ComEd 2013 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Generation and EDFI will also enter into a Put Option Agreement at closingpursuant to which EDFI will havethe option,exercisable

beginningon January1,2016andthereafter untilJune 30,2022,to sell its 49.99% interestinCENG to Generation for a fairmarket

value pricedeterminedbyagreement ofthe parties, or absent agreement,athird-partyarbitration process. The appraisers

determiningfairmarket value of EDF’s 49.99% interestinCENG under thePut Option Agreement are instructedto takeinto account

all rightsandobligationsunder theCENG OperatingAgreement,includingGeneration’s rightswithrespecttoanyunpaid aggregate

preferred distributionsandthe relatedreturn,andthevalue ofGeneration’s rightsto other distributions. Thebeginningofthe

exercise periodwill beacceleratedifExelon’s affiliatesceasetoownamajorityof CENG andexercise a relatedright to terminate the

Nuclear OperatingServicesAgreement.Inaddition,under limitedcircumstances, the periodfor exerciseofthe put option maybe

extendedfor 18months.

Alsoatclosing, Generation will execute an IndemnityAgreement pursuant to which Generation will indemnify EDF anditsaffiliates

againstthird-partyclaims that mayarisefromanyfuture nuclear incident (asdefinedinthePriceAnderson Act)inconnection with

theCENG nuclear plantsor their operations. Exelon will guarantee Generation’s obligationsunder this indemnity.

Currently, Exelon andGeneration account for theirinvestment inCENG under theequitymethodofaccounting. The transfer ofthe

operatinglicensesandcorrespondingoperational control to Exelon andGeneration will result inExelon andGeneration being

requiredto consolidate thefinancial position andresultsofoperationsof CENG. When that accountingchangeoccurs, Exelon and

Generation will derecognizetheirequitymethodinvestment inCENG andwill recordall assets, liabilitiesandthe non-controlling

interestinCENG at fairvalue on Exelon andGeneration’s balancesheets. Any differencebetween theformer carryingvalue and

newlyrecordedfairvalue at that date will berecognizedasagainorloss upon consolidation, which couldbematerial to Exelon’s

andGeneration’s resultsofoperations.

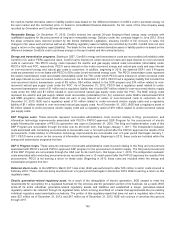

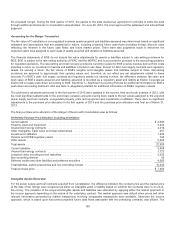

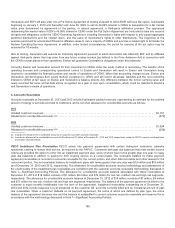

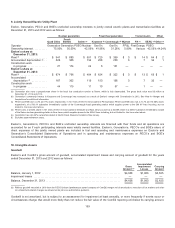

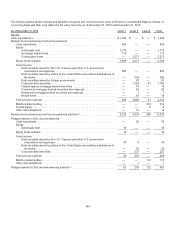

6. Accounts Receivable

Accountsreceivable at December 31,2013 and2012 includedestimatedunbilledrevenues, representingan estimate for theunbilled

amount ofenergy or servicesprovidedto customers, andisnet ofan allowancefor uncollectible accountsasfollows:

2013

Unbilledcustomer revenues ............................................................................... $1,151

Allowancefor uncollectible accounts(a)(b) .................................................................... (272)

2012

Unbilledcustomer revenues ............................................................................... $1,094

Allowancefor uncollectible accounts(a)(b) .................................................................... (293)

(a)Includesthe allowancefor uncollectible accountson customer andother accountsreceivable.

(b) Includesan allowancefor uncollectible accountsof$8million and$7million at December 31,2013 and2012,respectively, relatedto PECO’s current installment plan

receivablesdescribedbelow.

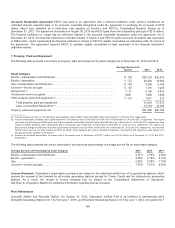

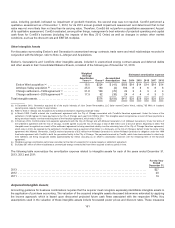

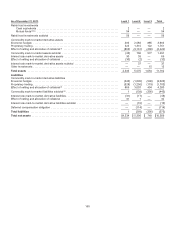

PECO Installment Plan Receivables PECO entersinto payment agreementswithcertaindelinquent customers, primarily

residential,seekingto restore theirservice,asrequiredbythePAPUC. Customerswithpastdue balancesthat meet certainincome

criteria are providedthe option to enter into an installment payment plan,someof which have terms greater than one year,to repay

pastdue balancesinaddition to payingfor theirongoingserviceonacurrent basis. Thereceivable balancefor thesepayment

agreement receivablesisrecordedinaccountsreceivable for thecurrent portion andother deferreddebitsandother assetsfor the

noncurrent portion.The net receivable balancefor installment planswithterms greater than one year was$19million and$18million

asofDecember 31,2013 and2012,respectively. The allowancefor uncollectible accountsreservemethodology andassessment of

thecreditqualityoftheinstallment plan receivablesare consistent withthecustomer accountsreceivable methodology discussedin

Note 1—Significant AccountingPolicies. The allowancefor uncollectible accountsbalanceassociatedwiththesereceivablesat

December 31,2013 of$18million consistsof$1million,$4million and$13 million for lowrisk, mediumrisk and high risk segments,

respectively. The allowancefor uncollectible accountsbalanceatDecember 31,2012 of$15million consistsof$1million,$3million

and$11 million for lowrisk, mediumrisk and high risk segments, respectively. Thebalanceofthepayment agreement is billedto the

customer inequal monthlyinstallmentsover the termoftheagreement.Installment receivablesoutstandingasofDecember 31,

2013 and2012 includebalancesnot yet presentedon thecustomer bill,accountscurrentlybilledandan immaterial amount ofpast

due receivables. When a customer defaultson itspayment agreement,the terms of which are definedbyplan type,the entire

balanceoftheagreement becomesdue andthebalanceis reclassifiedto current customer accountsreceivable andreservedfor in

accordancewiththemethodology discussedinNote 1—Significant AccountingPolicies.

155