ComEd 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ofOperationsandComprehensiveIncome.See Note 3—RegulatoryMattersandNote 23—Supplemental Financial Information for

additional information regardingGeneration’s nuclear fuel,Generation’s ARCandtheamortization ofComEd’s, PECO’s and BGE’s

regulatoryassets.

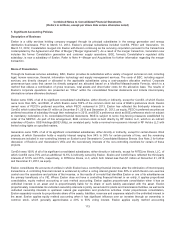

Asset Retirement Obligations

The authoritativeguidancefor accountingfor AROs requirestherecognition ofaliabilityfor a legal obligation to performan asset

retirement activityeven though thetimingand/or methodofsettlement maybeconditional on a future event.Toestimate its

decommissioningobligation relatedto itsnuclear generatingstations, Generation usesa probability-weighted, discountedcash flow

model which, on a unit-by-unitbasis, considersmultiple outcomescenariosthat includesignificant estimatesandassumptions, and

are basedon decommissioningcoststudies, costescalation rates, probabilistic cash flowmodelsand discount rates. Generation

generallyupdatesitsAROannuallyduringthethirdquarter,unless circumstanceswarrant more frequent updates, basedon its

reviewofupdatedcoststudiesanditsannual evaluation ofcostescalation factorsandprobabilitiesassignedto variousscenarios.

Decommissioningcoststudiesare updated, on a rotational basis, for each ofGeneration’s nuclear unitsat leastevery fiveyears.

TheliabilitiesassociatedwithExelon’s non-nuclear AROs are adjustedon an ongoingrotational basis, at leastonceevery fiveyears.

Changesto therecordedvalue ofan AROresult fromthepassageofnewlaws andregulations, revisionsto either thetimingor

amount ofestimatesofundiscountedcash flows, andestimatesofcostescalation factors. AROs are accretedeach year to reflect

thetimevalue ofmoneyfor these present value obligationsthrough acharge to operatingandmaintenanceexpenseinthe

ConsolidatedStatementsofOperationsor,inthecaseofthemajorityofComEd’s, PECO’s, and BGE’s accretion,through an

increasetoregulatoryassets. See Note 15—Asset Retirement Obligationsfor additional information.

Capitalized Interest and AFUDC

Duringconstruction,Exelon andGeneration capitalizethecostsofdebtfunds usedto finance non-regulatedconstruction projects.

Capitalization ofdebtfunds is recordedasachargetoconstruction workin progress andasa non-cash credittointerestexpense.

Exelon,ComEd, PECO and BGE applythe authoritativeguidancefor accountingfor certaintypesofregulation to calculate AFUDC,

which is thecost,duringthe periodofconstruction,ofdebtandequityfunds usedto financeconstruction projectsfor regulated

operations. AFUDC is recordedto construction workin progress andasa non-cash credittoAFUDC that is includedininterest

expensefor debt-relatedfunds andother incomeanddeductionsfor equity-relatedfunds. The ratesusedfor capitalizingAFUDC are

computedunder a methodprescribedbyregulatoryauthorities.

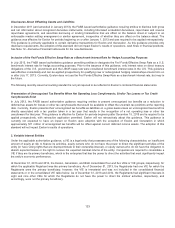

Thefollowingtable summarizestotal incurredinterest,capitalizedinterestandcreditsto AFUDC by year:

2013 (a) 2012 2011

Total incurredinterest(b) .................................................................... $1,423 $1,003 $783

Capitalizedinterest........................................................................ 54 67 49

Creditsto AFUDC debtandequity ............................................................ 352525

(a)Exelon activityfor theyear endedDecember 31,2012 includestheresultsofConstellation and BGE for March 12,2012—December 31,2012.

(b) Includesinterestexpensetoaffiliates.

Guarantees

Exelon recognizes, at theinception ofaguarantee,aliabilityfor thefairmarket value oftheobligationsithasundertaken inissuing

theguarantee,includingtheongoingobligation to performover the termoftheguarantee intheevent that thespecifiedtriggering

eventsor conditionsoccur.

Theliabilitythat is initiallyrecognizedat theinception oftheguarantee is reducedasExelon is releasedfromrisk under the

guarantee.Dependingon the nature oftheguarantee,the releasefromrisk ofExelon mayberecognizedonlyupon theexpiration or

settlement oftheguarantee or by asystematic andrational amortization methodover the termoftheguarantee.

See Note 22—CommitmentsandContingenciesfor additional information.

Asset Impairments

Long-Lived Assets. Exelon evaluatesthecarryingvalue ofitslong-livedassetsor asset groups, excludinggoodwill,when

circumstancesindicate thecarryingvalue ofthoseassetsmaynot berecoverable.Exelon determinesiflong-livedassetsandasset

120