ComEd 2013 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Economic Hedges. At December 31,2013,Generation had$144 million in notional amountsofinterest rate derivativecontractsto

economicallyhedgerisk associatedwiththeinterest rate component ofcommoditypositionsand$195 million in notional amountsof

foreigncurrency exchange rate swapsthat are marked-to-market to managetheexposure associatedwithinternational purchasesof

commoditiesincurrenciesother than U.S. dollars.

At December 31,2013,Exelon andGeneration had$150million in notional amountsof fixed-to-floatinginterest rate swapsthat are

marked-to-market,withunrealizedgainsof$2million.Theseswaps, which were acquiredaspart ofthemerger withConstellation,

expire in 2014. Duringtheyear endedDecember 31,2013,andthe periodfromMarch 12 to December 31,2012,theimpactonthe

resultsofoperationswas immaterial.

Fair Value Measurement and Accounting for the Offsetting of Amounts Related to Certain Contracts

Fairvalue accountingguidanceand disclosuresabout offsettingassetsandliabilitiesrequiresthefairvalue ofderivativeinstruments

to beshownintheNotesto theConsolidatedFinancial Statementson a gross basis, even when thederivativeinstrumentsare

subjecttolegallyenforceable master nettingagreementsandqualify for net presentation intheConsolidatedBalanceSheet.A

master nettingagreement is an agreement between twocounterpartiesthat mayhavederivativeandnon-derivativecontractswith

each other providingfor the net settlement ofall referencingcontractsvia one payment stream, which takesplaceeither asthe

contractsdeliver,when collateral is requestedor intheevent ofdefault.Generation’s useofcash collateral is generallyunrestricted

unless Generation is downgradedbelowinvestment grade(i.e.to BB+ or Ba1). Inthetable below, Generation’s energy-related

economic hedgesandproprietarytradingderivativesare showngross andtheimpactofthe nettingoffairvalue balanceswiththe

samecounterpartythat are subjecttolegallyenforceable master nettingagreements, aswell asnettingofcash collateral,is

aggregatedinthecollateral andnettingcolumn.AsofDecember 31,2013 and2012,$10 million ofcash collateral postedand$3

million ofcash collateral received, respectively, wasnot offset againstderivativepositionsbecausesuch collateral wasnot

associatedwithanyenergy-relatedderivativesor asofthebalancesheet date there were no positionsto offset. Excludedfromthe

tablesbeloware economic hedgesthat qualify for theNPNS scope exception andother non-derivativecontractsthat are accounted

for under theaccrual methodofaccounting.

ComEd’s useofcash collateral is generallyunrestrictedunless ComEd is downgradedbelowinvestment grade(i.e.to BB+ or Ba1).

Cash collateral held by PECO and BGE mustbedepositedin a non affiliate major U.S. commercial bankor foreignbankwithaU.S.

branch officethat meet certainqualifications.

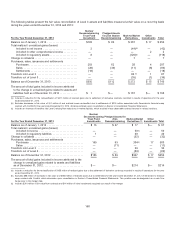

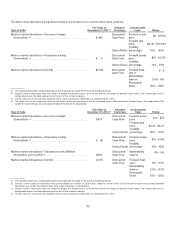

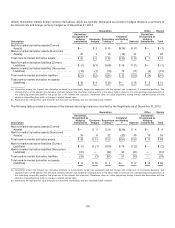

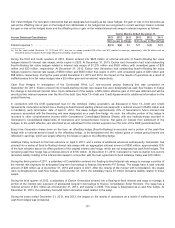

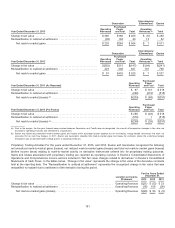

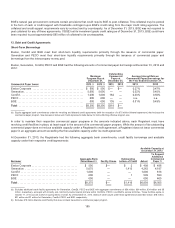

Thefollowingtable providesasummaryofthederivativefairvalue balancesrecordedbytheRegistrantsasofDecember 31,2013:

Generation ComEd Exelon

Derivatives

Economic

Hedges

Proprietary

Trading

Collateral

and

Netting (a) Subtotal (b)

Economic

Hedges (c)

Total

Derivatives

Mark-to-market derivativeassets(current assets) $ 2,616$1,476 $(3,364) $ 728$— $728

Mark-to-market derivativeassets(noncurrent assets) 1,344 285 (1,060) 569 — 569

Total mark-to-market derivativeassets ............... $3,960$1,761$(4,424) $1,297 $ — $1,297

Mark-to-market derivativeliabilities(current liabilities) $(2,023)$(1,410)$3,292$(141)$(17) $ (158)

Mark-to-market derivativeliabilities(noncurrent liabilities) (804) (293) 988 (109) (176) (285)

Total mark-to-market derivativeliabilities .............. $(2,827) $(1,703)$4,280$(250)$(193) $ (443)

Total mark-to-market derivative net assets(liabilities) $ 1,133 $58 $(144) $1,047 $(193) $ 854

(a)Exelon andGeneration net all available amountsallowedunder thederivativeaccountingguidanceonthebalancesheet.Theseamountsinclude unrealized

derivative transactionswiththesamecounterpartyunder legallyenforceable master nettingagreementsandcash collateral.InsomecasesExelon andGeneration

mayhaveother offsettingexposures, subjecttoamaster nettingor similar agreement,such astradereceivablesandpayables, transactionsthat do not qualify as

derivatives, lettersofcreditandother forms ofnon-cash collateral.These are not reflectedinthetable above.

(b) Current andnoncurrent assetsare shown net ofcollateral of $84 million and$72million,respectively, andcurrent andnoncurrent liabilitiesare shown net ofcollateral

of$(12)million and$0million,respectively. The total cash collateral posted, net ofcash collateral receivedandoffset againstmark-to-market assetsandliabilities

was$144 million at December 31,2013.

(c) Includescurrent andnoncurrent liabilitiesrelatingto floating-to-fixedenergy swap contractswithunaffiliatedsuppliers.

178