ComEd 2013 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

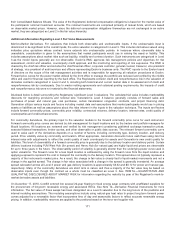

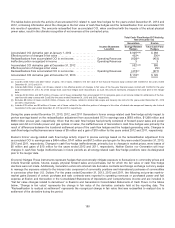

Fair Value Hedges.For derivativeinstrumentsthat are designatedandqualify asfairvalue hedges, thegainorloss on thederivativeas

well astheoffsettingloss or gainonthehedgeditemattributable to thehedgedrisk are recognizedincurrent earnings. Exelon includes

thegainorloss on thehedgeditems andtheoffsettingloss or gainonthe relatedinterest rate swapsininterestexpenseasfollows:

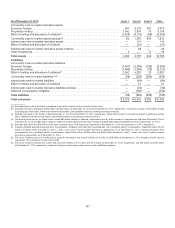

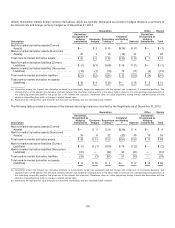

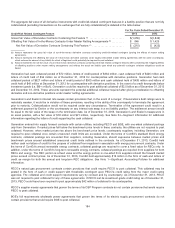

Twelve Months Ended December 31,

Income Statement Classification 2013 2012 2011 2013 2012 2011

Gain (Loss) on Swaps Gain (Loss) on Borrowings

Interestexpense(a)................................................... $(24) $(9) $1$11 $(3)$(1)

(a)For theyearsendedDecember 31,2013 and2012,theloss on swapsincluded$16million and$12 realizedin earnings, respectively, with$2million andan

immaterial amount excludedfromhedgeeffectiveness testing, respectively.

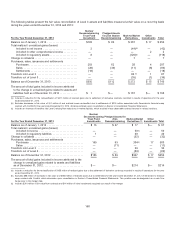

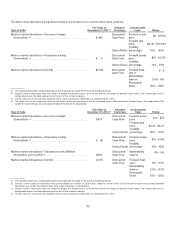

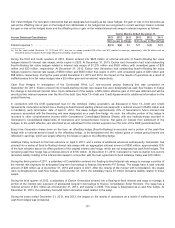

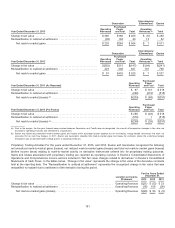

Duringthethirdandfourthquartersof2013,Exelon enteredinto $625million ofnotional amountsof fixed-to-floatingfairvalue

hedgesrelatedto interest rate swaps, which expire in 2020.At December 31,2013,Exelon andGeneration hadtotal outstanding

fixed-to-floatingfairvalue hedgesrelatedto interest rate swapsof$1,275 million and $550million,withunrealizedgainsof$26

million and$23 million,respectively. At December 31,2012,Exelon andGeneration hadoutstanding fixed-to-floatingfairvalue

hedgesrelatedto interest rate swapsof $650million and $550million that expire in 2015, withunrealizedgainsof $49 million and

$38million,respectively. DuringtheyearsendedDecember 31,2013 and2012,theimpactontheresultsofoperationsasaresult of

ineffectiveness fromfairvalue hedgeswasa$2million gainand immaterial,respectively.

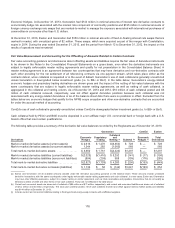

Cash Flow Hedges.In anticipation oftheContinental Wind, LLC non-recourse projectfinancingthat wascompletedon

September 30,2013,Exelon enteredinto forward-startinginterest rate swapsthat were designatedascash flowhedgesto hedge

thechangeinbenchmarkinterest rates. Upon settlement oftheswaps, a$26million effectivegaininOCI wasdeferredandwill be

amortizedinto interestexpenseover thelifeofthedebt.See Note 13—DebtandCreditAgreementsfor additional information on the

projectfinancing.

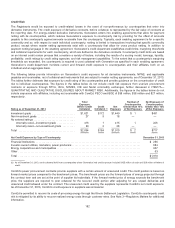

Inconnection withtheDOE guaranteedloan for the Antelope Valleyacquisition,as discussedinNote 13—DebtandCredit

Agreements, Generation enteredinto a floating-to-fixedforwardstartinginterest rate swap witha notional amount of $485 million and

amandatoryearlytermination date ofApril5, 2014. Theswap hedgesapproximately 75% ofGeneration’s future interest rate

exposure associatedwiththefinancingandwasdesignatedasacash flowhedge.Assuch, theeffective portion ofthehedgeis

recordedinother comprehensiveincomewithinGeneration’s ConsolidatedBalanceSheets, withanyineffectiveness recordedin

Generation’s ConsolidatedStatementsofOperationsandComprehensiveIncome.Net gains(or losses) fromsettlement ofthe

hedges, to theextent effective,are amortizedasan adjustment to theinterestexpenseover the termoftheDOE guaranteedloan.

EverytimeGeneration draws downonthe loan,an offsettinghedge(fixed-to-floating) is executedanda portion ofthecash flow

hedgewitha notional amount equal to theoffsettinghedge,isde-designatedandthe relatedgainsor lossesgoingforwardare

reflectedin earnings, which are largelyoffset by thelossesor gainsintheoffsettinghedge.

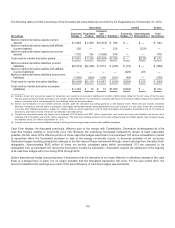

Antelope Valleyreceiveditsfirst loan advance on April5, 2012,andaseriesofadditional advancessubsequently. Generation has

enteredinto a seriesof fixed-to-floatinginterest rate swapswithan aggregatednotional amount of$350million,approximately 75%

ofthe loan advanceamount to offset portionsoftheoriginal interest rate hedge, which are not designatedascash flowhedges. The

remainingcash flowhedgehasa notional amount of$135million.At December 31,2013,Generation’s mark-to-market non-current

derivativeliabilityrelatingto theinterest rate swapsinconnection withthe loan agreement to fundAntelope Valleywas$10 million.

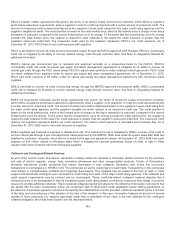

Duringthethirdquarter of2011,asubsidiaryofConstellation enteredinto floating-to-fixedinterest rate swapsto manage a portion of

theinterest rate exposure for anticipatedlong-termborrowings to financeSacramento PV Energy. Theswapshave a total notional

amount of$28million asofDecember 31,2013 andexpire in 2027. After theclosingofthemerger withConstellation,theswaps

were re-designatedascash flowhedges. At December 31,2013,thesubsidiaryhada$1million derivativeliabilityrelatedto these

swaps.

Duringthethirdquarter of2012,asubsidiaryofExelon Generation enteredinto a floating-to-fixedinterest rate swap to managea

portion oftheinterest rate exposure ofanticipatedlong-termborrowings to financeConstellation Solar Horizons. Theswap hasa

notional amount of$27million asofDecember 31,2013,andexpiresin 2030. This swap is designatedasacash flowhedge.At

December 31,2013,thesubsidiaryhada$2million derivativeasset relatedto theswap.

DuringtheyearsendedDecember 31,2013,and2012,theimpactontheresultsofoperationsasaresult ofineffectiveness from

cash flowhedgeswas immaterial.

177