ComEd 2013 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

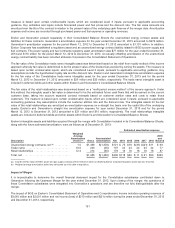

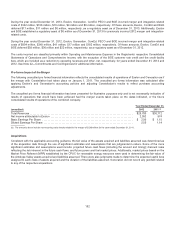

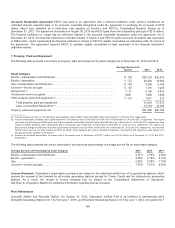

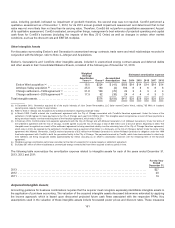

Thefollowingtable summarizestheacquisition-date fairvalue oftheconsideration transferredandtheassetsandliabilitiesassumed

for each ofthecompaniesacquiredbyGeneration duringtheyear endedDecember 31,2011:

Acquisitions

2011

Wolf

Hollow

Antelope

Valley

Fair value of consideration transferred

Cash ......................................................................................... $305$75

Plus: GainonPPAsettlement ..................................................................... 6 —

Total fair value of consideration transferred ....................................................... $311 $75

Recognized amounts of identifiable assets acquired and liabilities assumed

Property, plant andequipment .................................................................... $347 $ 15

Inventory ...................................................................................... 5 —

Intangible assets(a)............................................................................. — 190

Payable to FirstSolar,Inc. (b) ..................................................................... — (135)

Workingcapital,net ............................................................................. (5) —

Other Assets ................................................................................... — 5

Total net identifiable assets ..................................................................... $347 $ 75

Bargain purchase gain ......................................................................... $ 36$—

(a)See Note 10—Intangible Assetsfor additional information.

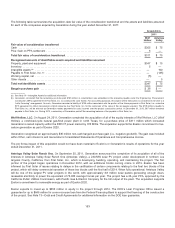

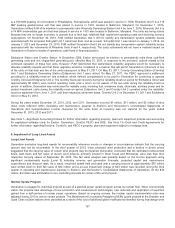

(b) Generation concludedthat theremaining, yet-to-bepaid $135million inconsideration wasembeddedintheamountspayable under theEngineering, Procurement,

Construction (EPC) agreement for FirstSolar,Inc. to constructthesolar facility. For accountingpurposes, this aspectofthe transaction is consideredto beakintoa

“seller financing” arrangement.Assuch, Generation recordedaliabilityof$135million associatedwiththe portion ofthefuture paymentsto FirstSolar,Inc. under the

EPC agreement to reflectGeneration’s implicitamountsdue FirstSolar,Inc. for theremainder ofthevalue ofthe net assetsacquired. The$135million payable to

FirstSolar,Inc. will be relievedasGeneration makespaymentsfor costsincurredover the projectconstruction period. At December 31,2012, $87 million remained

payable to FirstSolar,Inc. During2013,asubsidiaryofGeneration paid off theremainingbalanceofthepayable to FirstSolar,Inc.

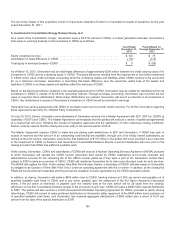

Wolf Hollow, LLC. OnAugust24, 2011,Generation completedtheacquisition ofall oftheequityinterestsofWolfHollow, LLC (Wolf

Hollow), acombined-cycle natural gas-firedpower plant in northTexas, for a purchasepriceof$311 million which increased

Generation’s ownedcapacitywithintheERCOT power market by 720 MWs. Theacquisition supportstheExelon commitment to low-

carbon generation aspart ofExelon 2020.

Generation recognizedan approximately$36million non-cash bargain purchasegain(i.e., negativegoodwill). Thegainwasincluded

withinOther,net inExelon’s andGeneration’s ConsolidatedStatementsofOperationsandComprehensiveIncome.

The pro formaimpactofthis acquisition wouldnot havebeen material to Exelon’s or Generation’s resultsofoperationsfor theyear

endedDecember 31,2011.

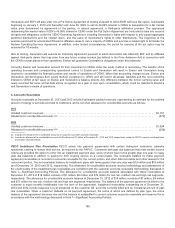

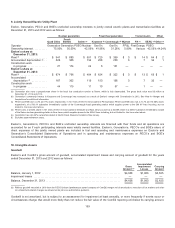

Antelope Valley Solar Ranch One. OnSeptember 30,2011,Generation announcedthecompletion ofitsacquisition ofall ofthe

interestsin Antelope ValleySolar Ranch One (Antelope Valley), a 230-MW solar PV projectunder development in northern Los

AngelesCounty, California,fromFirstSolar,Inc., which is developing, building, operating, andmaintainingthe project.Thefirst

portion ofthe projectbegan operationsinDecember 2012,with six additional blocks comingonline in 2013.Exelon hasbeen

informedbyFirstSolar of issuesrelatingto delays inthecertification ofcertaincomponentsrelatingto thefinal twoblocks ofthe

project, which will delaycommercial operation ofthesetwoblocks untilthefirsthalfof2014. When fullyoperational,Antelope Valley

will be one ofthe largestPV solar projectsintheworld, withapproximately3.8 million solar panelsgeneratingenough clean,

renewable electricityto power theequivalent of 75,000 averagehomesper year.The projecthasa25-year PPA,approvedbythe

CaliforniaPublic UtilitiesCommission,withPacific Gas&Electric Companyfor thefull output ofthe plant.Theacquisition supports

Exelon’s commitment to renewable energy aspart ofExelon 2020.

Exelon expectsto investupto$650million inequityinthe projectthrough 2014. TheDOE’s Loan Programs Officeissueda

guarantee for up to $646 million for a non-recourse loan fromtheFederal FinancingBankto support thefinancingoftheconstruction

ofthe project.See Note 13—DebtandCreditAgreementsfor additional information on theDOE loan guarantee.

153