ComEd 2013 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

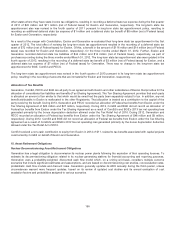

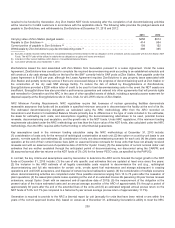

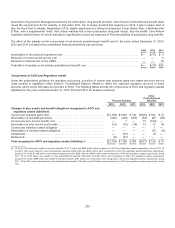

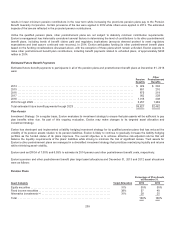

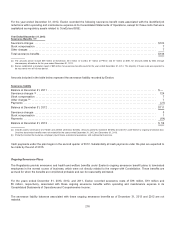

Thefollowingtable providesthecomponentsofExelon’s gross accumulatedother comprehensiveloss andregulatoryassets

(liabilities) that have not been recognizedascomponentsofperiodic benefitcostatDecember 31,2013 and2012,respectively, for

all planscombined:

Pension Benefits

Other

Postretirement Benefits

2013 2012 2013 2012

Prior servicecost(credit)............................................... $ 62$76 $(73)$(107)

Actuarial loss ........................................................ 6,1927,931 474 1,185

Total (a).............................................................. $6,254 $8,007$401 $1,078

(a)Ofthe$6,254 million relatedto pension benefits, $3,523 million and$2,731 million are includedinAOCI andregulatoryassets, respectively, at December 31,2013.

Of the$401 million relatedto other postretirement benefits, $161million and$240million are includedinAOCI andregulatoryassets(liabilities), respectively, at

December 31,2013.Ofthe$8,007million relatedto pension benefits, $4,594 million and$3,413 million are includedinAOCI andregulatoryassets, respectively, at

December 31,2012.Ofthe$1,078 million relatedto other postretirement benefits, $514million and $564 million are includedinAOCI andregulatoryassets,

respectively, at December 31,2012.

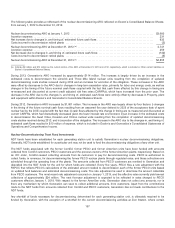

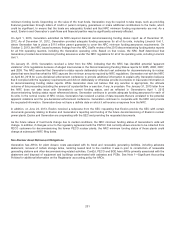

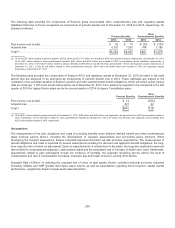

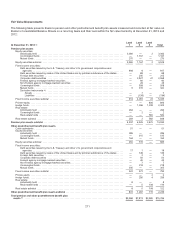

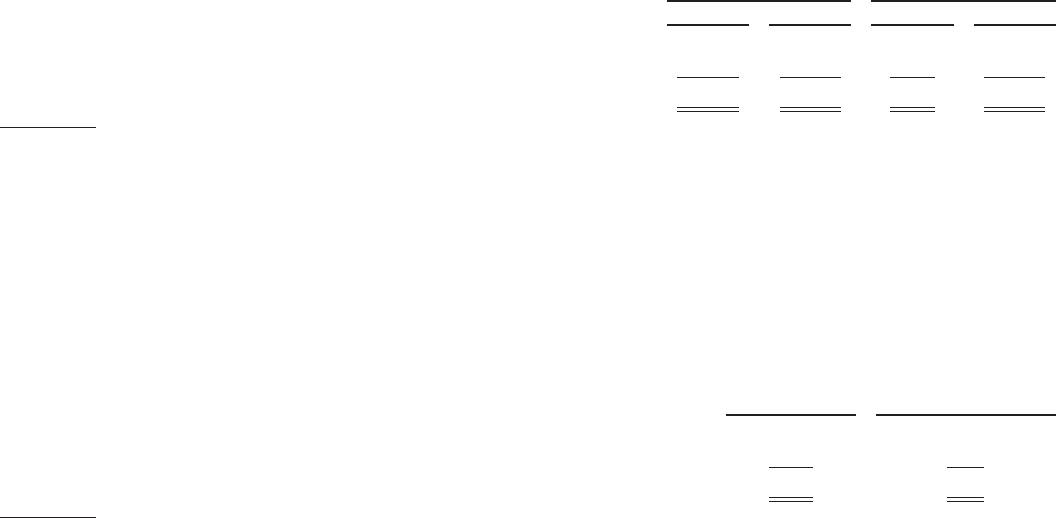

Thefollowingtable providesthecomponentsofExelon’s AOCI andregulatoryassetsat December 31,2013 (includedinthetable

above)that are expectedto beamortizedascomponentsofperiodic benefitcostin 2014. Theseestimatesare subjecttothe

completion ofan actuarial valuation ofExelon’s pension andother postretirement benefitobligations, which will reflectactual census

data asofJanuary1,2014andactual claims activityasofDecember 31,2013.Thevaluation is expectedto becompletedinthefirst

quarter of2014for legacy Exelon plansandinthesecondquarter of2014for legacy Constellation plans.

Pension Benefits

Other

Postretirement Benefits

Prior servicecost(credit) ..................................................... $ 14$(16)

Actuarial loss............................................................... 42732

Total (a)$441$16

(a)Ofthe$441million relatedto pension benefitsat December 31,2013,$232 million and$209million are expectedto beamortizedfromAOCI andregulatoryassetsin

2013,respectively. Of the$16million relatedto other postretirement benefitsat December 31,2013,$7million and$9million are expectedto beamortizedfrom

AOCI andregulatoryassetsin 2013,respectively.

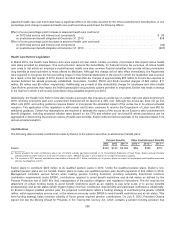

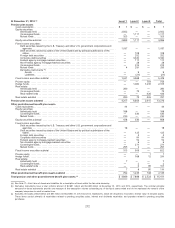

Assumptions

Themeasurement ofthe plan obligationsandcostsofprovidingbenefitsunder Exelon’s definedbenefitandother postretirement

plansinvolvesvariousfactors, includingthedevelopment ofvaluation assumptionsandaccountingpolicy elections. When

developingtherequiredassumptions, Exelon considers historical information aswell asfuture expectations. Themeasurement of

benefitobligationsandcostsisimpactedbyseveral assumptionsincludingthediscount rate appliedto benefitobligations, the long-

termexpectedrate ofreturn on plan assets, Exelon’s expectedlevel ofcontributionsto the plans, the long-termexpectedinvestment

rate creditedto employeesparticipatingincash balance plansandthe anticipatedrate ofincreaseofhealthcare costs. Additionally,

assumptionsrelatedto plan participantsincludetheincidenceofmortality, theexpectedremainingservice period, thelevel of

compensation andrate ofcompensation increases, employee ageandlengthofservice,amongother factors.

Expected Rate of Return. Inselectingtheexpectedrate ofreturn on plan assets, Exelon considers historical economic indicators

(includinginflation and GDP growth) that impactasset returns, aswell asexpectationsregardingfuture long-termcapital market

performance,weightedbyExelon’s target asset class allocations.

206