ComEd 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Solar Project Entity Group. In 2011,Constellation formedagroup ofsolar projectlimitedliabilitycompaniesto build, own,and

operate solar power facilities, which are nowpart ofGeneration.Additionally, on September 30,2011,Generation acquiredall ofthe

equityinterestsin Antelope ValleySolar Ranch One (Antelope Valley) fromFirstSolar,Inc., a 230-MW solar PV projectunder

construction in northern LosAngelesCounty, California. While Generation owns100%ofthese entities, ithasbeen determinedthat

certainoftheindividual solar project entitiesare VIEs becausethe entitiesrequire additional subordinatedfinancial support inthe

formofa parental guarantee ofdebt,loansfromthecustomersinorder to obtainthenecessaryfunds for construction ofthesolar

facilities, or thecustomersabsorbpricevariabilityfromthe entitiesthrough thefixedpricepower and/or REC purchaseagreements.

Generation is theprimarybeneficiaryofthesolar project entitiesthat qualify as VIEs becauseGeneration controlsthedesign,

construction,andoperation ofthesolar power facilities. Generation providescapital fundingto thesesolar VIE entitiesfor ongoing

construction ofthesolar power facilities. Inaddition,thesesolar VIE entitieshaveanaggregate amount ofoutstandingdebtwiththird

partiesof$536million,asofDecember 31,2013,for which thecreditorshavenorecoursetoGeneration,however there is limited

recoursetoGeneration withrespecttoremainingequitycontributionsnecessaryto complete the Antelope Valleyproject.For

additional information on these project-specific financingarrangementsrefer to Note 13—DebtandCreditAgreements.

Retail Power Supply Entity. InAugust 2013,Generation executedan agreement to terminate itsenergy supplycontractwitha

retailpower supplycompanythat waspreviouslyaconsolidated VIE. Generation did not haveanownershipinterestinthe entity, but

wastheprimarybeneficiarythrough the energy supplycontract.Asaresult ofthe termination,Generation no longer hasavariable

interestinthe retailpower supplycompanyandceasedconsolidation ofthe entityduringthethirdquarter of2013.Upon

deconsolidation,there wasno gainorloss recognized. Theassets, liabilities, andnon-controllinginterestwere removedfrom

Exelon’s andGeneration’s balancesheet andthechangein non-controllinginterestis alsoreflectedon theStatement ofChangesin

Shareholders’ EquityandtheStatement ofChangesinMember’s Equityfor Exelon andGeneration,respectively.

Wind Project Entity Group. Generation ownsandoperatesanumber ofwindprojectlimitedliabilityentities, themajorityof which

were acquiredon December 9, 2010 when Generation completedtheacquisition ofall oftheequityinterestsofJohnDeere

Renewables, LLC (nowknownasExelon Wind). Generation hasevaluatedthesignificant agreementsandownershipstructuresand

risks ofeach ofitswindprojectsandunderlyingentities, anddeterminedthat certainofthe entitiesare VIEs becauseeither the

projectshave non-controllinginterestholdersthat absorbvariabilityfromthewindprojects, or thecustomersabsorbpricevariability

fromthe entitiesthrough thefixedpricepower and/or REC purchaseagreements. Generation is theprimarybeneficiaryofthewind

project entitiesthat qualify as VIEs becauseGeneration controlsthedesign,construction,andoperation ofthewindpower

facilities. While Generation owns100%ofthemajorityofthewindproject entities, 10 ofthe projectshave non-controllingequity

interestsheldbythirdparties, that currentlyrangebetween 1%and 6%. Of these 10 projects, Generation’s current economic

interestsinnine ofthe projectsare significantlygreater than itsstatedcontractual governancerightsandall ofthese projectshave

reversionaryinterest provisionsthat providethe non-controllinginterestholder witha purchase option,certainof which are

consideredbargain purchaseprices, which, if exercised, transfersownershipofthe projectsto the non-controllinginterestholder

upon either thepassageoftimeortheachievement oftargetedfinancial returns. Theownershipagreementswiththe non-controlling

interestsstate that Generation is to providefinancial support to the projectsin proportion to itscurrent economic interestsinthe

projectsthat currentlyrangebetween 94% and 99%. However,no additional support to these projectsbeyondwhat was

contractuallyrequiredhasbeen providedduring2013.AsofDecember 31,2013,thecarryingamount oftheassetsandliabilities

that are consolidatedasaresult ofGeneration beingtheprimarybeneficiaryofthewind VIE entitiesprimarilyrelate to thewind

generatingassets, PPAintangible assetsandworkingcapital amounts.

AsofDecember 31,2013 and2012,ComEd and PECO did not haveanyconsolidated VIEs.

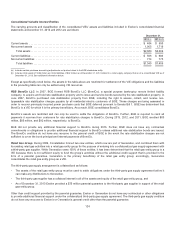

Unconsolidated Variable Interest Entities

Exelon’s andGeneration’s variable interestsinunconsolidated VIEs generallyincludethree transaction types: (1)equity

investments, (2)energy purchaseandsale contracts, and(3)fuel purchasecommitments. For theequityinvestments, thecarrying

amount oftheinvestmentsisreflectedon theirConsolidatedBalanceSheetsinInvestmentsinaffiliates. For the energy purchase

andsale contractsandthefuel purchasecommitments(commercial agreements), thecarryingamount ofassetsandliabilitiesin

Exelon’s andGeneration’s ConsolidatedBalanceSheetsthat relate to theirinvolvement withtheVIEs are predominatelyrelatedto

workingcapital accountsandgenerallyrepresent theamountsowed by, or owedto,Exelon andGeneration for thedeliveries

associatedwiththecurrent billing cyclesunder thecommercial agreements. Further,Exelon andGeneration have not provided

material debtorequitysupport,liquidityarrangementsor performanceguaranteesassociatedwiththesecommercial agreements.

AsofDecember 31,2013 and2012,Exelon andGeneration had significant unconsolidatedvariable interestsineightandnine,

respectively, VIEs for which theywere not theprimarybeneficiary; includingcertainequityinvestmentsandcertaincommercial

125