ComEd 2013 Annual Report Download - page 247

Download and view the complete annual report

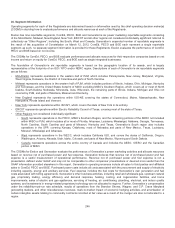

Please find page 247 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(Debentures), ofConstellation between January30,2008andSeptember 16, 2008, andwhoacquiredDebenturesinanoffering

completedinJune 2008. Thesecuritiesclass actionsgenerallyallegethat Constellation,anumber ofitsformer officersor directors,

andtheunderwritersviolatedthesecuritieslaws by issuingafalseand misleadingregistration statement andprospectusin

connection withConstellation’s June 27, 2008offeringoftheDebentures. Thesecuritiesclass actionsalso allegethat Constellation

issuedfalseormisleadingstatementsor wasaware ofmaterial undisclosedinformation which contradictedpublic statements,

includinginconnection withitsannouncementsoffinancial resultsfor 2007, thefourthquarter of2007, thefirstquarter of2008and

thesecondquarter of2008andthefilingofitsfirstquarter 2008Form10-Q. Thesecuritiesclass actionssought,amongother things,

certification ofthecasesasclass actions, compensatorydamages, reasonable costsandexpenses, includingcounsel fees, and

rescission damages.

TheSouthern DistrictofNewYorkgrantedthedefendants’ motion to transfer thetwosecuritiesclass actionsfiledinMarylandto the

DistrictofMaryland, andtheactionshavesincebeen transferredfor coordination withthesecuritiesclass action filedthere.On

May9,2013,thefederal court inMarylandpreliminarilyapprovedthesettlement ofConstellation’s 2008SecuritiesClass Action for a

payment of$4million, which will bepaid by Constellation’s insurer.Noticeofthesettlement wasprovidedto class membersinJune

2013 andthecourt approvedthefinal settlement on November 4, 2013. This settlement will resolve all ofConstellation’s litigation

arisingfromthe 2008SecuritiesClass Action lawsuit.

Fund Transfer Restrictions

Under applicable law, Exelon mayborrowor receiveanextension ofcreditfromitssubsidiaries. Under the terms ofExelon’s

intercompanymoneypool agreement,Exelon can lendto,but not borrowfromthemoneypool.

TheFederal Power Actdeclaresittobe unlawful for anyofficer or director ofanypublic utility“to participate inthemakingor paying

ofany dividends ofsuch public utilityfromanyfunds properlyincludedincapital account.” What constitutes“funds properlyincluded

incapital account”isundefinedintheFederal Power Actorthe relatedregulations; however,FERChasconsistentlyinterpretedthe

provision to allow dividends to bepaid aslongas: (1)thesourceofthedividends is clearly disclosed; (2)thedividendisnot

excessive;and(3)there is no self-dealingon the part ofcorporate officials. While theserestrictionsmaylimittheabsolute amount of

dividends that a particular subsidiarymaypay, Exelon doesnot believetheselimitationsare materiallylimitingbecause,under these

limitations, thesubsidiariesare allowedto pay dividends sufficient to meet Exelon’s actual cash needs.

Under Illinois law, ComEd maynot payany dividendon itsstock unless, amongother things, “[its] earnings andearnedsurplusare

sufficient to declare andpaysameafter provision is madefor reasonable andproper reserves,” or unless ithasspecific authorization

fromtheICC. ComEd hasalsoagreedinconnection withfinancings arrangedthrough ComEd Financing III that itwill not declare

dividends on anysharesofitscapital stock intheevent that:(1)itexercisesitsrighttoextendtheinterestpayment periods on the

subordinateddebtsecurities issuedto ComEd Financing III; (2)itdefaultson itsguarantee ofthepayment of distributionson the

preferredtrustsecuritiesofComEd Financing III; or (3)an event ofdefault occursunder theIndenture under which thesubordinated

debtsecuritiesare issued.

PECO’s ArticlesofIncorporation prohibitpayment ofany dividendon,or other distribution to theholdersof, common stock if, after

givingeffectthereto,thecapital of PECO representedbyitscommon stock together withitsretainedearnings is, intheaggregate,

less than theinvoluntaryliquidatingvalue ofitsthen outstandingpreferredsecurities. OnMay1,2013, PECO redeemedall

outstandingpreferredsecurities. Asaresult,theabove ratiocalculation is no longer applicable.Additionally, PECO maynot declare

dividends on anysharesofitscapital stock intheevent that:(1)itexercisesitsrighttoextendtheinterestpayment periods on the

subordinateddebentures, which were issuedto PEC L.P. or PECO TrustIV; (2)itdefaultson itsguarantee ofthepayment of

distributionson theSeriesDPreferredSecuritiesof PEC L.P. or the preferredtrustsecuritiesof PECO TrustIV; or (3)an event of

default occursunder theIndenture under which thesubordinateddebenturesare issued.

BGE pays dividends on itscommon stock after itsboardofdirectorsdeclaresthem. However, BGE is subjecttocertaindividend

restrictionsestablishedbytheMDPSC. First, BGE is prohibitedfrompayingadividendon itscommon sharesthrough theendof

2014. Second, BGE is prohibitedfrompayingadividendon itscommon sharesif(a)after thedividendpayment, BGE’s equityratio

wouldbebelow 48% ascalculatedpursuant to theMDPSC’s ratemakingprecedentsor (b) BGE’s senior unsecuredcredit ratingis

ratedbytwoofthethree major credit ratingagenciesbelowinvestment grade.Finally, BGE must notify theMDPSC that itintends to

declare a dividendon itscommon sharesat least30days before such adividendispaid. There are no other limitationson BGE

payingcommon stock dividends unless: (1) BGE electsto defer interestpaymentson the6.20%Deferrable InterestSubordinated

Debenturesdue 2043,andanydeferredinterestremainsunpaid; or (2)any dividends (andanyredemption payments) due on BGE’s

preferencestock have not been paid.

241