ComEd 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exelon Credit Facilities

See Note 13 oftheCombinedNotesto ConsolidatedFinancial Statementsfor discussion oftheRegistrants’ creditfacilitiesandshort

termborrowingactivity.

Other Credit Matters

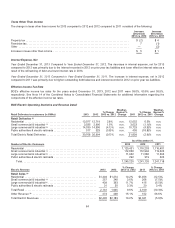

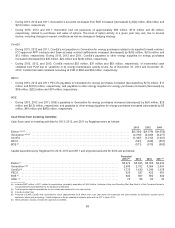

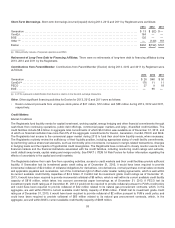

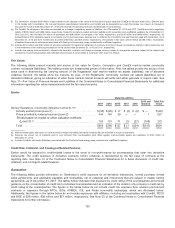

Capital Structure.At December 31,2013,thecapital structuresoftheRegistrantsconsistedofthefollowing:

Exelon Generation ComEd PECO BGE

Long-termdebt........................................................... 44% 30%42%40%42%

Long-termdebttoaffiliates(a)............................................... 2%8%2%4%5%

Common equity .......................................................... 53% — 55% 56% 49%

Member’s equity ......................................................... — 62%— ——

PreferenceStock ......................................................... — — — — 4%

Commercial paper andnotespayable ........................................ 1%— 1%— —

(a)Includesapproximately $648 million,$206million,$184 million and$258 million owedto unconsolidatedaffiliatesofExelon,ComEd, PECO and BGE respectively.

Thesespecial purpose entitieswere createdfor thesole purposesof issuingmandatorilyredeemable trust preferredsecuritiesofComEd, PECO and BGE. See Note

2oftheCombinedNotesto ConsolidatedFinancial Statementsfor additional information regardingthe authoritativeguidancefor VIEs.

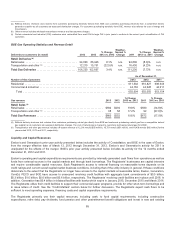

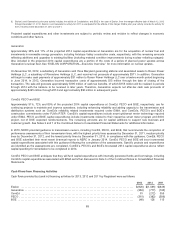

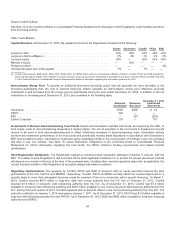

Intercompany Money Pool. To provideanadditional short-termborrowingoption that will generallybemore favorable to the

borrowingparticipantsthan thecostofexternal financing, Exelon operatesan intercompanymoneypool.Maximumamounts

contributedto andborrowedfromthemoneypool by participantsduringtheyear endedDecember 31,2013,inaddition to the net

contribution or borrowingasofDecember 31,2013,are presentedinthefollowingtable:

Maximum

Contributed

Maximum

Borrowed

December 31, 2013

Contributed

(Borrowed)

Generation .............................................................. $159 $435$44

PECO .................................................................. 304— —

BSC .................................................................... — 287 (223)

Exelon Corporate ......................................................... 237— 179

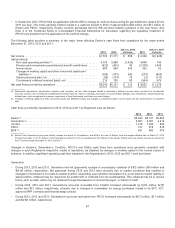

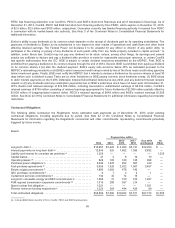

Investments in Nuclear Decommissioning Trust Funds. Exelon andGeneration maintain trustfunds, asrequiredbytheNRC, to

fundcertaincostsofdecommissioningGeneration’s nuclear plants. Themix ofsecuritiesi

nthe trustfunds is designedto provide

returnsto beusedto funddecommissioningandto offset inflationaryincreasesindecommissioningcosts. Generation actively

monitorstheinvestment performanceofthe trustfunds andperiodicallyreviews asset allocationsinaccordancewithGeneration’s

NDT fundinvestment policy. Generation’s investment policy establisheslimitson theconcentration ofholdings inanyone company

andalsoinanyone industry. See Note 15—Asset Retirement ObligationsoftheCombinedNotesto ConsolidatedFinancial

Statementsfor further information regardingthe trustfunds, theNRC’s minimumfundingrequirementsandrelatedliquidity

ramifications.

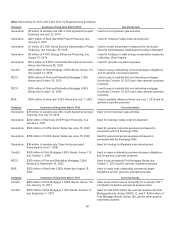

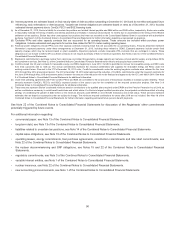

Shelf Registration Statements. TheRegistrantsmaintainacombinedshelfregistration statement unlimitedinamount,withthe

SEC. Theabilityofeach Registrant to sell securitiesoff theshelfregistration statement or to access theprivate placement markets

will dependon a number offactorsat thetimeofthe proposedsale,includingother requiredregulatoryapprovals, asapplicable,the

current financial condition oftheRegistrant,itssecuritiesratings andmarket conditions.

Regulatory Authorizations. Theissuanceby ComEd, PECO and BGE oflong-termdebtorequitysecuritiesrequirestheprior

authorization oftheICC, PAPUC and MDPSC, respectively. ComEd, PECO and BGE normallyobtaintherequiredapprovalson a

periodic basis to cover their anticipatedfinancingneeds for a periodoftimeorinconnection withaspecific financing. OnMarch 1,

2013,ComEd received $470million in long-termdebtnewmoneyauthorityfromtheICC andon February27, 2012,ComEd

received$1.3billion in long-termdebtrefinancingauthorityfromtheICC. AsofDecember 31,2013,ComEd had$1.3billion

available in long-termdebtrefinancingauthorityand$218million available innewmoneylong-termdebtfinancingauthorityfromthe

ICC. Duringthefourthquarter of2013,ComEd requestedandreceived$1billion innewmoneyfinancingauthorityfromtheICC. The

authorityiseffectiveonJanuary1,2014andexpiresJanuary1,2017. AsofDecember 31,2013, PECO had$1.4 billion available in

long-termdebtfinancingauthorityfromthePAPUC. AsofDecember 31,2013, BGE had $850million available in long-termfinancing

authorityfrom MDPSC.

94