ComEd 2013 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Continental Wind. OnSeptember 30,2013,Continental Wind, LLC (Continental Wind), an indirectsubsidiaryofExelon and

Generation,completedtheissuanceandsale of$613 million aggregate principal amount ofContinental Wind’s 6.00%senior

securednotesdue February28, 2033.Continental Windownsandoperatesa portfolioofwindfarms inIdaho,Kansas, Michigan,

Oregon,NewMexicoandTexaswitha total net capacityof 667 MW. The net proceeds were distributedto Generation for itsgeneral

business purposes. Inconnection withthis non-recourse projectfinancing, Exelon terminatedexistinginterest rate swapswitha total

notional amount of$350million duringthethirdquarter of2013,andrealizeda total gainof$26million upon termination.Thegain

on theinterest rate swapswasrecordedwithinOCI andwill reducetheeffectiveinterest rate over thelifeofthedebtfor Exelon.See

Note 12—DerivativeFinancial Instrumentsfor additional information on theinterest rate swaps.

Inaddition,Continental Windenteredinto a $131 million letter ofcreditfacilityand$10 million workingcapital revolver facility.

Continental Windhas issuedlettersofcredittosatisfy certainofitscreditsupport andsecurityobligations. AsofDecember 31,2013,

theContinental Windletter ofcreditfacilityhad$93million in lettersofcredit outstandingrelatedto the project.

ExGen Renewables Energy I LLC. OnFebruary6,2014, ExGen Renewables I, LLC (EGR), an indirectsubsidiaryofExelon and

Generation,completedtheissuanceandsale of$300 million aggregate principal amount ofEGR’s LIBOR plus425bps

non-recoursesenior securedloan,due February6,2021.EGRindirectlyownsContinental Wind LLC (Continental).

Antelope Valley Project Development Debt Agreement. TheDOE Loan Programs Officeissuedaguarantee for up to $646

million for a non-recourse loan fromtheFederal FinancingBankto support thefinancingoftheconstruction ofthe Antelope Valley

facility. The projectis expectedto becompletedinthefirsthalfof2014. The loan will mature on January5,2037. Interest rateson

the loan are fixedupon each advanceataspreadof37.5 basis pointsaboveU.S. Treasuriesofcomparable maturity.

Inaddition,Generation has issuedlettersofcredittosupport itsequityinvestment inthe project.AsofDecember 31,2013,

Generation had$334million in lettersofcredit outstandingrelatedto the projectThe lettersofcreditbalanceis expectedto decline

over timeas scheduledequitycontributionsfor the project are made.

Inconnection withthis agreement,Generation enteredinto a floating-for-fixedinterest rate swap witha notional amount of $485

million to mitigate interest-rate risk associatedwiththefinancing. AsGeneration receivedadditional loan advances, itsubsequently

enteredinto a seriesof fixed-to-floatinginterest rate swapsto offset portionsoftheoriginal interest rate hedge.

See Note 12—DerivativeFinancial Instrumentsfor additional information regardinginterest rate swapsassociatedwithAntelope

Valley.

Sacramento PV Energy. InJuly, 2011,asubsidiaryofGeneration enteredinto a $41million non-recourse projectfinancingfor a

30MW solar facilityinSacramento,California.AsofDecember 31,2013,$37million wasoutstanding. Borrowings under thefacility

bear interestatavariable rate,payable quarterly, andare securedbyequityinterestsandassetsofthesubsidiary. Asof

December 31,2013,thesubsidiaryhadinterest rate swapswitha notional value of$29million inorder to convert thevariable

interestpaymentsto fixedpaymentson 75% ofthe$41million facility. See Note 12—DerivativeFinancial Instrumentsfor additional

information regardinginterest rate swaps.

Constellation Solar Horizons Financing. InSeptember 2012,asubsidiaryofGeneration enteredinto an 18-year $38million non-

recoursevariable interest note to recover capital usedto builda16MWsolar facilityinEmmitsburg, Maryland. Interestis payable

quarterly, andthe note is securedbytheequityinterestsandassetsofthesubsidiary. AsofDecember 31,2013,$36million was

outstanding. Thesubsidiaryalsoexecutedinterest rate swapsfor a notional amount of$29million inorder to convert thevariable

interestpaymentsto fixedpaymentson 75% ofthe$38million facilityamount.See Note 12—DerivativeFinancial Instrumentsfor

additional information regardinginterest rate swaps.

Secured Solar Credit Lending Agreement. InDecember 2013,aGeneration subsidiary, Constellation Solar, LLC, paid off the

remainingbalanceofthethree-year senior securedcreditfacilitythat is designedto support thegrowthofsolar operationsinthe

amount of $94 million andterminatedthefacility. Thefacilitywas scheduledto mature inJune of2014.

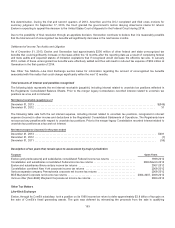

Other Solar Project Financings. Generation hasthefollowingamountsoutstandingunder solar project loan agreements:

•$7million fullyamortizingbyJune 30,2031 relatedto a solar projectattheDenver International Airport,and

•$10 million fullyamortizingbyDecember 31,2031 relatedto a solar projectinHolyoke,Massachusetts.

189