ComEd 2013 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

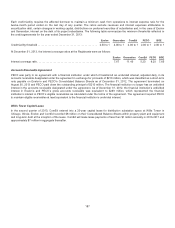

For theyear endedDecember 31,2013,there were no borrowings under theRegistrants’ creditfacilities.

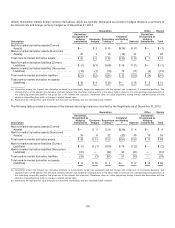

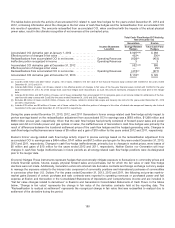

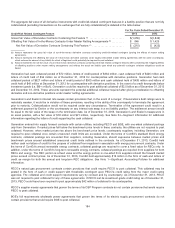

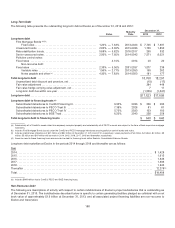

Thefollowingtable presentstheshort-termborrowingactivityfor Exelon during2013,2012 and2011.

2013 2012 2011

Averageborrowings ......................................................................... $254 $ 199 $ 218

Maximumborrowings outstanding .............................................................. 682505600

Averageinterest rates, computedon a dailybasis................................................. 0.37% 0.48% 0.50%

Averageinterest rates, at December 31 ......................................................... 0.35% n.a.0.44%

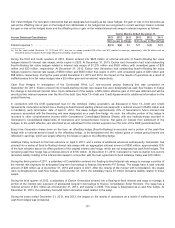

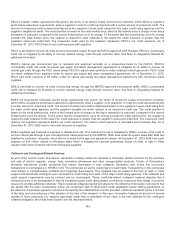

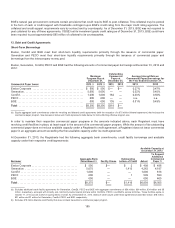

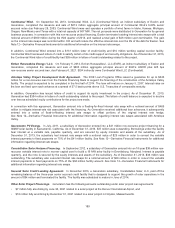

Credit Agreements

OnJanuary23,2013,Generation enteredinto a twoyear $75 million bilateral letter ofcreditfacilitywithabank. Thecredit

agreement expiresinJanuary2015. This facilitywill solelybeutilizedbyGeneration to issue lettersofcredit.

OnMarch 14, 2013,ComEd extendeditsunsecuredrevolvingcreditfacilitywithaggregate bankcommitmentsof$1.0billion.Under

this facility, ComEd may issue lettersofcreditintheaggregate amount ofup to $500 million.Thecreditagreement expireson

March 28, 2018, andComEd mayrequest another one-year extension ofthat term. Thecreditfacilityalso allows ComEd to request

increasesintheaggregate commitmentsofup to an additional $500 million.Anysuch extension or increasesare subjecttothe

approval ofthe lenderspartyto thecreditagreement intheirsole discretion.Costsincurredto extendthefacilityfor ComEd were not

material.

OnAugust10,2013,Exelon Corporate,Generation, PECO and BGE amendedandextendedtheirrespectiveunsecuredsyndicated

revolvingcreditfacilities, withaggregate bankcommitmentsof$500 million, $5.3billion,$600 million and$600 million,respectively.

Thenewcovenantsare substantiallyconsistent withexistingcovenants. Costsincurredto amendandextendthefacilitiesfor Exelon

Corporate,Generation, PECO and BGE were not material.

EffectiveAugust10,2013,Exelon andComEd enteredinto amendmentsto each oftheirrespectiverevolvingcreditfacilities(the

Amendments). TheAmendmentsrelate to theIRS’s challengetotheposition taken by Exelon on its1999 federal incometaxreturn

withrespecttothesale ofComEd’s fossilgeneratingassetsinalike-kindexchangetaxposition.TheAmendmentsare intendedto

excludethe non-cash impactofthelike-kindexchangetaxposition fromthecalculation oftheinterestcoverage ratiounder each of

Exelon andComEd’s respectivecreditfacilities. See Note 12—IncomeTaxesfor additional information.

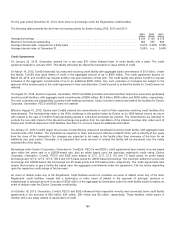

OnJanuary27, 2014ComEd began the process ofextendingitsunsecuredsyndicatedrevolvingcreditfacility, withaggregate bank

commitmentsof$1.0billion.The transaction is expectedto closeandbecomeeffectiveinMarch 2014, withamaturityof fiveyears

fromthecloseofthe transaction.Nochangesare expectedto bemadetothefacilityother than extension ofthe termfor an

additional one year period. Generally, itis expectedthat costsincurredto extendthefacilitywill beamortizedover thenewly

extendedlifeofthefacility.

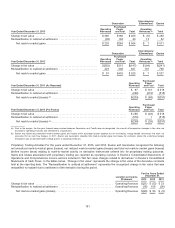

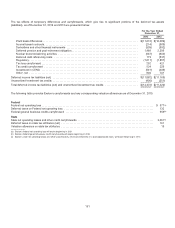

Borrowings under Exelon Corporate’s, Generation’s, ComEd’s, PECO’s and BGE’s creditagreementsbear interest at a rate based

upon either theprime rate or a LIBOR-basedrate,plusan adder basedupon the particular registrant’s credit rating. Exelon

Corporate,Generation,ComEd, PECO and BGE haveaddersof27.5, 27.5, 27.5, 0.0and 7.5 basis pointsfor primebased

borrowings and127.5, 127.5, 127.5, 100.0and107.5 basis pointsfor LIBOR-basedborrowings. Themaximumaddersfor prime rate

borrowings and LIBOR-basedrate borrowings are 65 basis pointsand165 basis points, respectively. Thecreditagreementsalso

require theborrower to payafacilityfee basedupon theaggregate commitmentsunder theagreement.Thefee variesdepending

upon therespectivecredit ratings oftheborrower.

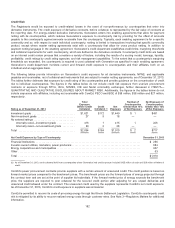

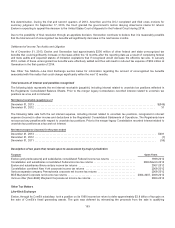

An event ofdefault under anyoftheRegistrants’ creditfacilitieswouldnot constitute an event ofdefault under anyoftheother

Registrants’ creditfacilities, except that a bankruptcy or other event ofdefault inthepayment ofprincipal,premiumor

indebtedness inprincipal amount inexcess of$100 million intheaggregate by Generation under itscreditfacilitywouldconstitute an

event ofdefault under theExelon Corporate creditfacility.

OnOctober 18, 2013,Generation,ComEd, PECO and BGE refinancedtheirrespectiveminorityandcommunitybankcreditfacility

agreementsintheamountsof$50million,$34million,$34million and$5million,respectively. Thesefacilities, which expire in

October 2014, are solelyutilizedto issue lettersofcredit.

186