ComEd 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

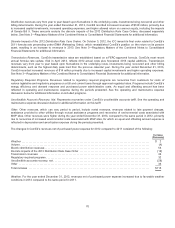

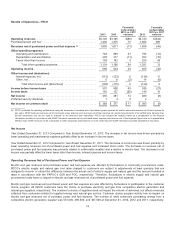

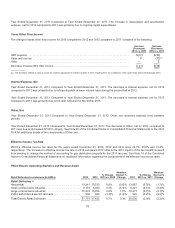

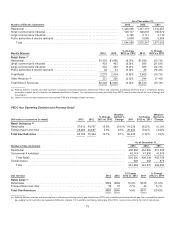

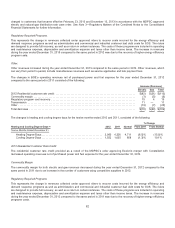

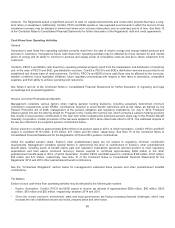

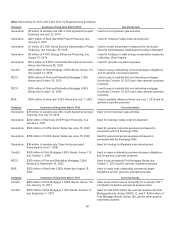

Results of Operations—BGE

2013 2012

Favorable

(unfavorable)

2013 vs. 2012

variance 2011

Favorable

(unfavorable)

2012 vs. 2011

variance

Operating revenues ........................................... $3,065 $2,735$330 $3,068 $(333)

Purchasedpower andfuel expense................................ 1,421 1,369 (52)1,593224

Revenue net of purchased power and fuel expense (a) .............. 1,644 1,366 278 1,475 (109)

Other operating expenses

Operatingandmaintenance.................................. 63472894680(48)

Depreciation andamortization ................................ 348 298 (50)274 (24)

Taxesother than income..................................... 213 208 (5) 207(1)

Total other operatingexpenses............................ 1,195 1,234391,161(73)

Operating income ............................................. 449 132 317314(182)

Other income and (deductions)

Interestexpense,net ........................................ (122)(144) 22 (129) (15)

Other,net ................................................. 1723 (6) 26(3)

Total other incomeand(deductions) ....................... (105) (121)16(103)(18)

Income before income taxes .................................... 344 11 333 211 (200)

Income taxes ................................................. 1347(127) 75 68

Net income ................................................... 210 4206136(132)

Preferencestock dividends....................................... 13 13 —13 —

Net income (loss) attributable to common shareholder ............. $ 197 $ (9) $ 206$123 $(132)

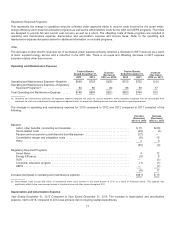

(a) BGE evaluatesitsoperatingperformanceusingthemeasuresofrevenuesnet ofpurchasedpower expensefor electric salesandrevenuesnet offuel expensefor

gassales. BGE believesrevenuesnet ofpurchasedpower andfuel expense are useful measurementsofitsperformancebecausetheyprovideinformation that can

beusedto evaluate itsnet revenuesfromoperations. BGE hasincludedthe analysis belowasacomplement to thefinancial information providedinaccordancewith

GAAP. However,revenuesnet ofpurchasedpower andfuel expensefiguresare not a presentation definedunder GAAPandmaynot becomparable to other

companies’ presentationsor more useful than theGAAPinformation providedelsewhere inthis report.

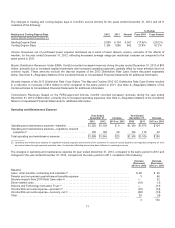

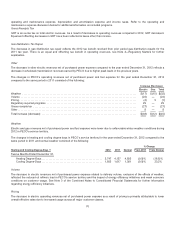

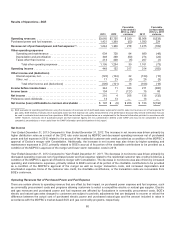

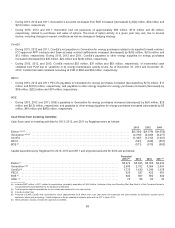

Net Income

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012. Theincreasein net incomewasdriven primarilyby

higher distribution ratesasaresult ofthe 2012 rate order issued by MDPSC anddecreasedoperatingrevenuesnet ofpurchased

power andfuel expensein 2012 relatedto theaccrual oftheresidential customer rate credit providedasacondition oftheMDPSC’s

approval ofExelon’s merger withConstellation.Additionally, theincreasein net incomewasalsodriven by higher operatingand

maintenanceexpensesin 2012,primarilyrelatedto BGE’s accrual ofitsportion ofthecharitable contributionsto be providedasa

condition oftheMDPSC’s approval ofthemerger andlower stormrestoration costsin 2013.

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011. Thedecreasein net incomewasdriven primarilyby

decreasedoperatingrevenuesnet ofpurchasedpower andfuel expense relatedto theresidential customer rate credit providedasa

condition oftheMDPSC’s approval ofExelon’s merger withConstellation.Thedecreasein net incomewasalsodriven by increased

operatingandmaintenanceexpenses, primarilyrelatedto BGE’s accrual ofitsportion ofthecharitable contributionsto be provided

asacondition oftheMDPSC’s approval ofthemerger aswell asmerger transaction costs, andincreaseddepreciation and

amortization expense.None ofthecustomer rate credit,thecharitable contributions, or the transaction costsare recoverable from

BGE’s customers.

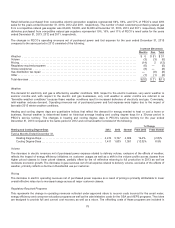

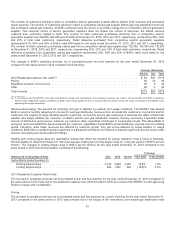

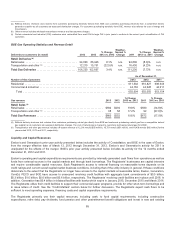

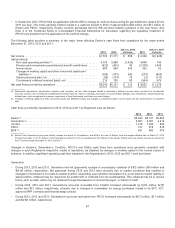

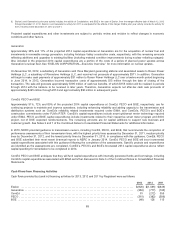

Operating Revenues Net of Purchased Power and Fuel Expense

There are certaindriversto operatingrevenue that are offset by theirimpact on purchasedpower expenseandfuel expense,such

ascommodityprocurement costsandprograms allowingcustomersto selectacompetitive electric or natural gassupplier.Electric

andgasrevenuesandpurchasedpower andfuel expense are affectedbyfluctuationsincommodityprocurement costs. BGE’s

electric andnatural gasrateschargedto customersare subject to periodic adjustmentsthat are designedto recover or refundthe

differencebetween theactual costofpurchasedelectric power andpurchasednatural gasandtheamount includedin ratesin

accordancewiththeMDPSC’s market-based SOS andgascommodityprograms, respectively.

80