ComEd 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

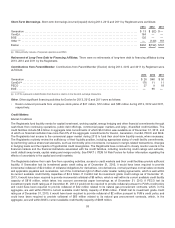

FERChasfinancingjurisdiction over ComEd’s, PECO’s and BGE’s short-termfinancings andall ofGeneration’s financings. Asof

December 31,2013,ComEd, PECO had BGE hadshort-termfinancingauthorityfromFERC, which expireson December 31,2015,

of$2.5 billion,$2.5 billion and$700 million,respectively. Generation currentlyhasblanket financingauthorityitreceivedfromFERC

inconnection withitsmarket-basedrate authority. See Note 3 oftheCombinedNotesto ConsolidatedFinancial Statementsfor

additional information.

Exelon’s abilityto pay dividends on itscommon stock depends on thereceipt of dividends paid by itsoperatingsubsidiaries. The

paymentsof dividends to Exelon by itssubsidiariesin turn dependon theirresultsofoperationsandcash flows andother items

affectingretainedearnings. TheFederal Power Actdeclaresittobe unlawful for anyofficer or director ofanypublic utility“to

participate inthemakingor payingofany dividends ofsuch public utilityfromanyfunds properlyincludedincapital account.” In

addition,under Illinois law, ComEd maynot payany dividendon itsstock, unless, amongother things, itsearnings andearned

surplusare sufficient to declare andpayadividendafter provision is madefor reasonable andproper reserves, or unless ComEd

hasspecific authorization fromtheICC. BGE is subjecttocertaindividendrestrictionsestablishedbytheMDPSC. First, BGE is

prohibitedfrompayingadividendon itscommon sharesthrough theendof2014. Second, BGE is prohibitedfrompayingadividend

on itscommon sharesif(a)after thedividendpayment, BGE’s equityratiowouldbebelow 48% ascalculatedpursuant to the

MDPSC’s ratemakingprecedentsor (b) BGE’s senior unsecuredcredit ratingisratedbytwoofthethree major credit ratingagencies

belowinvestment grade.Finally, BGE must notify theMDPSC that itintends to declare a dividendon itscommon sharesat least30

days before such adividendispaid. There are no other limitationson BGE payingcommon stock dividends unless: (1) BGE elects

to defer interestpaymentson the6.20%Deferrable InterestSubordinatedDebenturesdue 2043,andanydeferredinterestremains

unpaid; or (2)any dividends (andanyredemption payments) due on BGE’s preferencestock have not been paid. At December 31,

2013,Exelon hadretainedearnings of$10,358 million,includingGeneration’s undistributedearnings of$3,613 million,ComEd’s

retainedearnings of $750million consistingofretainedearnings appropriatedfor future dividends of$2,389 million partiallyoffset by

$1,639million ofunappropriatedretaineddeficit, PECO’s retainedearnings of $649 million and BGE’s retainedearnings $1,005

million.See Note 22 oftheCombinedNotesto ConsolidatedFinancial Statementsfor additional information regardingfundtransfer

restrictions.

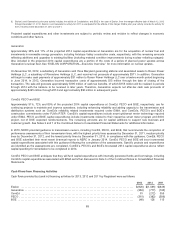

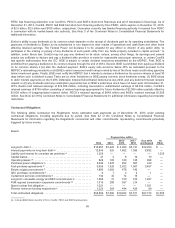

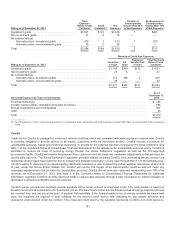

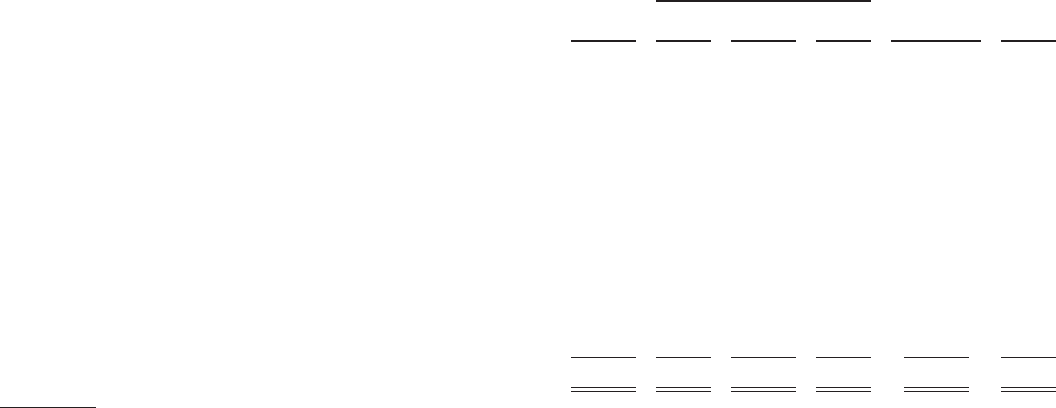

Contractual Obligations

ThefollowingtablessummarizetheRegistrants’ future estimatedcash paymentsasofDecember 31,2013 under existing

contractual obligations, includingpaymentsdue by period. See Note 22 oftheCombinedNotesto ConsolidatedFinancial

Statementsfor information regardingtheRegistrants’ commercial andother commitments, representingcommitmentspotentially

triggeredbyfuture events.

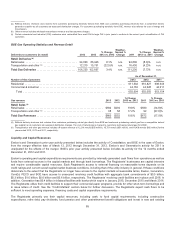

Exelon

Payment due within

Total 2014

2015-

2016

2017-

2018

Due 2019

and beyond

All

Other

Long-termdebt(a)........................................... $19,367 $1,424$2,953$2,731 $12,259 $ —

Interestpaymentson long-termdebt(b) ......................... 12,845 9251,6921,396 8,832 —

Liabilityandinterestfor uncertaintaxpositions(c) ................. 1,255 — — — — 1,255

Capital leases.............................................. 414810 19—

Operatingleases(d) ......................................... 826103 180145 398 —

Purchasepower obligations(e)................................ 3,046 1,378 852367 449 —

Fuel purchaseagreements(f) ................................. 9,6061,520 2,622 1,967 3,497 —

Electric supplyprocurement (f) ................................ 1,8801,062678 140——

AEC purchasecommitments(f) ................................ 6 122 1—

Curtailment servicescommitments(f) ........................... 132 45 74 13 ——

Long-termrenewable energy andREC commitments(g) ........... 1,589 721501601,207—

PJM regional transmission expansion commitments(h) ............ 1,019208 597 214——

Spent nuclear fuel obligation .................................. 1,021 ———1,021 —

Pension minimumfundingrequirement (i) ....................... 1,223 264 444 42689—

Total contractual obligations .................................. $53,856 $7,006$10,252$7,571$27,772$1,255

(a)Includes $648 million due after 2016to ComEd, PECO and BGE financingtrusts.

95