ComEd 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

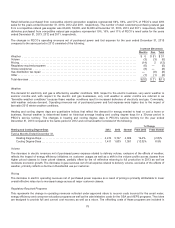

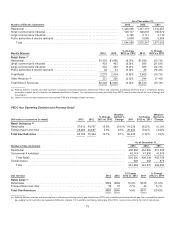

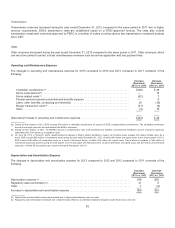

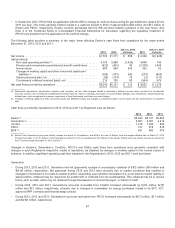

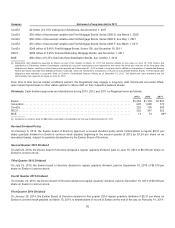

(a)Reflectsdeliveryrevenuesandvolumesfromcustomerspurchasingelectricitydirectlyfrom BGE andcustomerspurchasingelectricityfromacompetitive electric

generation supplier asall customersare assessed distribution charges. For customerspurchasingelectricityfrom BGE, revenue alsoreflectsthecostofenergy and

transmission.

(b) Other revenue includeswholesale transmission revenue andlate payment charges.

(c) Certaincommercial andindustrial (C&I) customerswere reclassifiedfromsmall C&I to largeC&I inprior yearsto conformto thecurrent year’s classification of C&I

customers.

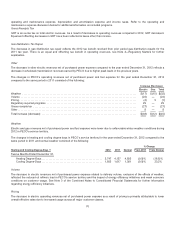

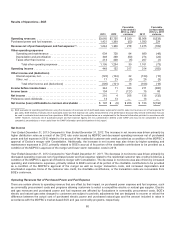

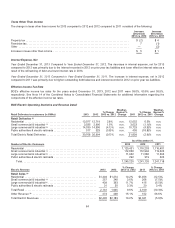

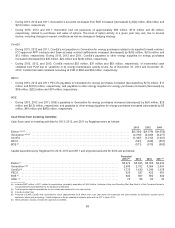

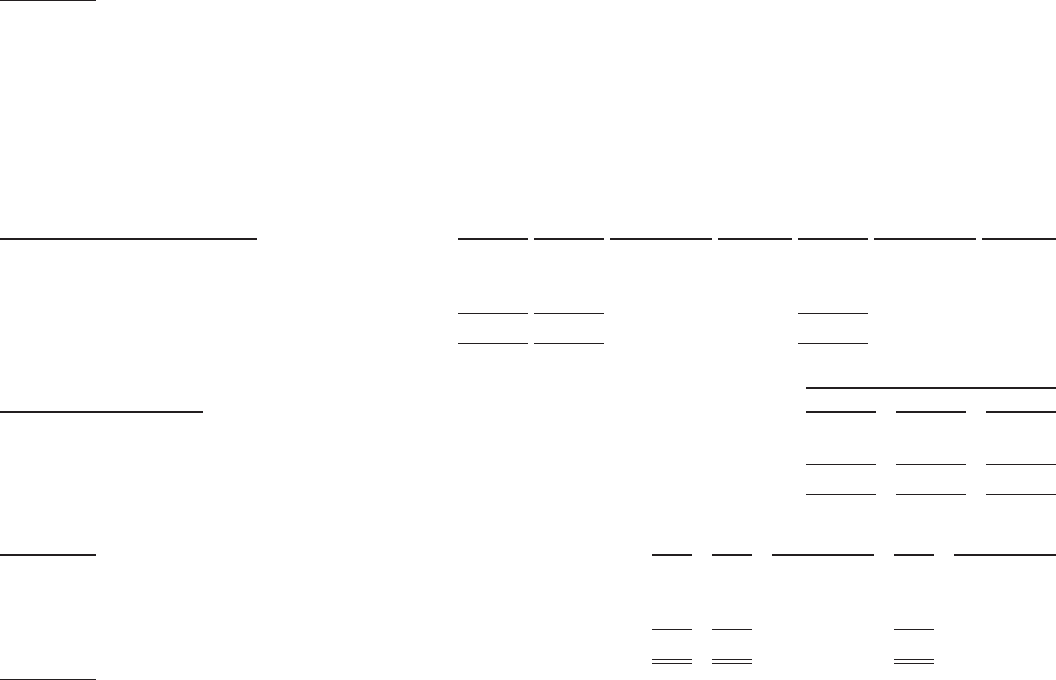

BGE Gas Operating Statistics and Revenue Detail

Deliveries to customers (in mmcf) 2013 2012

% Change

2013 vs. 2012

Weather-

Normal %

Change 2011

% Change

2012 vs. 2011

Weather-

Normal %

Change

Retail Deliveries (d)

Retailsales ..................................... 94,020 86,946 8.1%n.m. 94,800 (8.3)% n.m.

Transportation andother (e)........................ 12,210 15,751(22.5)% n.m. 16,436 (4.2)% n.m.

Total Gas Deliveries ............................. 106,230 102,697 3.4% n.m. 111,236 (7.7)% n.m.

As of December 31,

Number of Gas Customers 2013 2012 2011

Residential ......................................................................... 611,532 610,827608,943

Commercial &industrial .............................................................. 44,16244,228 44,211

Total .......................................................................... 655,694 655,055 653,154

Gas revenue 2013 2012

% Change

2013 vs. 2012 2011

% Change

2012 vs. 2011

Retail Sales (d)

Retailsales ........................................................ $592$494 19.8% $580(14.8)%

Transportation andother (e)........................................... 68 58 17.2%92(37.0)%

Total Gas Revenues ................................................ $660$55219.6% $672(17.9)%

(d) Reflectsdeliveryrevenuesandvolumesfromcustomerspurchasingnatural gasdirectlyfrom BGE andcustomerspurchasingnatural gasfromacompetitive natural

gassupplier asall customersare assessed distribution charges. Thecostofnatural gasischargedto customerspurchasingnatural gasfrom BGE.

(e)Transportation andother gasrevenue includesoff-systemrevenue of12,210 mmcfs ($55 million), 15,751mmcfs ($51million), and16,436 mmcfs ($82million)for the

yearsended2013,2012 and2011,respectively.

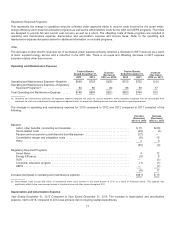

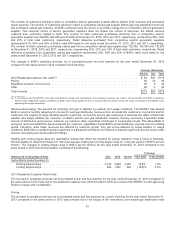

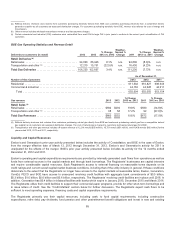

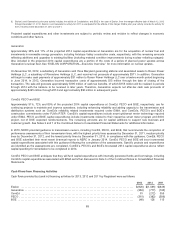

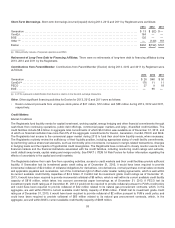

Liquidity and Capital Resources

Exelon’s andGeneration’s prior year activitypresentedbelowincludestheactivityofConstellation,and BGE inthecaseofExelon,

fromthemerger effectivedate ofMarch 12,2012 through December 31,2012.Exelon’s andGeneration’s activityfor 2011 is

unadjustedfor theeffectsofthemerger. BGE’s prior year activitypresentedbelowincludesitsactivityfor the12months ended

December 31,2012 and2011.

Exelon’s operatingandcapital expendituresrequirementsare providedbyinternallygeneratedcash flows fromoperationsaswell as

funds fromexternal sourcesinthecapital marketsandthrough bankborrowings. TheRegistrants’ businessesare capital intensive

andrequire considerable capital resources. Each Registrant’s access to external financingon reasonable terms depends on its

credit ratings andcurrent overall capital market business conditions, includingthat oftheutilityindustryingeneral.Iftheseconditions

deteriorate to theextent that theRegistrantsno longer haveaccess to thecapital marketsat reasonable terms, Exelon,Generation,

ComEd, PECO and BGE haveaccess to unsecuredrevolvingcreditfacilitieswithaggregate bankcommitmentsof$0.5 billion,

$5.3billion,$1.0billion,$0.6 billion and$0.6 billion,respectively. TheRegistrants’ revolvingcreditfacilitiesare in place until 2018. In

addition,Generation has$0.4 billion inbilateral facilitieswithbanks which expire inJanuary2015, December 2015andMarch 2016.

TheRegistrantsutilizetheircreditfacilitiesto support theircommercial paper programs, providefor other short-termborrowings and

to issue lettersofcredit.See the“CreditMatters” section belowfor further discussion.TheRegistrantsexpectcash flows to be

sufficient to meet operatingexpenses, financingcostsandcapital expenditure requirements.

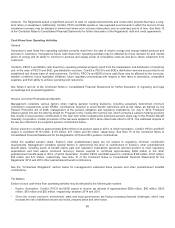

TheRegistrantsprimarilyusetheircapital resources, includingcash, to fundcapital requirements, includingconstruction

expenditures, retire debt,pay dividends, fundpension andother postretirement benefitobligationsandinvestinnewandexisting

85