ComEd 2013 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

which, when combinedwiththen current market conditions, madethe projectsnot economicallyviable.Additionally, themarket

conditionspromptedGeneration to cancel the previouslydeferredextendedpower uprate projectsat theLaSalle and Limerick

nuclear stations. During2013,Generation recordeda pre-taxcharge to operatingandmaintenanceexpenseandinterestexpenseof

approximately$111 million and$8million,respectively, to accrue remainingcostsandreversethe previouslycapitalizedcosts.

Like-Kind Exchange Transaction

Prior to thePECO/UnicomMerger inOctober 2000, UII, LLC (formerlyUnicomInvestments, Inc.) (UII), awhollyownedsubsidiaryof

Exelon,enteredinto a like-kindexchange transaction pursuant to which approximately$1.6 billion wasinvestedincoal-fired

generatingstation leaseslocatedinGeorgiaandTexaswithtwoseparate entitiesunrelatedto Exelon.Thegeneratingstationswere

leasedback to such entitiesaspart ofthe transaction.See Note 14—IncomeTaxesfor further information.For financial accounting

purposes, theinvestmentsare accountedfor asdirectfinancingleaseinvestments. UII holds the leaseholdinterestsinthe

generatingstationsinseveral separate bankruptcy remote,special purposecompaniesitdirectlyor indirectlywhollyowns. The lease

agreementsprovidethelesseeswith fixedpurchase optionsat theendofthe lease terms. If thelesseesdo not exercisethefixed

purchase options, Exelon hastheabilityto require thelesseesto return the leaseholdinterestsor to arrangefor a third-partyto bid

on a servicecontractfor a periodfollowingthe lease term. If Exelon choosestheservicecontract option,the leaseholdinterestswill

be returnedto Exelon at theendofthe termoftheservicecontract.Inanyevent,Exelon will besubjecttoresidual value risk if the

lesseesdo not exercisethefixedpurchase options. This risk is partiallymitigatedbythefairvalue ofthescheduledpaymentsunder

theservicecontract.However,such paymentsare not guaranteed. Further,the termoftheservicecontractis less than theexpected

remaininguseful lifeofthe plantsand, therefore,Exelon’s exposure to residual value risk will not bemitigatedbypaymentsunder

theservicecontractinthis remainingperiod. Inthefourthquarter of2000,under the terms ofthe leaseagreements, UII receiveda

prepayment of$1.2billion for all rent, which reducedtheinvestment inthe leases. There are no minimum scheduledleasepayments

to bereceivedover theremainingtermofthe leases.

Pursuant to the applicable accountingguidance,Exelon is requiredto reviewtheestimatedresidual valuesofitsdirectfinancing

leaseinvestmentsat least annuallyandrecordan impairment chargeif thereviewindicatesan other than temporarydecline inthe

fairvalue oftheresidual valuesbelowtheircarryingvalues. Exelon estimatesthefairvalue oftheresidual valuesofitsdirect

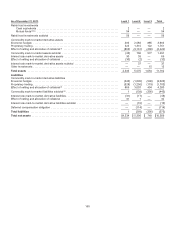

financingleaseinvestmentsunder theincome approach, which usesadiscountedcash flowanalysis, which takesinto consideration

significant unobservable inputs(Level 3)includingtheexpectedrevenuesto begeneratedandcoststo beincurredto operate the

plantsover theirremaininguseful livessubsequent to the leaseenddates. Significant assumptionsusedinestimatingthefairvalue

includefundamental energy andcapacityprices, fixedandvariable costs, capital expenditure requirements, discount rates, taxrates,

andtheestimatedremaininguseful livesofthe plants. Theestimatedfairvaluesalsoreflectthecash flows associatedwiththe

servicecontract option discussedabovegiven that a market participant wouldtakeinto consideration all ofthe terms andconditions

containedinthe leaseagreements.

Basedon thereviewperformedinthesecondquarter of2013,theestimatedresidual value ofone ofExelon’s directfinancingleases

experiencedan other than temporarydecline given reducedlong-termenergy andcapacitypriceexpectations. Asaresult,Exelon

recordeda$14million pre-taximpairment chargeinthesecondquarter of2013, which wasrecordedininvestmentsandoperating

andmaintenanceexpenseintheConsolidatedBalanceSheet andtheConsolidatedStatement ofOperations, respectively. Changes

intheassumptionsdescribedabovecouldpotentiallyresult infuture impairmentsofExelon’s directfinancingleaseinvestments,

which couldbematerial.Through December 31,2013,no eventshaveoccurredthat wouldrequire Exelon to reviewtheestimated

residual valuesofitsdirectfinancingleaseinvestmentssubsequent to thereviewperformedinthesecondquarter of2013.

AsofDecember 31,2012,Exelon concludedthat theestimatedfairvaluesoftheresidual valuesat theendofthe lease terms

exceededtheresidual valuesestablishedat the leasedates.

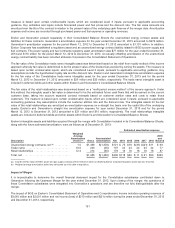

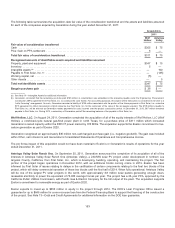

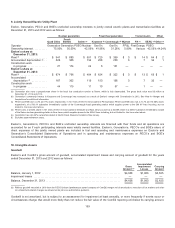

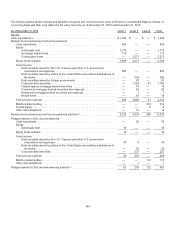

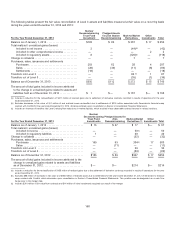

At December 31,2013 andDecember 31,2012,thecomponentsofthe net investment in long-termleaseswere asfollows:

December 31, 2013 December 31, 2012

Estimatedresidual value ofleasedassets ......................................... $1,465 $1,492

Less: unearnedincome........................................................ 767 807

Net investment in long-termleases ............................................... $ 698 $ 685

158