ComEd 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

measure is basedupon certain unobservable inputs, which are consideredLevel 3 inputs, pursuant to applicable accounting

guidance.Keyestimatesandinputsincludeforecastedpower andfuel pricesandthediscount rate.Thefairvalue amountsare

amortizedover thelifeofthecontractin relation to the present value oftheunderlyingcash flows asofthemerger date.Amortization

expenseandincome are recordedthrough purchasedpower andfuel expense or operatingrevenues.

Exelon andGeneration present separatelyintheirConsolidatedBalanceSheetsthe unamortizedenergy contractassetsand

liabilitiesfor thesecontracts. Generation’s amortization expensefor theyear endedDecember 31,2013 amountedto $470million.

Generation’s amortization expensefor the periodMarch 12,2012 to December 31,2012 amountedto $1,101 million.Inaddition,

Exelon Corporate hasestablishedaregulatoryasset andan unamortizedenergy contractliabilityrelatedto BGE’s power supplyand

fuel contracts. Thepower supplyandfuel contractsregulatoryasset amortization was $77 million for theyear endedDecember 31,

2013 and$116million for the periodMarch 12,2012 to December 31,2012.An equallyoffsettingamortization ofthe unamortized

energy contractliabilityhasbeen recordedat Exelon Corporate intheConsolidatedStatement ofOperations.

Thefairvalue oftheConstellation tradenameintangible asset wasdeterminedbasedon the relieffromroyaltymethodoftheincome

approach whereby fairvalue is determinedto bethe present value ofthelicensefeesavoidedbyowningtheassets. Themeasure is

basedupon certain unobservable inputs, which are consideredLevel 3 inputs, pursuant to applicable accountingguidance.Key

assumptionsincludethehypothetical royaltyrate andthediscount rate.Exelon’s andGeneration’s straightline amortization expense

for thefairvalue oftheConstellation tradenameintangible asset for theyear endedDecember 31,2013 andfor the period

March 12,2012 to December 31,2012 amountedto $26million and$20 million,respectively. The tradenameintangible asset is

includedindeferreddebitsandother assetswithinExelon’s andGeneration’s ConsolidatedBalanceSheets.

Thefairvalue ofthe retail relationshipswasdeterminedbasedon a “multi-periodexcess method” oftheincome approach. Under

this method, theintangible asset’s fairvalue is determinedto betheestimatedfuture cash flows that will be earnedon thecurrent

customer base,takinginto account expectedcontract renewalsbasedon customer attrition ratesandcoststo retainthose

customers. Themeasure is basedupon certain unobservable inputs, which are consideredLevel 3 inputs, pursuant to applicable

accountingguidance.Keyassumptionsincludethecustomer attrition rate andthediscount rate.Theintangible assetsfor thefair

value ofthe retail relationshipsare amortizedasamortization expenseonastraightline basis over theuseful lifeoftheunderlying

assets. Exelon’s andGeneration’s straightline amortization expensefor year endedDecember 31,2013 andfor the period

March 12,2012 to December 31,2012 amountedto $21 million and$15million,respectively. The retail relationshipsintangible

assetsare includedindeferreddebitsandother assetswithinExelon’s andGeneration’s ConsolidatedBalanceSheets.

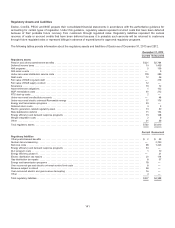

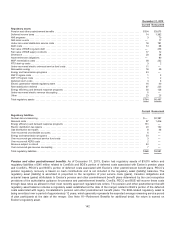

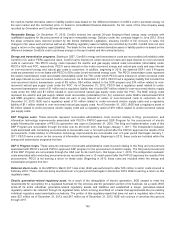

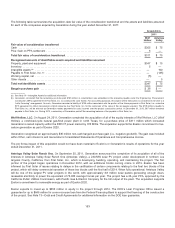

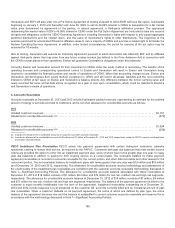

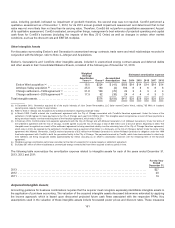

Exelon’s intangible assetsandliabilitiesacquiredthrough themerger withConstellation includedinitsConsolidatedBalanceSheets,

alongwiththefuture estimatedamortization,were asfollows asofDecember 31,2013:

Estimated amortization expense

Description

Weighted

Average

Amortization

(Years) (b) Gross

Accumulated

Amortization Net 2014 2015 2016 2017 2018

2019

and

Beyond

Unamortizedenergy contracts, net (a)........... 1.5 $1,499 $(1,378) $121 $75 $18$(31)$(21)$11 $69

Tradename................................ 10.0243(46) 197 242424242477

Retail relationships .......................... 12.4 214(36) 178 191818181887

Total,net .................................. $1,956 $(1,460) $496 $118$60$11 $21 $53$233

(a)Includesthefairvalue of BGE’s power andgassupplycontractsof$12 million for which an offsettingExelon Corporate regulatoryasset wasalsorecorded.

(b) Weightedaverageamortization periodwascalculatedasofthedate ofacquisition.

Impact of Merger

Itis impracticable to determine theoverall financial statement impactfor theConstellation subsidiariescontributeddownto

Generation followingtheUpstreamMerger for theyear endedDecember 31,2012.Upon closingofthemerger,the operationsof

theseConstellation subsidiarieswere integratedinto Generation’s operationsandare therefore not fully distinguishable after the

merger.

Theimpactof BGE on Exelon’s ConsolidatedStatement ofOperationsandComprehensiveIncomeincludesoperatingrevenuesof

$3,065 million and$2,091million andnet income(loss) of$210 million and$(31)million duringtheyearsendedDecember 31,2013

andDecember 31,2012,respectively.

151