ComEd 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exelon expectsthe projecttobeinfull commercial operation inthefirsthalfof2014. Theacquisition supportstheExelon

commitment to renewable energy aspart ofExelon 2020.The projecthasa25-year PPA,approvedbytheCPUC, withPacific

Gas&Electric Companyfor thefull output ofthe plant.Upon completion,thefacilitywill add 230 MWs to Generation’s renewable

generation fleet.Total capitalizedcostsfor thefacilityare expectedto be approximately$1.1billion.Total capitalizedcostsincurred

through December 31,2013 were approximately $968 million.

Wolf Hollow Generating Station. OnAugust24, 2011,Generation completedtheacquisition ofall oftheequityinterestsofWolf

Hollow, LLC (WolfHollow), acombined-cycle natural gas-firedpower plant in northTexas, for a purchasepriceof$311 million which

increasedGeneration’s ownedcapacitywithintheERCOT power market by 720 MWs.

See Note 4oftheCombinedNotesto ConsolidatedFinancial Statementsfor additional information on theaboveacquisitions.

Significant Dispositions

Maryland Clean Coal Stations. OnNovember 30,2012,asubsidiaryofGeneration soldtheBrandon Shoresgeneratingstation and

H.A.Wagner generatingstation in Anne Arundel County, Maryland, andtheC.P. Crane generatingstation inBaltimore County,

Marylandto Raven Power Holdings LLC, asubsidiaryofRiverstone Holdings LLC to complywithcertainoftheregulatoryapprovals

requiredbythemerger,for net proceeds ofapproximately$371million, which resultedin a pre-taxloss of$272million.See Note 4

oftheCombinedNotesto ConsolidatedFinancial Statementsfor additional information.

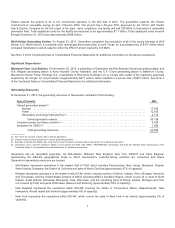

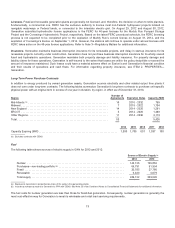

Generating Resources

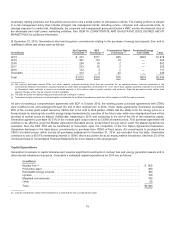

At December 31,2013,thegeneratingresourcesofGeneration consistedofthefollowing:

Type of Capacity MW

Ownedgeneration assets(a)

Nuclear .................................................................................. 17,263

Fossil.................................................................................... 12,165

Renewable (including Hydroelectric) (b) ......................................................... 3,710

Ownedgeneration assets................................................................ 33,138

Long-termpower purchasecontracts(c) ............................................................ 9,426

Investment inCENG (d) ......................................................................... 1,999

Total generatingresources............................................................... 44,563

(a)See “Fuel”for sourcesoffuelsusedin electric generation.

(b) Includesequitymethodinvestment incertaingeneratingfacilities.

(c) Excludescontractswith CENG. See Long-TermPower PurchaseContractstable inthis section for additional information.

(d) Generation ownsa50.01%interestinCENG, ajoint venture with EDF. See ITEM 2.PROPERTIES—Generation andNote 25—RelatedPartyTransactionsofthe

CombinedNotesto ConsolidatedFinancial Statementsfor additional information.

Generation has six reportable segments, theMid-Atlantic, Midwest,NewEngland, NewYork, ERCOT andOther Regions,

representingthedifferent geographical areasinwhich Generation’s customer-facingactivitiesare conductedandwhere

Generation’s generatingresourcesare located.

• Mid-Atlantic representsoperationsintheeastern halfof PJM, which includesPennsylvania,NewJersey, Maryland, Virginia,

WestVirginia,Delaware,theDistrictofColumbiaandpartsofNorthCarolina (approximately37% ofcapacity).

• Midwest representsoperationsinthewestern halfof PJM, which includesportionsofIllinois, Indiana, Ohio, Michigan,Kentucky

andTennessee;andtheUnitedStatesfootprint of MISO excluding MISO’s Southern Region, which coversall or mostofNorth

Dakota,SouthDakota,Nebraska,Minnesota,Iowa, Wisconsin,andtheremainingpartsofIllinois, Indiana, Michigan and Ohio

not covered by PJM; andpartsofMontana, MissouriandKentucky (approximately34% ofcapacity).

•NewEnglandrepresentsthe operationswithinISO-NE coveringthestatesofConnecticut,Maine,Massachusetts, New

Hampshire,RhodeIslandandVermont (approximately8%ofcapacity).

•NewYorkrepresentsthe operationswithinISO-NY, which coversthestate ofNewYorkinitsentirety(approximately3%of

capacity).

7