ComEd 2013 Annual Report Download - page 256

Download and view the complete annual report

Please find page 256 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

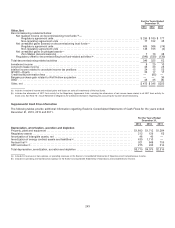

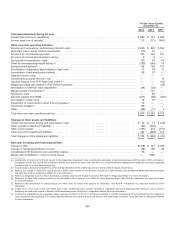

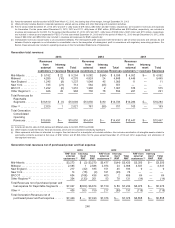

December 31,

2013 2012

Investmentsinaffiliates:

ComEd FinancingIII............................................................................. $ 6 $ 6

PECO Energy Capital Corporation ................................................................. 4 4

PECO TrustIV ................................................................................. 4 4

BGE Capital TrustII ............................................................................. 8 8

Total investmentsinaffiliates...................................................................... $ 22 $22

Receivablesfromaffiliates(current):

CENG (b) ...................................................................................... $ 3$16

Payablesto affiliates(current):

CENG (c) ...................................................................................... $ 85 $ 83

ComEd FinancingIII............................................................................. 4 4

PECO TrustIII.................................................................................. 11

BGE Capital TrustII ............................................................................. 4 4

Keystone Fuels,LLC ............................................................................ 12 11

Conemaugh Fuels,LLC .......................................................................... 9 9

Other ......................................................................................... 1—

Total payablesto affiliates(current) ................................................................ $116$112

Long-termdebtdue to financingtrusts:

ComEd FinancingIII............................................................................. $206$206

PECO TrustIII.................................................................................. 8181

PECO TrustIV ................................................................................. 103 103

BGE Capital TrustII ............................................................................. 258 258

Total long-termdebtdue to financingtrusts .......................................................... $648 $648

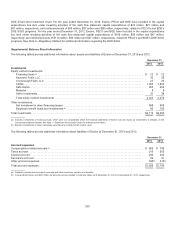

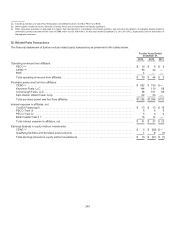

(a)Theintersegment profitassociatedwiththesale ofcertain productsandservicesbyandbetween Exelon’s segmentsisnot eliminatedinconsolidation due to the

recognition ofintersegment profitinaccordancewithregulatoryaccountingguidance.For Exelon,theseamountsare includedin operatingrevenuesinthe

ConsolidatedStatement ofOperations. See Note 3—RegulatoryMattersfor additional information.

(b) Exelon hasasharedservicesagreement (SSA)with CENG, which expiresin 2017. Pursuant to an agreement between Exelon and EDF, thepricingintheSSAfor

servicesreflectactual costsdeterminedon thesamebasis that BSC chargesitsaffiliatesfor similar servicessubject to an annual cap for mostSSAservices

provided. Inaddition to theSSA,Generation hasapower servicesagency agreement (PSAA)withtheCENG plants, which expireson December 31,2014. The

PSAA is afive-year agreement under which Generation provides scheduling, asset management andbillingservicesto theCENG plantsfor a specifiedmonthlyfee.

Thechargesfor servicesreflectthecostoftheservices. At theclosing, asdescribedunder theMaster Agreement,thePSAA will beamendedandextendeduntilthe

complete andpermanent cessation ofoperation oftheCENG generation plants. For further information regardingtheInvestment inCENG see Note 5—Investment in

Constellation Energy Nuclear Group, LLC.

(c) CENG owns100%offour nuclear unitsinMarylandandNewYorkand82%ofNine Mile Point Unit2inNewYork. Generation hasaPPAunder which itis

purchasing 85% ofthenuclear plant output owned by CENG that is not soldto thirdpartiesunder pre-existingfirmandunit-contingent PPAsthrough 2014. Beginning

on January1,2015andcontinuingto theendofthelifeoftherespective plants, Generation will purchaseonaunit-contingent basis 50.01%ofthenuclear plant

output owned by CENG andasubsidiaryof EDF will purchaseonaunit-contingent basis 49.99% ofthenuclear plant output owned by CENG (EDF PPA). This

agreement will continue to beeffectiveandisnot affectedbytheMaster Agreement,except that if the put option under theMaster Agreement is exercised, then the

EDF PPAwouldtransfer to Generation upon completion ofthePut Option Agreement transaction.For further information regardingtheInvestment inCENG see Note

5—Investment inConstellation Energy Nuclear Group, LLC.

(d) Exelon Foundation is a nonconsolidatednot-for-profitIllinois corporation.TheExelon Foundation wasestablishedin 2007to serveeducational andenvironmental

philanthropic purposesanddoesnot serveadirectbusiness or political purposeofExelon.

(e)Generation’s total gain(loss) inequitymethodinvestmentsincludesequityinvestment income(loss) andamortization ofbasis difference.For further information

regardingtheInvestment inCENG see Note 5—Investment inConstellation Energy Nuclear Group, LLC.

(f) TheBGE Capital TrustII portion ofExelon’s interestexpensetoaffiliates, net,for December 31,2012 excludes$4million ofexpenseincurredin 2012 prior to the

closingofExelon’s merger withConstellation on March 12,2012.

250