ComEd 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

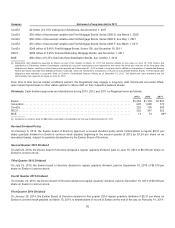

(f) For Generation,includes$146 million ofgainsrelatedto thechangesinfairvalue ofthefive-year financial swap withComEd for theyear ended2012. Effectiveprior

to themerger withConstellation,thefive-year financial swap between Generation andComEd wasde-designatedasacash flowhedge.Asaresult,all changesin

fairvalue for theyear endedDecember 31,2013 were recordedto operatingrevenuesandeliminatedinconsolidation.

(g) For ComEd, thechangesinfairvalue are recordedasachangeinregulatoryassetsor liabilities. AsofDecember 31,2013 and2012,ComEd recordedaregulatory

liabilityof$193million and$293million,respectively, relatedto itsmark-to-market derivativeliabilitieswithGeneration andunaffiliatedsuppliers. AsofDecember 31,

2013 and2012,this includes$11 million ofdecreasesand $98 million ofincreasesinfairvalue,respectively, and$215million and $566 million,respectively, for

reclassificationsfromregulatoryassetsto recognizecostin purchasepower expensedue to settlementsofComEd’s five-year financial swap withGeneration.Asof

December 31,2013 and2012 ComEd alsorecorded$126million and$34million,respectively, ofincreasesinfairvalue,and$7million and$5million,respectively,

ofrealizedlossesdue to settlementsassociatedwithfloating-to-fixedenergy swap contractswithunaffiliatedsuppliers.

(h) Includes$104million and$160million ofamountsreclassifiedto realizedat settlement ofcontractsrecordedto resultsofoperationsrelatedto option premiums due

to thesettlement oftheunderlyingtransactionsfor theyearsendedDecember 31,2013 and2012,respectively.

(i) Includestheendingbalance relatedto interest rate derivativecontractsandforeignexchangecurrency swapsto managetheexposure relatedto theinterest rate

component ofcommoditypositionsandinternational purchasesofcommoditiesincurrenciesother than U.S. Dollars.

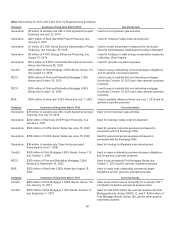

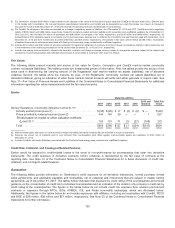

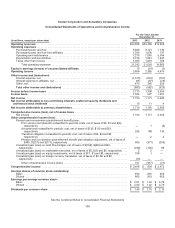

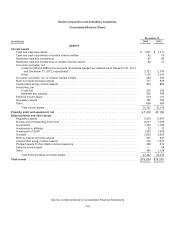

Fair Values

Thefollowingtablespresent maturityandsourceoffairvalue for Exelon,Generation andComEd mark-to-market commodity

contract net assets(liabilities). Thetablesprovidetwofundamental piecesofinformation.First,thetablesprovidethesourceoffair

value usedindeterminingthecarryingamount oftheRegistrants’ total mark-to-market net assets(liabilities), net ofallocated

collateral.Second, thetablesshowthematurity, by year,oftheRegistrants’ commoditycontract net assets(liabilities) net of

allocatedcollateral, givingan indication ofwhen thesemark-to-market amountswill settle andeither generate or require cash. See

Note 11—FairValue ofFinancial AssetsandLiabilitiesoftheCombinedNotesto ConsolidatedFinancial Statementsfor additional

information regardingfairvalue measurementsandthefairvalue hierarchy.

Exelon

Maturities Within

Total Fair

Value2014 2015 2016 2017 2018

2019 and

Beyond

Normal Operations, Commodity derivative contracts (a)(b):

Activelyquotedprices(Level 1) .............................. $(30)$(26) $ 17 $ (4) $ (2) $ — $ (45)

Pricesprovidedbyexternal sources(Level 2) .................. 444 14339— — 1627

Pricesbasedon model or other valuation methods

(Level 3)(c) ....................................... 155 1517125(22)(108) 272

Total .................................................... $569 $268 $127$21 $(24) $(107) $854

(a)Mark-to-market gainsandlosseson other economic hedgeandtradingderivativecontractsthat are recordedinresultsofoperations.

(b) Amountsare shown net ofcollateral paid to andreceivedfromcounterparties(andoffset againstmark-to-market assetsandliabilities) of$144 million at

December 31,2013.

(c) IncludesComEd’s net assets(liabilities) associatedwiththefloating-to-fixedenergy swap contractswithunaffiliatedsuppliers.

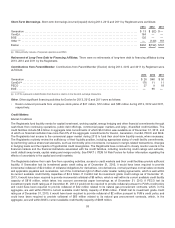

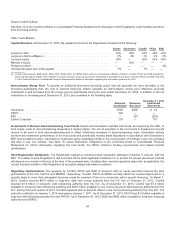

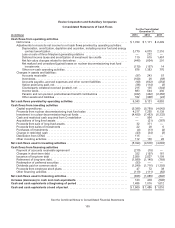

Credit Risk, Collateral, and Contingent Related Features

Exelon wouldbeexposedto credit-relatedlossesintheevent ofnon-performanceby counterpartiesthat enter into derivative

instruments. Thecreditexposure ofderivativecontracts, before collateral,isrepresentedbythefairvalue ofcontractsat the

reportingdate.See Note 12 oftheCombinedNotesto ConsolidatedFinancial Statementsfor a detaildiscussion ofcreditrisk,

collateral,andcontingent relatedfeatures.

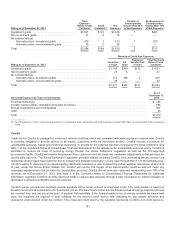

Generation

Thefollowingtablesprovideinformation on Generation’s creditexposure for all derivativeinstruments, normal purchase normal

salesagreements, andapplicable payablesandreceivables, net ofcollateral andinstrumentsthat are subjecttomaster netting

agreements, asofDecember 31,2013.Thetablesfurther delineate that exposure by credit ratingofthecounterpartiesandprovide

guidanceontheconcentration ofcreditrisk to individual counterpartiesandan indication oftheduration ofacompany’s creditrisk by

credit ratingofthecounterparties. Thefiguresinthetablesbelowdo not includecreditrisk exposure fromuraniumprocurement

contractsor exposure through RTOs, ISOs, NYMEX, ICE, andNodal commodityexchanges, which are discussedbelow.

Additionally, thefiguresinthetablesbelowdo not includeexposureswithaffiliates, includingnet receivableswithComEd, PECO

and BGE of$38million,$38million and$27million,respectively. See Note 25oftheCombinedNotesto ConsolidatedFinancial

Statementsfor further information.

100