ComEd 2013 Annual Report Download - page 231

Download and view the complete annual report

Please find page 231 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

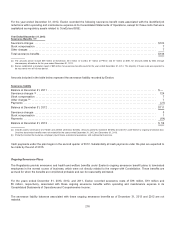

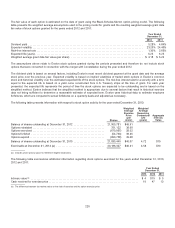

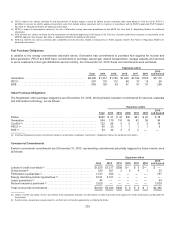

(a)Amountsin parenthesis represent a decreasein net income.

(b) This accumulatedother comprehensiveincomecomponent is includedinthecomputation ofnet periodic pension and OPEB cost(see note 16for additional details).

(c) Amortization ofthedeferredcompensation unit plan is allocatedto capital andoperatingandmaintenanceexpense.

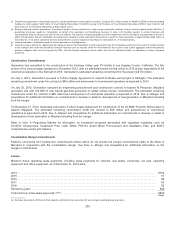

22. Commitments and Contingencies

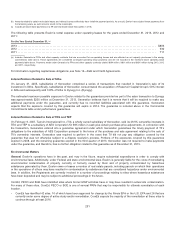

Nuclear Insurance

Generation is subjecttoliability, propertydamageandother risks associatedwithmajor incidentsat anyofitsnuclear stations,

includingtheCENG nuclear stations. Generation hasreduceditsfinancial exposure to theserisks through insuranceandother

industryrisk-sharingprovisions.

ThePrice-Anderson Actwasenactedto ensure theavailabilityoffunds for public liabilityclaims arisingfroman incident at anyofthe

U.S. licensednuclear facilitiesandalsotolimittheliabilityofnuclear reactor ownersfor such claims fromanysingle incident.Asof

December 31,2013,thecurrent liabilitylimit per incident was$13.6 billion andissubjecttochangetoaccount for theeffectsof

inflation andchangesinthenumber oflicensedreactors. An inflation adjustment mustbemade at leastonceevery5yearsandthe

lastinflation adjustment wasmadeeffectiveSeptember 10,2013.InaccordancewiththePrice-Anderson Act,Generation maintains

financial protection at levelsequal to theamount ofliabilityinsuranceavailable fromprivate sourcesthrough the purchaseofprivate

nuclear energy liabilityinsurancefor public liabilityclaims that couldariseintheevent ofan incident.AsofJanuary1,2013,the

amount ofnuclear energy liabilityinsurance purchasedis$375 million for each operatingsite.Additionally, thePrice-Anderson Act

requiresasecondlayer ofprotection through themandatoryparticipation in a retrospective ratingplan for power reactors(currently

104reactors) resultinginanadditional $13.2billion infunds available for public liabilityclaims. Participation inthis secondary

financial protection pool requiresthe operator ofeach reactor to funditsproportionate share ofcostsfor anysingle incident that

exceeds theprimarylayer offinancial protection.Under thePrice-Anderson Act,themaximumassessment intheevent ofan

incident for each nuclear operator,per reactor,per incident (includinga5% surcharge), is $127.3million,payable at no more than

$19million per reactor per incident per year.Exelon’s maximumliabilityper incident is approximately$2.4 billion.

Inaddition,theU.S. Congress couldimposerevenue-raisingmeasureson thenuclear industryto paypublic liabilityclaims

exceedingthe$13.6 billion limitfor a single incident.

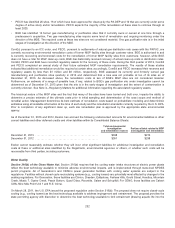

Generation is requiredeach year to report to theNRCthecurrent levelsandsourcesofpropertyinsurancethat demonstrates

Generation possessessufficient financial resourcesto stabilizeanddecontaminate a reactor andreactor station site intheevent of

an accident.The propertyinsurancemaintainedfor each facilityiscurrentlyprovidedthrough insurance policiespurchasedfrom

NEIL, an industrymutual insurancecompanyof which Generation is amember.

NEIL maydeclare distributionsto itsmembersasaresult offavorable operatingexperience.Inrecent years NEIL hasmade

distributionsto itsmembers, but Generation cannot predictthelevel offuture distributionsor if theywill continue at all. NEIL declared

adistribution for 2013,of which Generation’s portion was$18.5 million.Thedistribution wasrecordedasareduction to Operating

andmaintenanceexpensewithinExelon andGeneration’s ConsolidatedStatementsofOperationsandComprehensiveIncome.No

distributionswere declaredin 2011 or 2012.Premiums paid to NEIL by itsmembersare subjecttoassessment for adverseloss

experience(the retrospective premiumobligation). NEIL hasnever exercisedthis assessment sinceitsformation in1973,and while

Generation cannot predictthelevel offuture assessments, or if theywill beimposedat all,asofDecember 31,2013,thecurrent

maximumaggregate annual retrospective premiumobligation for Generation is approximately$287 million.

NEIL provides“all risk” propertydamage,decontamination andpremature decommissioninginsurancefor each station for losses

resultingfromdamagetoitsnuclear plants, either due to accidentsor actsofterrorism. AsofDecember 31,2013,Generation’s

current limitfor this coverageis $2.1billion.For propertylimitsinexcess ofthefirst$1.25billion ofthat limit,Generation participates

inan$850million single limitblanket policy sharedbyall theGeneration operatingnuclear sitesandtheSalemandHope Creek

nuclear sites. This blanket limitis not subject to automatic reinstatement intheevent ofaloss. Intheevent ofan accident,insurance

proceeds mustfirstbeusedfor reactor stabilization andsite decontamination.Ifthedecision is madetodecommission thefacility, a

portion oftheinsurance proceeds will be allocatedto a fund, which Generation is requiredbytheNRCto maintain,to providefor

decommissioningthefacility. Intheevent ofan insuredloss, Generation is unable to predictthetimingoftheavailabilityofinsurance

proceeds to Generation andtheamount ofsuch proceeds that wouldbeavailable.Under the terms ofthevariousinsurance

agreements, Generation couldbeassessedup to $229million per year for lossesincurredat anyplant insuredbytheinsurance

company(the retrospective premiumobligation). Intheevent that one or more actsofterrorism causeaccidental propertydamage

withinatwelve-monthperiodfromthefirstaccidental propertydamageunder one or more policiesfor all insuredplants, the

225