ComEd 2013 Annual Report Download - page 180

Download and view the complete annual report

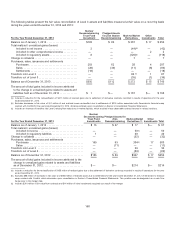

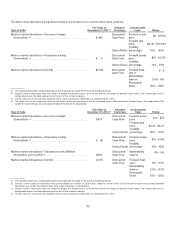

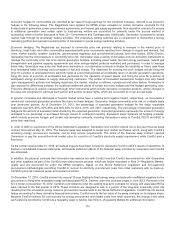

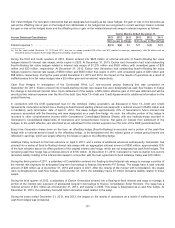

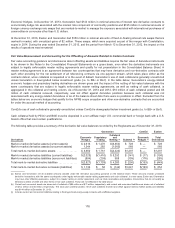

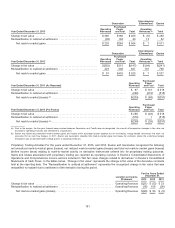

Please find page 180 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.economic hedgesfor commoditiesare recordedat fairvalue through earnings for thecombinedcompany, referredto aseconomic

hedgesinthefollowingtables. TheRegistrantshave appliedtheNPNS scope exception to certainderivativecontractsfor the

forwardsale ofgeneration,power procurement agreements, andnatural gassupplyagreements. Non-derivativecontractsfor access

to additional generation andcertainsalesto load-servingentitiesare accountedfor primarilyunder theaccrual methodof

accounting, which is further discussedinNote 22—CommitmentsandContingencies. Additionally, Generation is exposedto certain

market risks through itsproprietarytradingactivities. The proprietarytradingactivitiesare a complement to Generation’s energy

marketingportfoliobut represent a small portion ofGeneration’s overall energy marketingactivities.

Economic Hedging. TheRegistrantsare exposedto commoditypricerisk primarilyrelatingto changesinthemarket priceof

electricity, fossilfuels, andother commoditiesassociatedwithpricemovementsresultingfromchangesinsupplyanddemand, fuel

costs, market liquidity, weather conditions, governmental regulatoryandenvironmental policies, andother factors. WithinExelon,

Generation hasthemostexposure to commoditypricerisk. Generation usesavarietyofderivativeandnon-derivativeinstrumentsto

managethecommoditypricerisk ofitselectric generation facilities, includingpower sales, fuel andenergy purchases, natural gas

transportation andpipeline capacityagreementsandother energy-relatedproductsmarketedandpurchased. Inorder to manage

theserisks, Generation mayenter into fixed-pricederivative or non-derivativecontractsto hedgethevariabilityinfuture cash flows

fromforecastedsalesofenergy andpurchasesoffuel andenergy. Theobjectivesfor enteringinto such hedgesincludefixingthe

pricefor a portion ofanticipatedfuture electricitysalesat a level that providesan acceptable return on electric generation operations,

fixingthepriceofa portion ofanticipatedfuel purchasesfor the operation ofpower plants, and fixingthepricefor a portion of

anticipatedenergy purchasesto supplyload-servingcustomers. The portion offorecastedtransactionshedgedmayvarybased

upon management’s policiesandhedgingobjectives, themarket,weather conditions, operational andother factors. Generation is

alsoexposedto differencesbetween thelocational settlement pricesofcertaineconomic hedgesandthehedgedgeneratingunits.

This pricedifferenceis activelymanagedthrough other instruments which includederivativecongestion products, whosechangesin

fairvalue are recognizedin earnings each period, andauction revenue rights, which are accountedfor on an accrual basis.

Ingeneral,increasesanddecreasesinforwardmarket priceshaveapositiveandnegativeimpact,respectively, on Generation’s

ownedandcontractedgeneration positionsthat have not been hedged. Generation hedgescommoditypricerisk on a ratable basis

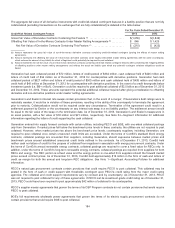

over three-year periods. AsofDecember 31,2013,the percentageofexpectedgeneration hedgedfor themajor reportable

segmentswas92%-95%, 62%-65% and30%-33%for 2014, 2015, and2016, respectively. The percentageofexpectedgeneration

hedgedistheamount ofequivalent sales dividedbytheexpectedgeneration.Expectedgeneration representstheamount ofenergy

estimatedto begeneratedor purchasedthrough ownedor contractedcapacity. Equivalent salesrepresent all hedgingproducts,

which includeeconomic hedgesandcertain non-derivativecontracts, includingGeneration’s salesto ComEd, PECO and BGE to

servetheir retail load.

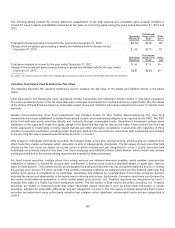

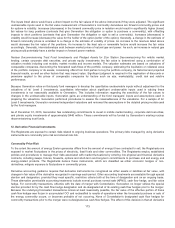

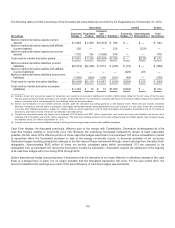

Inorder to fulfill a requirement oftheIllinois Settlement Legislation,Generation andComEd enteredinto a five-year financial swap

contractthat expiredMay31,2013.Thefinancial swap wasdesignedto hedgespot market purchases, which, alongwithComEd’s

remainingenergy procurement contracts, met itsloadservicerequirements. The terms ofthefinancial swap contractrequired

Generation to paythe around-the-clock market pricefor a portion ofComEd’s electricitysupplyrequirement, while ComEd paid a

fixedprice.

AsthecontractexpiredMay31,2013,all realizedimpactshavebeen includedinGeneration’s andComEd’s resultsofoperations. In

Exelon’s consolidatedfinancial statements, all financial statement effectsofthefinancial swap recordedbyGeneration andComEd

are eliminated.

Inaddition,thephysical contractsthat Generation hasenteredinto withComEd andthat ComEd hasenteredinto withGeneration

andother suppliersaspart oftheComEd power procurement process, which are further discussedinNote 3—RegulatoryMatters,

qualify andare accountedfor under theNPNS exception.Basedon theIllinois Settlement Legislation and ICC-approved

procurement methodologiespermittingComEd to recover itselectricityprocurement costsfromretailcustomerswithno mark-up,

ComEd’s pricerisk relatedto power procurement is limited.

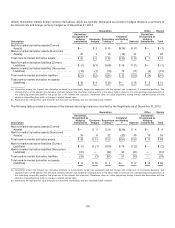

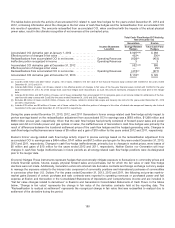

OnDecember 17, 2010,ComEd enteredinto several 20-year floating-to-fixedenergy swap contractswithunaffiliatedsuppliersfor the

procurement oflong-termrenewable energy andassociatedRECs. Deliveryunder thecontractsbegan inJune 2012.Pursuant to the

ICC’s Order on December 19, 2012,ComEd’s commitmentsunder theexistinglong-termcontractsfor energy andassociatedRECs

were reducedinthefirstquarter of2013.Thesecontractsare designedto lock in a portion ofthelong-termcommoditypricerisk

resultingfromthe renewable energy resourceprocurement requirementsintheIllinois Settlement Legislation.ComEd hasnot elected

hedgeaccountingfor thesederivativefinancial instruments. ComEd records thefairvalue oftheswap contractson itsbalancesheet.

BecauseComEd receivesfull costrecoveryfor energy procurement andrelatedcostsfromretailcustomers, thechangeinfairvalue

each periodisrecordedbyComEd asaregulatoryasset or liability. See Note 3—RegulatoryMattersfor additional information.

174