ComEd 2013 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

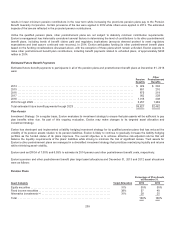

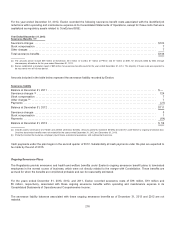

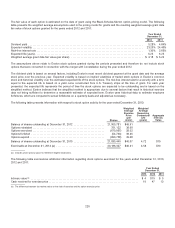

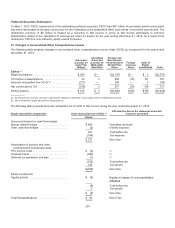

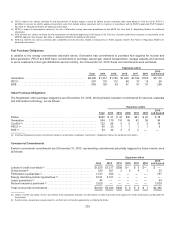

Thefollowingtable presentsthestock-basedcompensation expenseincludedinExelon’s ConsolidatedStatementsofOperationsfor

theyearsendedDecember 31,2013,2012 and2011:

Year Ended

December 31,

Components of Stock-Based Compensation Expense 2013 2012 2011

Performanceshare awards ..................................................................... $ 48 $ 46 $26

Restrictedstock units.......................................................................... 615031

Stock options ................................................................................ 3158

Other stock-basedawards...................................................................... 6 4 4

Total stock-basedcompensation expenseincludedin operatingandmaintenanceexpense................ 11811569

Incometaxbenefit............................................................................ (44) (44) (27)

Total after-taxstock-basedcompensation expense................................................. $ 74 $ 71$42

There were no significant stock-basedcompensation costscapitalizedduringtheyearsendedDecember 31,2013,2012 and2011.

Exelon receivesataxdeduction basedon theintrinsic value oftheawardon theexercisedate for stock optionsandthedistribution

date for performanceshare awards andrestrictedstock units. For each award, throughout therequisite service period, Exelon

recognizesthetaxbenefit relatedto compensation costs. Thetaxdeductionsinexcess ofthebenefitsrecordedthroughout the

requisite service periodare recordedto common stock andare includedinother financingactivitieswithinExelon’s Consolidated

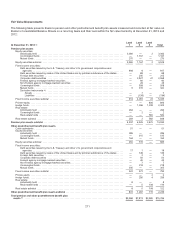

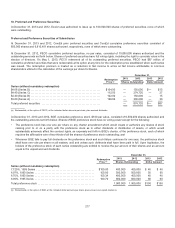

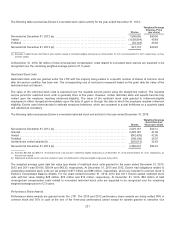

StatementsofCash Flows. Thefollowingtable presentsinformation regardingExelon’s taxbenefitsfor theyearsended

December 31,2013,2012 and2011:

Year Ended

December 31,

2013 2012 2011

Realizedtaxbenefitwhen exercised/distributed:

Stock options ......................................................................... $— $ 3$2

Restrictedstock units .................................................................. 11 11 8

Performanceshare awards ............................................................. 11 77

Stock deferral plan .................................................................... 1—1

Excess taxbenefitsincludedinother financingactivitiesofExelon’s

ConsolidatedStatementsofCash Flows:

Stock options ......................................................................... $— $ 2$1

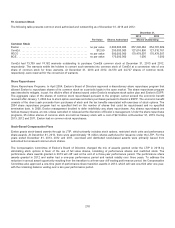

Stock Options

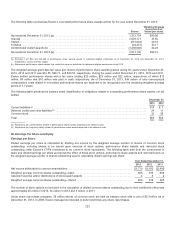

Non-qualifiedstock optionsto purchasesharesofExelon’s common stock are grantedunder theLTIP. Theexercisepriceofthe

stock optionsisequal to thefairmarket value oftheunderlyingstock on thedate ofoption grant.Thevestingperiodofstock options

is generallyfour years. All stock optionsexpire ten yearsfromthedate ofgrant.

There were no stock optionsgrantedin 2013.TheCompensation Committee eliminatedstock option grantsbychangingthemix of

long-termincentivesfor senior vice presidents (SVPs) and higher officersfrom 75% performancesharesand25% stock optionsto

67% performancesharesand33%restrictedstock units.

Thevalue ofstock optionsat thedate ofgrant is expensedover therequisite service periodusingthestraight-line method. The

requisite service periodfor stock optionsisgenerallyfour years. However,certainstock optionsbecomefullyvestedupon the

employee reachingretirement-eligibility. Thevalue ofthestock optionsgrantedto retirement-eligible employeesiseither recognized

immediatelyupon thedate ofgrant or through thedate at which theemployee reachesretirement eligibility.

Historically, Exelon hasgrantedmostofitsstock optionsinthefirstquarter ofeach year.Stock optionsgrantedduringtheremaining

quartersof2012 and2011 were not significant.

219