ComEd 2013 Annual Report Download - page 202

Download and view the complete annual report

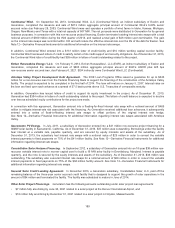

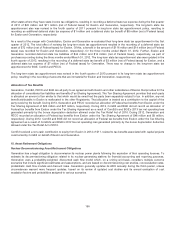

Please find page 202 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other stateswhere theyhavestate incometaxobligations, resultinginrecordingadeferredstate taxexpenseduringthefirstquarter

of2011 of$22 million and$11 million (net ofFederal taxes) for Exelon andGeneration,respectively. The long-termstate tax

apportionment alsowasrevisedinthefourthquarter of2011 pursuant to long-termstate taxapportionment policy, resultingin

recordingan additional deferredstate taxexpenseof$1million andadeferredstate taxbenefitof$8million (net ofFederal taxes)

for Exelon andGeneration,respectively.

Asaresult ofthemerger withConstellation,Exelon andGeneration re-evaluatedtheir long-termstate taxapportionment inthefirst

quarter of2012.The total effectofrevisingthe long-termstate taxapportionment resultedintherecordingofadeferredstate tax

asset of$72million (net ofFederal taxes) for Exelon.Ofthis, abenefitintheamount of$116million and$14million (net ofFederal

taxes) wasrecordedfor Exelon andGeneration,respectively, for thethree months endedMarch 31,2012.Further,Exelon and

Generation recordeddeferredstate taxliabilitiesof $44 million and$14million (net ofFederal taxes), respectively, aspart of

purchaseaccountingduringthethree months endedMarch 31,2012.The long-termstate taxapportionment alsowasupdatedinthe

fourthquarter of2012,resultingintherecordingofadeferredstate taxbenefitof$3million (net ofFederal taxes) for Exelon,anda

deferredstate taxexpenseof$7million (net ofFederal taxes) for Generation.There wasno changetothe long-termstate tax

apportionment for BGE, ComEd and PECO.

The long-termstate taxapportionment wasrevisedinthefourthquarter of2013 pursuant to itslong-termstate taxapportionment

policy, resultingintherecordingofamountsthat are immaterial for Exelon andGeneration,respectively.

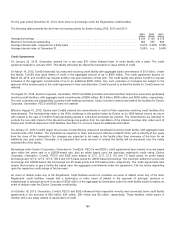

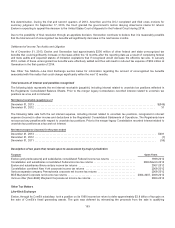

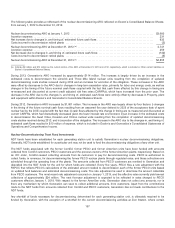

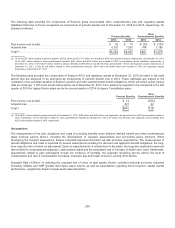

Allocation of Tax Benefits

Generation,ComEd, PECO andBGEare all partyto an agreement withExelon andother subsidiariesofExelon that providesfor the

allocation ofconsolidatedtaxliabilitiesandbenefits(TaxSharingAgreement). TheTaxSharingAgreement providesthat each party

is allocatedan amount oftax similar to that which wouldbeowedhadthe partybeen separatelysubjecttotax. Inaddition,anynet

benefit attributable to Exelon is reallocatedto theother Registrants. That allocation is treatedasacontribution to thecapital ofthe

partyreceivingthebenefit.During2013,Generation and PECO recordedan allocation ofFederal taxbenefitsfromExelon under the

TaxSharingAgreement of$26million and$27million,respectively. During2013,ComEd and BGE did not recordan allocation of

Federal taxbenefitsfromExelon under theTaxSharingAgreement asaresult ofComEd’s and BGE’s 2013 taxnet operatingloss

generatedprimarilybythebonusdepreciation deduction allowedunder theTaxReliefActof2010.During2012,Generation and

PECO recordedan allocation ofFederal taxbenefitsfromExelon under theTaxSharingAgreement of $48 million and$9million,

respectively. During2012,ComEd and BGE did not recordan allocation ofFederal taxbenefitsfromExelon under theTaxSharing

Agreement asaresult ofComEd’s and BGE’s 2012 taxnet operatingloss generatedprimarilybythebonusdepreciation deduction

allowedunder theTaxReliefActof2010.

ComEd receiveda non-cash contribution to equityfromExelon in 2012 of$11,relatedto taxbenefitsassociatedwithcapital projects

constructedbyComEd on behalfofExelon andGeneration.

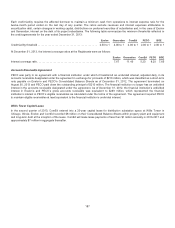

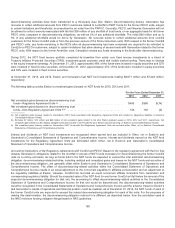

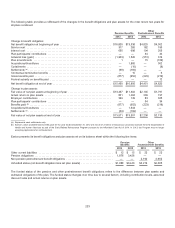

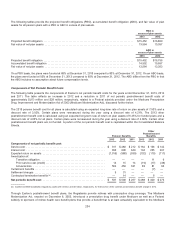

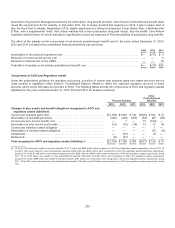

15. Asset Retirement Obligations

Nuclear Decommissioning Asset Retirement Obligations

Generation hasalegal obligation to decommission itsnuclear power plantsfollowingtheexpiration oftheir operatinglicenses. To

estimate itsdecommissioningobligation relatedto itsnuclear generatingstationsfor financial accountingandreportingpurposes,

Generation usesa probability-weighted, discountedcash flowmodel which, on a unit-by-unitbasis, considersmultiple outcome

scenariosthat includesignificant estimatesandassumptions, andare basedon decommissioningcoststudies, costescalation rates,

probabilistic cash flowmodelsand discount rates. Generation generallyupdatesitsAROannuallyduringthethirdquarter,unless

circumstanceswarrant more frequent updates, basedon itsreviewofupdatedcoststudiesanditsannual evaluation ofcost

escalation factorsandprobabilitiesassignedto variousscenarios.

196