ComEd 2013 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.annual reimbursement requeststo theDOE for costsassociatedwiththestorageof SNF. In all cases, reimbursement requestsare

made onlyafter costsare incurredandonlyfor costsresultingfrom DOE delays inacceptingtheSNF.

Under thesettlement agreement,Generation hasreceivedcash reimbursementsfor costsincurredthrough April30,2013,totaling

approximately$712 million ($601 million after consideringamountsdue to co-ownersofcertainnuclear stationsandto theformer

owner of Oyster Creek). AsofDecember 31,2013,theamount of SNF storagecostsfor which reimbursement will berequestedfrom

theDOE under thesettlement agreement is $71million, which is recordedwithinAccountsreceivable,other.Ofthis amount,$18

million representsamountsowedto theco-ownersofthePeach BottomandQuadCitiesgeneratingfacilities.

CENG enteredinto settlement agreementswiththeDOE during2011 and2012 to recover damagescausedbytheDOE’s failure to

complywithlegal andcontractual obligationsto disposeofspent nuclear fuel relatedto theGinna,Calvert Cliffs andNine Mile Point

nuclear power plants. At December 31,2012,Generation hadapproximately$22 million recordedasareceivable from CENG with

respecttocostsincurredbyConstellation prior to theformation oftheCENG joint venture for theNine Mile Point andCalvert Cliffs

nuclear power plants. CENG receivedthefunds for theNine Mile Point andCalvert Cliffs settlement fromtheDOE inJanuary2013

andFebruary2013,respectively, andremittedthe$22 million to Generation.

TheStandardContractswiththeDOE alsorequiredthepayment to theDOE ofa one-timefee applicable to nuclear generation

through April6, 1983.Thefee relatedto theformer PECO unitshasbeen paid. Pursuant to theStandardContracts, ComEd

previouslyelectedto defer payment ofthe one-timefee of$277 million for itsunits (which are nowpart ofGeneration), withinterest

to thedate ofpayment,untiljustprior to thefirstdeliveryof SNF to theDOE. AsofDecember 31,2013,theunfunded SNF liability

for the one-timefee withinterestwas$1,021 million.Interestaccruesat the13-weekTreasuryRate.The13-weekTreasuryRate in

effect,for calculation oftheinterestaccrual at December 31,2013,was0.051%. Theliabilitiesfor SNF disposal costs, includingthe

one-timefee,were transferredto Generation aspart ofExelon’s 2001 corporate restructuring. The outstandingone-timefee

obligationsfor theOyster Creekand TMI unitsremainwiththeformer owners. Clinton hasno outstandingobligation.See Note 11—

FairValue ofAssetsandLiabilitiesfor additional information.

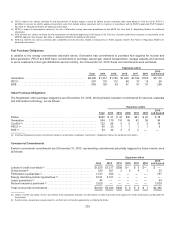

Energy Commitments

Generation’s customer facingactivitiesincludethephysical deliveryandmarketingofpower obtainedthrough itsgeneration

capacity, andlong-, intermediate-andshort-termcontracts. Generation maintainsan effectivesupplystrategy through ownershipof

generation assetsandpower purchaseandleaseagreements. Generation hasalsocontractedfor access to additional generation

through bilateral long-termPPAs. Theseagreementsare firmcommitmentsrelatedto power generation ofspecific generation plants

and/or are dispatchable in nature.Several ofGeneration’s long-termPPAs, which havebeen determinedto be operatingleases,

havesignificant contingent rental paymentsthat are dependent on thefuture operatingcharacteristics oftheassociatedplants, such

asplant availability. Generation recognizescontingent rental expensewhen itbecomesprobable ofpayment.Generation entersinto

PPAswiththeobjectiveofobtaininglow-cost energy supplysourcesto meet itsphysical deliveryobligationsto itscustomers.

Generation hasalso purchasedfirmtransmission rightsto ensure that ithasreliable transmission capacityto physicallymoveits

power suppliesto meet customer deliveryneeds. Theprimaryintent andbusiness objectivefor theuseofitscapital assetsand

contractsisto provideGeneration withphysical power supplyto enable ittodeliver energy to meet customer needs. Inaddition to

physical contracts, Generation usesfinancial contractsfor economic hedgingpurposesand, to a lesser extent,aspart ofproprietary

tradingactivities.

Generation hasenteredinto bilateral long-termcontractual obligationsfor salesofenergy to load-servingentities, includingelectric

utilities, municipalities, electric cooperativesandretail loadaggregators. Generation also entersinto contractual obligationsto deliver

energy to market participantswhoprimarilyfocuson theresale ofenergy productsfor delivery. Generation providesfor deliveryofits

energy to thesecustomersthrough firmtransmission.

Aspart ofreachingacomprehensiveagreement with EDF inOctober 2010,theexistingpower purchaseagreementswith CENG

were modifiedto beunit-contingent through theendoftheiroriginal termin 2014. Under theseagreements, CENG hastheabilityto

fix the energy priceonaforwardbasis by enteringinto monthlyenergy hedge transactionsfor a portion ofthefuture sale, while any

unhedgedportionswill be providedat market pricesbydefault.Additionally, beginningin 2015andcontinuingto theendofthelifeof

therespective plants, Generation agreedto purchase50.01%ofthenuclear plant output owned by CENG at market prices.

Generation disclosesinthetable belowcommitmentsto purchasefrom CENG at fixedprices. All commitmentsto purchaseat

market prices, which include all purchasessubsequent to December 31,2014, are excludedfromthetable.Generation continuesto

owna50.01%membershipinterestinCENG that is accountedfor asan equitymethodinvestment.See Note 5—Investment in

Constellation Energy Nuclear Group, LLC andNote 25—RelatedPartyTransactionsfor more detailson this arrangement.

227