ComEd 2013 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

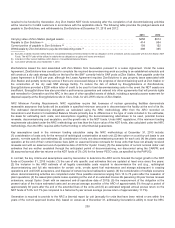

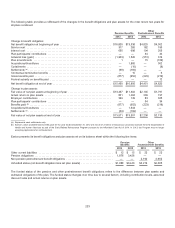

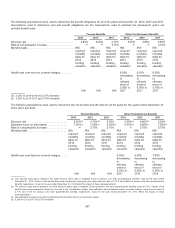

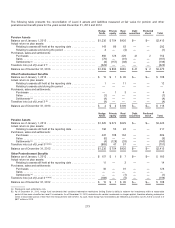

Assumedhealthcare cost trendrateshaveasignificant effectonthecostsreportedfor theother postretirement benefit plans. A one

percentagepoint changeinassumedhealthcare cost trendrateswouldhavethefollowingeffects:

Effectofa one percentagepoint increaseinassumedhealthcare cost trend:

on 2013 total serviceandinterestcostcomponents ......................................................... $ 90

on postretirement benefitobligation at December 31,2013 ................................................... 858

Effectofa one percentagepoint decreaseinassumedh

ealthcare cost trend:

on 2013 total serviceandinterestcostcomponents ......................................................... (62)

on postretirement benefitobligation at December 31,2013 ................................................... (607)

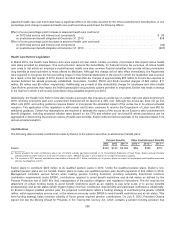

Health Care Reform Legislation

InMarch 2010,theHealthCare ReformActswere signedinto law, which containanumber ofprovisionsthat impact retiree health

care plansprovidedbyemployers. One such provision reducesthedeductibility, for Federal incometaxpurposes, ofretiree health

care coststo theextent an employer’s postretirement healthcare plan receivesFederal subsidiesthat provide retiree prescription

drugbenefitsat leastequivalent to thoseofferedbyMedicare.Although this changedid not takeeffectimmediately, theRegistrants

were requiredto recognizethefull accountingimpactintheirfinancial statementsinthe periodinwhich thelegislation wasenacted.

Asaresult,inthefirstquarter of2010,Exelon recordedtotal after-taxchargesofapproximately $65 million to incometaxexpenseto

reversedeferredtaxassetspreviouslyestablished. Generation,ComEd, PECO and BGE recordedchargesof$24million,$11

million,$9million and$3million,respectively. Additionally, asaresult ofthis deductibilitychangefor employersandother Health

Care Reformprovisionsthat impactthefederal prescription drugsubsidy optionsprovidedto employers, Exelon hasmadeachange

inthemanner inwhich itwill receive prescription drugsubsidiesbeginningin 2013.

Additionally, theHealthCare ReformActsalsoinclude a provision that imposesan excisetaxon certainhigh-cost plansbeginningin

2018, whereby premiums paid over a prescribedthresholdwill betaxedat a 40%rate.Although theexcisetaxdoesnot gointo

effect until 2018, accountingguidancerequiresExelon to incorporate theestimatedimpactoftheexcisetaxinitsannual actuarial

valuation.The application ofthelegislation is still unclear andExelon continuesto monitor theDepartment ofLabor andIRSfor

additional guidance.Certainkeyassumptionsare requiredto estimate theimpactoftheexcisetaxon Exelon’s other postretirement

benefitobligation,includingprojectedinflation rates(basedon theCPI) andwhether pre-andpost-65 retiree populationscan be

aggregatedindeterminingthe premiumvaluesofhealthcare benefits. Exelon reflecteditsbestestimate oftheexpectedimpactinits

annual actuarial valuation.

Contributions

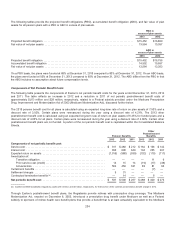

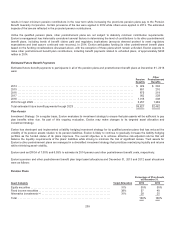

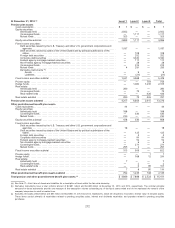

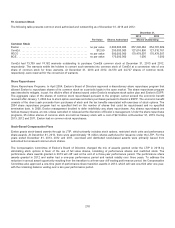

Thefollowingtable providescontributionsmadeby Exelon to the pension andother postretirement benefit plans:

Pension Benefits Other Postretirement Benefits

2013 2012 2011 (b) 2013 (a) 2012 (a) 2011 (a)

Exelon .......................................................... $339$149 $2,094 $83$323 $277

(a)Exelon presentsthecash contributionsabove net ofFederal subsidy paymentsreceivedon itsConsolidatedStatement ofCash Flows. Exelon receivedFederal

subsidy paymentsof$10 million in 2012 and$11 million in 2011. EffectiveJanuary1,2013,Exelon is no longer receivingthis subsidy.

(b) Theincreasein 2011 pension contributionswasrelatedto Exelon’s $2.1billion contribution to itspension plansasaresult ofacceleratedcash benefitsassociated

withtheTaxReliefActof2010.

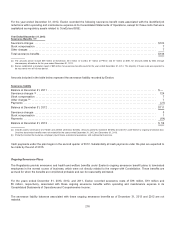

Exelon plansto contribute $264 million to itsqualifiedpension plansin 2014. Unlikethequalifiedpension plans, Exelon’s non-

qualifiedpension plansare not funded. Exelon plansto make non-qualifiedpension plan benefitpaymentsof$12 million in 2014.

Management considersvariousfactorswhen makingpension fundingdecisions, includingactuariallydeterminedminimum

contribution requirementsunder ERISA,contributionsrequiredto avoid benefitrestrictionsandat-risk statusasdefinedbythe

Pension Protection Actof2006(theAct), management ofthe pension obligation andregulatoryimplications. TheActrequiresthe

attainment ofcertainfundinglevelsto avoid benefitrestrictions(such asan inabilityto paylumpsums or to accrue benefits

prospectively), andat-risk status (which triggers higher minimumcontribution requirementsandparticipant notification). Additionally,

for Exelon’s largestqualifiedpension plan,the projectedcontributionsreflectafundingstrategy ofcontributingthegreater of$250

million, which approximatesservicecost,or theminimumamountsunder ERISAtoavoid benefitrestrictionsandat-risk status. This

level fundingstrategy helpsminimizevolatilityoffuture periodrequiredpension contributions. OnJuly6,2012,President Obama

signedinto lawtheMovingAheadfor Progress intheTwenty-firstCenturyAct, which containsa pension fundingprovision that

208