ComEd 2013 Annual Report Download - page 220

Download and view the complete annual report

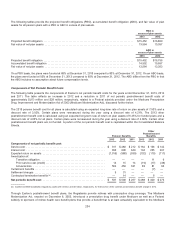

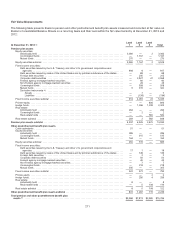

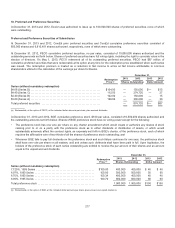

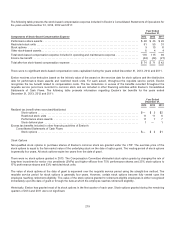

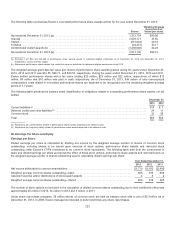

Please find page 220 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(c) Inconnection withtheacquisition ofConstellation inMarch 2012,Exelon assumedConstellation’s pension plan assetsresultingin transfersinto Level 3 of$141

million.

(d) In 2012,Exelon refineditspolicy over thecriteriathat hedgefundinvestmentsmustmeet inorder to becategorizedwithinLevel 2 andLevel 3 ofthefairvalue

hierarchy. Therefore,certainhedgefundinvestmentsthat were categorizedwithinLevel 3 inprior periods havebeen re-categorizedasLevel 2 investmentsasof

December 31,2012.There-categorization ofthesehedgefundinvestmentsisreflectedastransfersout ofLevel 3 of$1.1billion.

(e)In 2012,theliquidityterms ofacertain real estate investment changedto allowredemption within a reasonable periodoftimefromtheredemption date which ledto a

transfer out ofLevel 3 to Level 2 of$5million.

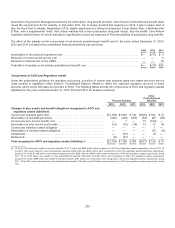

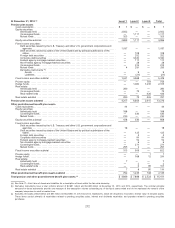

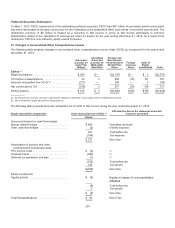

Valuation Techniques Used to Determine Fair Value

Cash equivalents.Investmentswithmaturitiesofthree months or less when purchased, includingcertainshort—term fixedincome

securitiesandmoneymarket funds, are consideredcash equivalents. Thefairvaluesare basedon observable market pricesand,

therefore,are includedintherecurringfairvalue measurementshierarchy asLevel 1.

Equity securities.Withrespecttoindividuallyheldequitysecurities, includinginvestmentsinU.S. andinternational securities, the

trusteesobtainpricesfrompricingservices, whosepricesare obtainedfromdirectfeeds frommarket exchanges, which Exelon is

able to independentlycorroborate.Equitysecuritiesheldindividuallyare primarilytradedon exchangesthat contain onlyactively

tradedsecurities, due to thevolume tradingrequirementsimposedbytheseexchanges. Equitysecuritiesare valuedbasedon

quotedpricesinactivemarketsandare categorizedasLevel 1.Certainprivate placement equitysecuritiesare categorizedasLevel

3becausetheyare not publiclytradedandare pricedusing significant unobservable inputs.

Equitycommingledfunds andmutual funds are maintainedbyinvestment companiesthat holdcertaininvestmentsinaccordance

withastatedset offundobjectives, which are consistent withExelon’s overall investment strategy. Thevaluesofsomeofthese

funds are publiclyquoted. For mutual funds which are publiclyquoted, thefunds are valuedbasedon quotedpricesinactive

marketsandhavebeen categorizedasLevel 1.For equitycommingledfunds andmutual funds which are not publiclyquoted, the

fundadministratorsvalue thefunds usingthe net asset value per fundshare,derivedfromthequotedpricesinactivemarketsofthe

underlyingsecurities. Thesefunds havebeen categorizedasLevel 2.

Fixed income.For fixedincomesecurities, which consistprimarilyofcorporate debtsecurities, foreigngovernment securities,

municipal bonds, asset andmortgage-backedsecurities, commingledfunds, mutual funds andderivativeinstruments, the trustees

obtainmultiple pricesfrompricingvendorswhenever possible, which enablescross-provider validationsinaddition to checks for

unusual dailymovements. Aprimarypricesourceis identifiedbasedon asset type,class or issue for each security. The trustees

monitor pricessuppliedbypricingservicesandmayuseasupplemental pricesourceorchangetheprimarypricesourceofagiven

securityifthe portfoliomanagerschallengeanassignedpriceandthe trusteesdetermine that another pricesourceis consideredto

be preferable.Exelon hasobtainedan understandingofhowthesepricesare derived, includingthe nature andobservabilityofthe

inputsusedinderivingsuch prices. Additionally, Exelon selectivelycorroboratesthefairvaluesofsecuritiesbycomparison to other

market-basedpricesources. InvestmentsinU.S. Treasurysecuritieshavebeen categorizedasLevel 1 becausetheytradeinhighly-

liquid andtransparent markets. Certainprivate placement fixedincomesecuritieshavebeen categorizedasLevel 3 becausethey

are pricedusingcertainsignificant unobservable inputsandare typicallyilliquid. Thefairvaluesof fixedincomesecurities, excluding

U.S. Treasurysecuritiesandprivatelyplaced fixedincomesecurities, are basedon evaluatedpricesthat reflectobservable market

information,such asactual tradeinformation of similar securities, adjustedfor observable differencesandare categorizedas

Level 2.

Derivativeinstrumentsconsistingprimarilyofinterest rate swapsto managerisk are recordedat fairvalue.Derivativeinstruments

are valuedbasedon external pricedata ofcomparable securitiesandhavebeen categorizedasLevel 2.

Fixedincomecommingledfunds andmutual funds, includingshort-terminvestment funds, are maintainedbyinvestment companies

andholdcertaininvestmentsinaccordancewithastatedset offundobjectives, which are consistent withExelon’s overall

investment strategy. Thevaluesofsomeofthesefunds are publiclyquoted. For mutual funds which are publiclyquoted, thefunds

are valuedbasedon quotedpricesinactivemarketsandhavebeen categorizedasLevel 1.For fixedincomecommingledfunds and

mutual funds which are not publiclyquoted, thefundadministratorsvalue thefunds usingthe net asset value per fundshare,derived

fromthequotedpricesinactivemarketsoftheunderlyingsecurities. Thesefunds havebeen categorizedasLevel 2.

Private equity.Private equityinvestmentsincludethoseinlimitedpartnershipsthat investin operatingcompaniesthat are not

publiclytradedon a stock exchangesuch asleveragedbuyouts, growthcapital,venture capital, distressedinvestmentsand

investmentsin natural resources. Private equityvaluationsare reportedbythefundmanager andare basedon thevaluation ofthe

underlyinginvestments, which includeinputssuch ascost,operatingresults, discountedfuture cash flows andmarket based

comparable data.Sincethesevaluation inputsare not highlyobservable,private equityinvestmentshavebeen categorizedas

Level 3.

214