ComEd 2013 Annual Report Download - page 122

Download and view the complete annual report

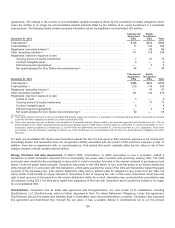

Please find page 122 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.thebenefitofthetaxposition will besustainedon itstechnical merits, no benefitis recorded. Uncertaintaxpositionsthat relate only

to timingofwhen an itemisincludedon a taxreturn are consideredto havemet therecognition threshold. TheRegistrantsrecognize

accruedinterest relatedto unrecognizedtaxbenefitsininterestexpenseorinother incomeanddeductions(interestincome)on their

ConsolidatedStatementsofOperations.

Pursuant to theIRCandrelevant state taxingauthorities, Exelon anditssubsidiariesfile consolidatedor combinedincometax

returnsfor Federal andcertainstate jurisdictionswhere allowedor required. See Note 14—IncomeTaxesfor further information.

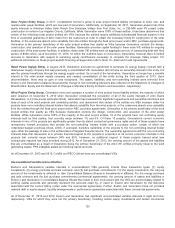

Taxes Directly Imposed on Revenue-Producing Transactions

Exelon collectscertaintaxesfromcustomerssuch assalesandgross receiptstaxes, alongwithother taxes, surcharges, andfees

that are leviedbystate or local governmentson thesale or distribution ofgasandelectricity. Someofthesetaxesare imposedon

thecustomer,but paid by theRegistrants, while othersare imposedon theRegistrants. Where thesetaxesare imposedon the

customer,such assalestaxes, theyare reportedon a net basis withno impacttotheConsolidatedStatementsofOperationsand

ComprehensiveIncome.However,where thesetaxesare imposedon theRegistrants, such asgross receiptstaxesor other

surchargesor fees, theyare reportedon a gross basis. Accordingly, revenuesare recognizedfor thetaxescollectedfromcustomers

alongwithan offsettingexpense.See Note 23—Supplemental Financial Information for Generation’s, ComEd’s, PECO’s and BGE’s

utilitytaxesthat are presentedon a gross basis.

Cash and Cash Equivalents

Exelon considersinvestmentspurchasedwithan original maturityofthree months or less to becash equivalents.

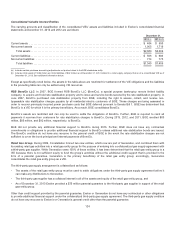

Restricted Cash and Investments

Restrictedcash andinvestmentsrepresent funds that are restrictedto satisfy designatedcurrent liabilities. AsofDecember 31,

2013 and2012,Exelon Corporate’s restrictedcash andinvestmentsprimarilyrepresentedrestrictedfunds for payment ofmedical,

dental, vision andlong-term disabilitybenefits. Additionally, Exelon Corporate hasfunds restrictedfor merger commitments. In

addition,Exelon Corporate’s investmentsincludeitsdirectfinancingleaseinvestments. AsofDecember 31,2013,Generation’s

restrictedcash andinvestmentsprimarilyincludedcash at Antelope Valleyrequiredfor debtserviceandconstruction andcash at

Continental Windrequiredfor debtserviceandfinancingofoperation andmaintenanceoftheunderlyingentities. Asof

December 31,2012,Generation’s restrictedcash primarilyincludedcash at Antelope Valleyrequiredfor debtserviceand

construction.AsofDecember 31,2013 and2012,ComEd’s restrictedcash primarilyrepresentedcash collateral heldfrom

suppliersassociatedwithComEd’s REC procurement contracts. AsofDecember 31,2013, PECO’s restrictedcash primarily

representedfunds fromthesalesofassetsthat were subjecttoPECO’s mortgageindenture.AsofDecember 31,2013 and2012,

BGE’s restrictedcash primarilyrepresentedfunds restrictedat itsconsolidatedvariable interest entityfor repayment ofrate

stabilization bonds.

Restrictedcash andinvestmentsnot available to satisfy current liabilitiesare classifiedasnoncurrent assets. AsofDecember 31,

2013 and2012,Exelon’s andGeneration’s NDT funds, which are designatedto satisfy future decommissioningobligations, were

classifiedasnoncurrent assets. AsofDecember 31,2013,Exelon,Generation,ComEd, PECO and BGE hadinvestmentsinRabbi

trustsclassifiedasnoncurrent assets.

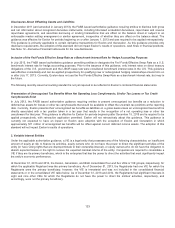

Allowance for Uncollectible Accounts

The allowancefor uncollectible accountsreflectsExelon’s bestestimatesoflosseson theaccountsreceivable balances. For

Generation,the allowanceis basedon accountsreceivable aging, historical experienceandother currentlyavailable information.

ComEd and PECO estimate the allowancefor uncollectible accountson customer receivablesbyapplyingloss ratesdeveloped

specificallyfor each companyto the outstandingreceivable balanceby risk segment.Risk segmentsrepresent a group ofcustomers

with similar creditqualityindicatorsthat are computedbasedon variousattributes, includingdelinquency oftheirbalancesand

payment history. Loss ratesappliedto theaccountsreceivable balancesare basedon historical averagecharge-offs asa

percentageofaccountsreceivable ineach risk segment. BGE estimatesthe allowancefor uncollectible accountson customer

receivablesbyassigningreservefactorsfor each agingbucket.These percentageswere derivedfromastudy ofbillingprogression

which determinedthereservefactorsbyagingbucket.ComEd, PECO and BGE customers’ accountsare generallyconsidered

delinquent if theamount billedisnot receivedbythetimethenextbill is issued, which normallyoccurson a monthlybasis. ComEd,

116