ComEd 2013 Annual Report Download - page 46

Download and view the complete annual report

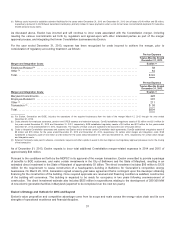

Please find page 46 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Exelon’s boardofdirectorsdeclaredthefirstquarter 2013 dividendof$0.525per share,andinresponsetolowforwardenergy

pricesandweaker financial expectations, amongother factors, approvedarevised dividendpolicy goingforward. Thefirstquarter

dividendwaspaid on March 8, 2013 to shareholdersofrecordon February19, 2013 andwasbasedon Exelon’s previous dividend

of$2.10 per share on an annualizedbasis. Thesecond, thirdandfourthquarter dividends were basedon Exelon’s new dividend

policy of$0.31 per share quarterly dividend($1.24per share on an annualizedbasis). All future quarterly dividends require approval

by Exelon’s boardofdirectors.

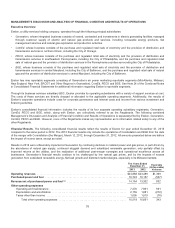

Exelon andGeneration evaluate theeconomic viabilityofeach oftheirgeneratingunitson an ongoingbasis. Decisionsregardingthe

future ofeconomicallychallengedgeneratingassetswill bebasedprimarilyon theeconomics ofcontinuedoperation oftheindividual

plants. If Exelon andGeneration do not see a pathto sustainable profitabilityinanyoftheir plants, Exelon andGeneration will take

stepsto retire those plantsto avoid sustainedlosses. Retirement ofplantscouldmateriallyaffectExelon’s andGeneration’s results

ofoperations, financial position,andcash flows through amongother things, potential impairment charges, accelerateddepreciation

anddecommissioningexpensesover the plantsremaininguseful lives, andongoingreductionsto operatingrevenues, operatingand

maintenanceexpenses, andcapital expenditures.

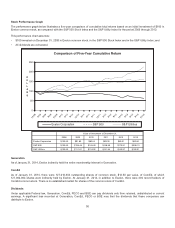

Hedging Strategy

Exelon’s policy to hedgecommodityrisk on a ratable basis over three-year periods is intendedto reducethefinancial impactof

market pricevolatility. Generation is exposedto commoditypricerisk associatedwiththeunhedgedportion ofitselectricityportfolio.

Generation entersinto non-derivativeandderivativecontracts, includingfinancially-settledswaps, futurescontractsandswap

options, andphysical optionsandphysical forwardcontracts, all withcredit-approvedcounterparties, to hedgethis anticipated

exposure.Generation hashedgesin placethat significantlymitigate this risk for 2014and2015. However,Generation is exposedto

relativelygreater commoditypricerisk inthesubsequent yearswithrespecttowhich a larger portion ofitselectricityportfoliois

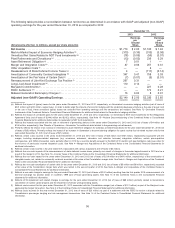

currentlyunhedged. AsofDecember 31,2013,the percentageofexpectedgeneration hedgedfor themajor reportable segments

was92%-95%, 62%-65% and30%-33%for 2014, 2015, and2016, respectively. The percentageofexpectedgeneration hedgedis

theamount ofequivalent sales dividedbytheexpectedgeneration.Expectedgeneration representstheamount ofenergy estimated

to begeneratedor purchasedthrough ownedor contractedcapacity. Equivalent salesrepresent all hedgingproducts, which include

economic hedgesandcertain non-derivativecontractsincludingGeneration’s salesofenergy to ComEd, PECO and BGE relatingto

theirrespective retail loadobligations. Generation hasbeen andwill continue to be proactiveinusinghedgingstrategiesto mitigate

commoditypricerisk insubsequent yearsaswell.

Generation procurescoal,oilandnatural gasthrough long-termandshort-termcontractsandspot-market purchases. Nuclear fuel is

obtainedpredominantlythrough long-termuraniumconcentrate supplycontracts, contractedconversion services, contracted

enrichment servicesandcontractedfuel fabrication services. Thesupplymarketsfor uraniumconcentratesandcertainnuclear fuel

services, coal,oilandnatural gasare subjecttopricefluctuationsandavailabilityrestrictions. Supplymarket conditionsmaymake

Generation’s procurement contractssubjecttocreditrisk relatedto the potential non-performanceofcounterpartiesto deliver the

contractedcommodityor serviceatthecontractedprices. Approximately60%ofGeneration’s uraniumconcentrate requirements

from2014through 2018are suppliedbythree producers. Intheevent ofnon-performanceby theseorother suppliers, Generation

believesthat replacement uraniumconcentratescan beobtained, although at pricesthat maybeunfavorable when comparedto the

pricesunder thecurrent supplyagreements. Non-performanceby thesecounterpartiescouldhaveamaterial adverseimpacton

Exelon’s andGeneration’s resultsofoperations, cash flows andfinancial position.ComEd, PECO and BGE mitigate such exposure

through regulatorymechanisms that allowthemto recover procurement costsfromretailcustomers.

Growth Opportunities

Exelon is currentlypursuinggrowthinboththeutilityandgeneration businessesfocusedprimarilyon smart meter andsmart grid

initiativesat theutilitiesandon renewablesdevelopment andthenuclear uprate programat Generation.Theutilitiesalso anticipate

making significant future investmentsininfrastructure modernization andimprovement initiatives. Management continuallyevaluates

growthopportunitiesalignedwithExelon’s existingbusinessesin electric andgas distribution,electric transmission,generation,

customer supplyofelectric andnatural gasproductsandservices, andnatural gasexploration andproduction activities, leveraging

Exelon’s expertiseinthose areas.

Transmission Development Project. Exelon andAEP Transmission HoldingCompany, LLC (AEP) are workingcollaborativelyto

develop an extra high-voltage transmission projectfromthewestern Ohioborder through Indiana to the northern portion ofIllinois.

Referredto asthe ReliabilityInterregional Transmission Extension (RITE) Line project,the projectis expectedto strengthen the

high-voltage transmission systemandimproveoverall systemreliability. RITELine Illinois, LLC (RITELine Illinois) andRITELine

40