ComEd 2013 Annual Report Download - page 166

Download and view the complete annual report

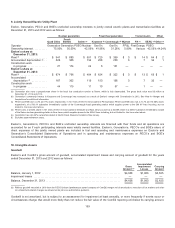

Please find page 166 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under the authoritativeguidancefor goodwill,a reportingunitis an operatingsegment or one level belowan operatingsegment

(knownasacomponent)andisthelevel at which goodwill is testedfor impairment.Acomponent ofan operatingsegment is a

reportingunitif thecomponent constitutesabusiness for which discrete financial information is available andisregularlyreviewed

by segment management.ComEd hasasingle operatingsegment for itscombinedbusiness. There is no level belowthis operating

segment for which discrete financial information is regularlyreviewedbysegment management.Therefore,ComEd’s operating

segment is considereditsonlyreportingunit.

Entitiesassessinggoodwill for impairment havethe option offirst performingaqualitativeassessment before calculatingthefair

value ofthe reportingunit(i.e., step one ofthetwo-step fairvalue basedimpairment test). If an entitydetermines, on thebasis of

qualitativefactors, that thefairvalue ofthe reportingunitis more likelythan not less than thecarryingamount,thetwo-step fairvalue

basedimpairment testis required. Otherwise,no further testingisrequired.

If an entitybypassesthequalitativeassessment or performs thequalitativeassessment,but determinesthat itis more likelythan not

that itsfairvalue is less than itscarryingamount,aquantitativetwo-step,fairvalue basedtestis performed. Thefirststep compares

thefairvalue ofthe reportingunittoitscarryingamount,includinggoodwill.Ifthecarryingamount ofthe reportingunitexceeds its

fairvalue,thesecondstep is performed. Thesecondstep requiresan allocation offairvalue to theindividual assetsandliabilities

usingpurchaseprice allocation inorder to determine theimpliedfairvalue ofgoodwill.Iftheimpliedfairvalue ofgoodwill is less than

thecarryingamount,an impairment loss is recordedasareduction to goodwill andacharge to operatingexpense.Anygoodwill

impairment chargeatComEd will affectExelon’s consolidatedresultsofoperations.

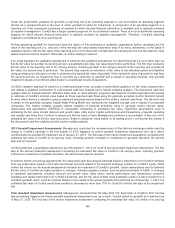

ComEd’s valuation approach is basedon a market participant view, pursuant to authoritativeguidancefor fairvalue measurement,

andutilizesaweightedcombination ofadiscountedcash flowanalysis andamarket multiplesanalysis. Thediscountedcash flow

analysis relieson a single scenarioreflecting“basecase”or “bestestimate”projectedcash flows for ComEd’s business andincludes

an estimate ofComEd’s terminal value basedon theseexpectedcash flows usingthegenerallyacceptedGordon DividendGrowth

formula, which derivesavaluation usingan assumedperpetual annuitybasedon the entity’s residual cash flows. Thediscount rate

is basedon thegenerallyacceptedCapital Asset PricingModel andrepresentstheweightedaveragecostofcapital ofcomparable

companies. Themarket multiplesanalysis utilizesmultiplesofbusiness enterprisevalue to earnings, before interest,taxes,

depreciation andamortization (EBITDA)ofcomparable companiesinestimatingfairvalue. Significant assumptionsusedin

estimatingthefairvalue includediscount andgrowthrates, utilitysector market performanceandtransactions, projectedoperating

andcapital cash flows fromComEd’s business andthefairvalue ofdebt.Management performs areconciliation ofthesumofthe

estimatedfairvalue ofall Exelon reportingunitsto Exelon’s enterprisevalue basedon itstradingpricetocorroborate theresultsof

thediscountedcash flowanalysis andthemarket multiple analysis.

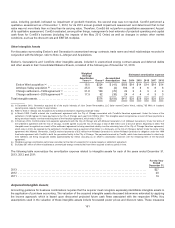

2013 Goodwill Impairment Assessments. Management concludedtheremeasurement ofthelike-kindexchangeposition andthe

chargetoComEd’s earnings inthefirstquarter of2013 triggeredan interim goodwill impairment assessment and, asaresult,

ComEd testeditsgoodwill for impairment asofJanuary31,2013.Thefirststep oftheinterim impairment assessment comparingthe

estimatedfairvalue ofComEd to itscarryingvalue,includinggoodwill,indicatedno impairment ofgoodwill;therefore,thesecond

step wasnot required.

ComEd performedaquantitativeassessment asofNovember 1,2013,for its2013 annual goodwill impairment assessment.Thefirst

step ofthe annual impairment assessment comparingtheestimatedfairvalue ofComEd to itscarryingvalue,includinggoodwill,

indicatedno impairment ofgoodwill;therefore,thesecondstep wasnot required.

Inboththeinterim andannual assessments, thediscountedcash flowanalysis reflectedExelon’s indemnityto holdComEd harmless

fromanyunfavorable impactsoftheafter-taxinterestamountsrelatedto thelike-kindexchangeposition on ComEd’s equity. While

neither theinterim nor the annual assessmentsindicatedan impairment ofComEd’s goodwill,certainassumptionsusedto estimate

thefairvalue ofComEd are highlysensitivetochanges. Adverseregulatoryactions, such asearlytermination of EIMA,or changes

insignificant assumptions, including discount andgrowthrates, utilitysector market performanceandtransactions, projected

operatingandcapital cash flows fromComEd’s business, andthefairvalue ofdebtcouldpotentiallyresult inafuture impairment of

ComEd’s goodwill, which couldbematerial.Basedon theresultsofthe annual goodwill test performedasofNovember 1,2013,the

estimatedfairvalue ofComEd wouldhave neededto decreaseby more than 10%for ComEd to failthefirststep oftheimpairment

test.

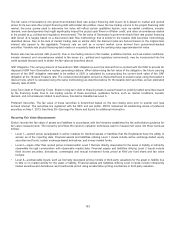

Prior Goodwill Impairment Assessments. Management concludedthat theMay2012 ICC final Order inComEd’s 2011 formula

rate proceedingtriggeredan interim goodwill impairment assessment and, asaresult,ComEd testeditsgoodwill for impairment as

ofMay31,2012.Thefirststep oftheinterim impairment assessment comparingtheestimatedfairvalue ofComEd to itscarrying

160