ComEd 2013 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

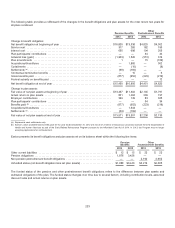

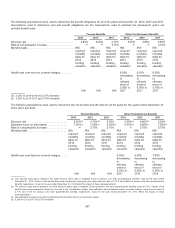

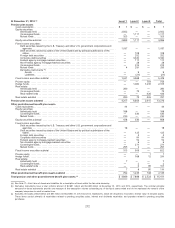

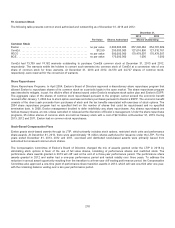

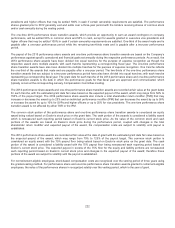

Thefollowingtable presentsthereconciliation ofLevel 3 assetsandliabilitiesmeasuredat fairvalue for pension andother

postretirement benefit plansfor theyearsendedDecember 31,2013 and2012:

Hedge

funds

Private

equity

Real

estate

Debt

securities

Preferred

stock Total

Pension Assets

BalanceasofJanuary1,2013 ................................... $1,235 $ 754 $426$— $— $2,415

Actual return on plan assets:

Relatingto assetsstill heldat the reportingdate ................. 14386 63——292

Relatingto assetssoldduringthe period ....................... 3— (4) — — (1)

Purchases, salesandsettlements:

Purchases ................................................ 360 123 226412752

Sales .................................................... (76) — (91)— — (167)

Settlements(a)............................................. (3)(157) (38) — — (198)

Transfersinto (out of) Level 3 (b) .................................. (623)— — — — (623)

BalanceasofDecember 31,2013 ................................ $1,039$806 $582$41$2$2,470

Other Postretirement Benefits

BalanceasofJanuary1,2013 ................................... $ 12 $1$95 $— $— $ 108

Actual return on plan assets:

Relatingto assetsstill heldat the reportingdate ................. 1—11 —— 12

Relatingto assetssoldduringthe period ....................... — — — — — —

Purchases, salesandsettlements:

Purchases ................................................ — 13—— 4

Sales .................................................... (1)— — — — (1)

Settlements(a)............................................. (4) — — — — (4)

Transfersinto (out of) Level 3 (b) .................................. (4) — — — — (4)

BalanceasofDecember 31,2013 ................................ $ 4 $ 2$109$— $— $115

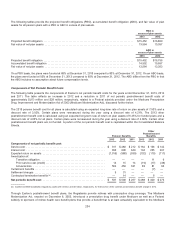

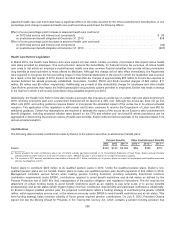

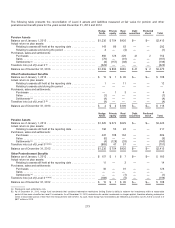

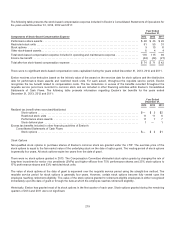

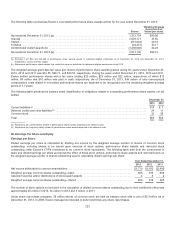

Hedge

funds

Private

equity

Real

estate

Debt

securities

Preferred

stock Total

Pension Assets

BalanceasofJanuary1,2012 ................................... $1,525$672$229$— $— $2,426

Actual return on plan assets:

Relatingto assetsstill heldat the reportingdate ................. 1385524— — 217

Purchases, salesandsettlements:

Purchases ................................................ 447 108134 — — 689

Sales .................................................... (6) — — — — (6)

Settlements(a)............................................. (4) (128) (28) — — (160)

Transfersinto (out of) Level 3 (c)(d)(e)............................... (865) 47 67 — — (751)

BalanceasofDecember 31,2012 ................................ $1,235 $ 754 $426$— $— $2,415

Other Postretirement Benefits

BalanceasofJanuary1,2012 ................................... $ 157 $ 1$ 7 $— $— $ 165

Actual return on plan assets:

Relatingto assetsstill heldat the reportingdate ................. 11 —3—— 14

Purchases, salesandsettlements:

Purchases ................................................ 32 —91——123

Sales .................................................... — — — — — —

Settlements(a)............................................. — — (1)— — (1)

Transfersinto (out of) Level 3 (c)(d)(e)............................... (188) — (5) — — (193)

BalanceasofDecember 31,2012 ................................ $ 12 $1$95 $— $— $ 108

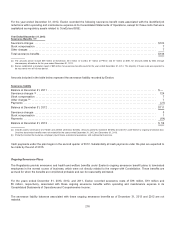

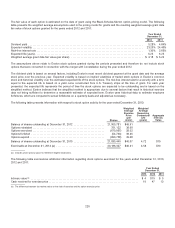

(a)Representscash settlementsonly.

(b) AsofDecember 31,2012,hedgefundinvestmentsthat containedredemption restrictionslimitingExelon’s abilityto redeemtheinvestmentswithin a reasonable

periodoftimewere classifiedasLevel 3 investments. AsofDecember 31,2013,restrictionsfor certaininvestmentsno longer applied, therefore allowingredemption

within a reasonable periodoftimefromthemeasurement date at NAV. Assuch, thesehedgefundinvestmentsare reflectedastransfersout ofLevel 3 to Level 2 of

$627million in 2013.

213