ComEd 2013 Annual Report Download - page 45

Download and view the complete annual report

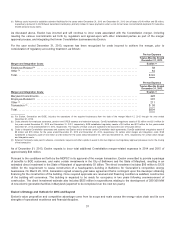

Please find page 45 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Exelon andothersfiledacomplaint infederal districtcourt challengingtheconstitutionalityandother aspectsoftheNewJersey

legislation. Similarly, Exelon andothersare alsochallengingtheselection ofthethree generation developersinNewJerseystate

court proceedings andtheMDPSC actionsinMarylandstate court.OnOctober 25, 2013,theU.S. DistrictCourt inNewJersey

issuedajudgment order findingthat theNewJerseylegislation violatestheSupremacy ClauseoftheUnitedStatesConstitution and

theNewJersey SOCAcontractis unenforceable. Similarly, on October 24, 2013,theU.S. DistrictCourt inMaryland issueda

judgment order findingthat theMDPSC’s Order directing BGE andtwoother Marylandelectric distribution companiesto enter into a

CfD violatestheSupremacy ClauseoftheUnitedStatesConstitution,asdescribedinNote 3—RegulatoryMattersoftheCombined

Notesto ConsolidatedFinancial Statements. Inaddition,on October 1,2013,aMarylandState CircuitCourt upheldtheMDPSC

OrdersasbeingwithintheMDPSC’s statutoryauthorityunder Marylandstate law. This decision is separate fromthejudgment inthe

federal litigation that theMDPSC Order is unconstitutional andtheCfD unenforceable under federal law. Thefederal judgment,if

upheld, wouldprevent enforcement oftheCfD even if theCircuitCourt decision stands. The non-prevailingpartieshavesought

appealsinfederal appellate court inboththeNewJerseyandMarylandfederal litigation.Finally, on October 23,2013,theNew

Jerseystate court dismissedtheNewJerseystate proceedingwithout prejudice,subjecttothefinal outcomeoftheNewJersey

federal litigation.

Asrequiredunder theircontracts, twooftheNewJerseygenerator developersandone inMarylandofferedandclearedinPJM’s

capacitymarket auctionsheldinMay2012 and2013.Inaddition, CPV hasannounceditsintention to moveforwardwith

construction ofitsNewJerseyplant,withor without thechallengedstate subsidy. Nonetheless to theextent that thestate-required

customer subsidiesare includedunder theirrespectivecontracts, Exelon believesthat these projectsmayhave artificially

suppressedcapacitypricesinPJM intheseauctionsandmaycontinue to dosoinfuture auctionsto thedetriment ofExelon’s

market driven position. While theU.S. DistrictCourt decisionsinMarylandandNewJerseyare positivedevelopments, continuation

ofthesestate efforts, if successful andunabatedbyan effectiveminimumoffer price rule (MOPR), couldcontinue to result in

artificiallydepressedwholesale capacityand/or energy prices. Other statescouldseekto establish programs, which could

substantiallyimpactExelon’s market driven position andcouldhaveasignificant effectonExelon’s financial resultsofoperations,

financial position andcash flows.

PJM’s capacitymarket rulesincludeaMOPR, which is intendedto precludesellersfromartificiallysuppressingthecompetitiveprice

signalsfor generation capacity. However,asdescribedabove,Exelon doesnot believethat theexisting MOPRwill workeffectively

withrespecttogenerator developerswhohaveastate-sponsoredsubsidy andhasconcernswithcertainother aspectsof PJM’s

rulesrelatedto thecapacityauction.Accordingly, Exelon is workingwithother market stakeholderson several proposedchangesto

thePJM tariff aimedat ensuringthat capacityresources(includingthosewithstate-sponsoredsubsidy contracts, excessiveimported

capacityresourcesandcertainlimitedavailabilitydemandresponseresources) cannot inappropriatelyaffectcapacityauction prices

inPJM.

See Note 3—RegulatoryMattersoftheCombinedNotesto ConsolidatedFinancial Statementsfor additional information on the

MarylandOrder.

Exelon remainsactiveinadvocatingfor competitivemarkets, opposingpoliciesthat ask either taxpayersor consumersto subsidize

or give preferential treatment to specific generation providersor technologies, or that wouldthreaten the reliabilityandvalue ofthe

integratedelectricitygrid.

Energy Demand. Thecontinuedtepid economic environment andgrowingenergy efficiency initiativeshavelimitedthedemandfor

electricityacross each oftheExelon utilitycompanies. ComEd is projectingloadvolumesto decreaseby 0.2%in 2014comparedto

2013, while PECO and BGE are projectingan increaseof0.3%and0.6%, respectively, in 2014comparedto 2013.

Retail Competition. Generation’s retail operationscompete for customersinacompetitiveenvironment, which affectthemargins

that Generation can earn andthevolumesthat itis able to serve.Recently, sustainedlowforwardnatural gasandpower pricesand

lowmarket volatilityhavecausedretailcompetitorsto aggressivelypursue market share,andwholesale generators(including

Generation)to usetheir retail operationsto hedgegeneration output.Thesefactorshaveadverselyaffectedoverall gross margins

andprofitabilityinGeneration’s retail operations.

Strategic Policy Alignment

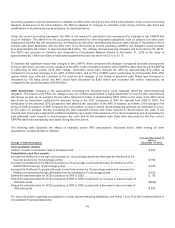

Exelon routinelyreviews itshedgingpolicy, dividendpolicy, operatingandcapital costs, capital spendingplans, strengthofits

balancesheet andcreditmetrics, andsufficiency ofitsliquidityposition,byperformingvariousstress testswith differingvariables,

such ascommoditypricemovements, increasesinmargin-relatedtransactions, changesinhedgingpractices, andtheimpactsof

hypothetical creditdowngrades.

39