystandardoption valuation model.The

Black model takesinto account inputssuch ascontract terms, includingmaturity, andmarket parameters, includingassumptionsof

thefuture pricesofenergy, interest rates, volatility, creditworthiness andcreditspread. For derivativesthat tradeinliquid markets,

such asgeneric forwards, swapsandoptions, model inputsare generallyobservable.Such instrumentsare categorizedinLevel 2.

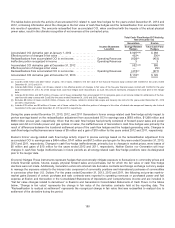

TheRegistrants’ derivativesare predominatelyat liquid tradingpoints. For derivativesthat tradeinless liquid marketswithlimited

pricinginformation model inputsgenerallywouldincludebothobservable andunobservable inputs. Thesevaluationsmayincludean

estimatedbasis adjustment froman illiquid tradingpoint to a liquid tradingpoint for which activepricequotationsare available.Such

instrumentsare categorizedinLevel 3.

Transfersinandout oflevelsare recognizedasoftheendofthe reportingperiodthe transfer occurred. Given derivatives

categorizedwithinLevel 1 are valuedusingexchange-basedquotedpriceswithinobservable periods, transfersbetween Level 2 and

Level 1 were not material.Transfersinto Level 2 fromLevel 3 generallyoccur when thecontract tenure becomesmore observable.

Transfersinto Level 3 fromLevel 2 generallyoccur due to changesinmarket liquidityor assumptionsfor certaincommodity

contracts.

Exelon mayutilizefixed-to-floatinginterest rate swaps, which are typicallydesignatedasfairvalue hedges, asameansto achieve

itstargetedlevel ofvariable-rate debtasa percent oftotal debt.Inaddition,theRegistrantsmayutilizeinterest rate derivativesto

lock ininterest rate levelsin anticipation offuture financings. Theseinterest rate derivativesare typicallydesignatedascash flow

hedges. Exelon determinesthecurrent fairvalue by calculatingthe net present value ofexpectedpaymentsandreceiptsunder the

swap agreement,basedon and discountedbythemarket’s expectation offuture interest rates. Additional inputsto the net present

value calculation mayincludethecontract terms, counterpartycreditrisk andother market parameters. Astheseinputsare basedon

observable data andvaluationsof similar instruments, theinterest rate swapsare categorizedinLevel 2 inthefairvalue hierarchy.

See Note 12—DerivativeFinancial Instrumentsfor further discussion on mark-to-market derivatives.

Deferred Compensation Obligations TheRegistrants’ deferredcompensation plansallowparticipantsto defer certaincash

compensation into a notional investment account.TheRegistrantsincludesuch plansinother current andnoncurrent liabilitiesin

170