ComEd 2013 Annual Report Download - page 163

Download and view the complete annual report

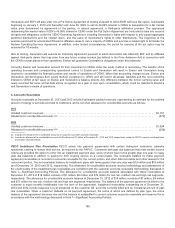

Please find page 163 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.is a166 MW peakingoilunitlocatedinPhiladelphia,Pennsylvania, which wasplacedinservicein1958. RiversideUnit6isa115

MW peakinggas/kerosene unitthat wasplacedinservicein1970,locatedinBaltimore,Maryland. OnDecember 1,2013,

Generation notified PJM ofitsintention to permanentlyretire RiversideGeneratingStation Unit4byJune 1,2016. RiversideUnit4is

a74 MW intermediate gasunitthat wasplacedinservicein1951alsolocatedinBaltimore,Maryland. Theunitsare beingretired

becausetheyare no longer economic to operate due to theirage,relatively high capital andoperatingcostsanddecliningrevenue

expectations. OnNovember 30,2012, PJM notifiedGeneration that itdid not identify anytransmission systemreliability issues

associatedwiththe proposed Schuylkill Unit 1 retirement date,andasaresult, Schuylkill Unit1wasretiredon January1,2013.On

January7,2013 andDecember 23,2013, PJM notifiedGeneration that itdid not identify anytransmission systemreliability issues

associatedwiththe retirementsofRiversideUnits6and4,respectively. The earlyretirementswill not haveamaterial impacton

Generation or Exelon’s resultsofoperations, cash flows or financial position.

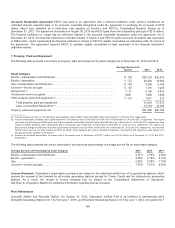

Eddystone Station and Cromby Station. InDecember 2009, Exelon announceditsintention to permanentlyretire three coal-fired

generatingunitsandone oil/gas-firedgeneratingunit,effectiveMay31,2011,inresponsetotheeconomic outlookrelatedto the

continuedoperation ofthesefour units. However, PJM determinedthat transmission reliabilityupgradeswouldbenecessaryto

alleviate reliabilityimpactsandthat thoseupgradeswouldbecompletedinamanner that will permitGeneration’s retirement oftwo

oftheunitson that date andtwooftheunitssubsequent to May31,2011.OnMay31,2011,Cromby GeneratingStation (Cromby)

Unit1and Eddystone GeneratingStation (Eddystone)Unit1were retired. OnMay27, 2011,theFERCapprovedasettlement

providingfor a reliability-must-run rate schedule, which definedcompensation to bepaid to Generation for continuingto operate

Cromby Unit2and Eddystone Unit2.Themonthly fixed-costrecoveryduringthe reliability-must-run periodfor Eddystone Unit2was

approximately$6million,andcoveredoperatingcosts, plusa return on net assets, ofthetwounitsduringthe reliability-must-run

period. Inaddition,Generation wasreimbursedfor variable costs, includingfuel,emissionscosts, chemicals, auxiliarypower andfor

projectinvestment costsduringthe reliability-must-run period. Eddystone Unit2andCromby Unit 2 operatedunder the reliability-

must-run agreement fromJune 1,2011 untiltheirrespective retirement dates, Cromby Unit2onDecember 31,2011 and Eddystone

Unit2onMay31,2012.

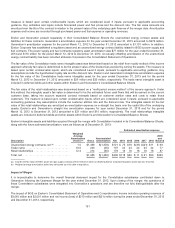

DuringtheyearsendedDecember 31,2013,2012,and2011,Generation incurred$1million,$11 million,and$2million ofshut

downcostsreflectedwithinOperatingandmaintenanceexpenseinExelon’s andGeneration’s ConsolidatedStatementsof

OperationsandComprehensiveIncome.Expensefor thewrite downofinventorywasnot material for theyearsended

December 31,2013,2012 and2011.

See Note 1—Significant AccountingPolicesfor further information regardingproperty, plant andequipment policiesandaccounting

for capitalizedsoftware costsfor Exelon,Generation,ComEd, PECO and BGE. See Note 13—DebtandCreditAgreementsfor

further information regardingExelon’s, ComEd’s, and PECO’s property, plant andequipment subjecttomortgageliens.

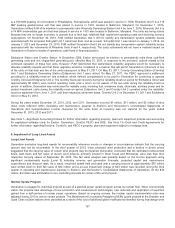

8. Impairment of Long-Lived Assets

Long-Lived Assets

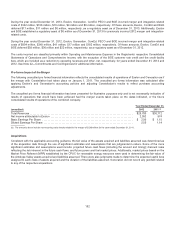

Generation evaluateslong-livedassetsfor recoverabilitywhenever eventsor changesincircumstancesindicate that thecarrying

amount maynot berecoverable.Inthethirdquarter of2013,lower projectedwindproduction andadecline inpower prices

suggestedthat thecarryingvalue ofcertainwindprojectsmaybeimpaired. Generation concludedthat theestimatedundiscounted

future cash flows andfairvalue ofeleven windprojects, primarilylocatedinWestTexasandMinnesota,were less than their

respectivecarryingvaluesat September 30,2013.Thefairvalue analysis wasprimarilybasedon theincome approach using

significant unobservable inputs(Level 3)includingrevenue andgeneration forecasts, projectedcapital andmaintenance

expendituresand discount rates. Asaresult,long-livedassetsheldandusedwithacarryingamount ofapproximately $75 million

were written downtotheirfairvalue of$32 million anda pre-taximpairment chargeof$43million wasrecordedduringthethird

quarter in operatingandmaintenanceexpenseinExelon’s andGeneration’s ConsolidatedStatementsofOperations. Of the$43

million,$4million wasattributable to non-controllinginterestsfor certainofthewindprojects.

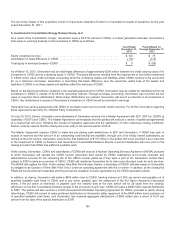

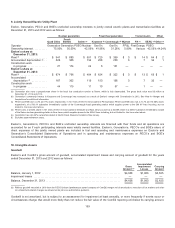

Nuclear Uprate Program

Generation is engagedinindividual projectsaspart ofa plannedpower uprate programacross itsnuclear fleet.When economically

viable,the projectstakeadvantageofnewproduction andmeasurement technologies, newmaterialsandapplication ofexpertise

gainedfromahalf-centuryofnuclear power operations. Basedon ongoingreviews, thenuclear uprate implementation plan was

adjustedduring2013 to cancel certain projects. TheMeasurement UncertaintyRecapture (MUR)uprate projectsat theDresden and

QuadCitiesnuclear stationswere cancelledasaresult ofthecostofadditional plant modificationsidentifiedduringfinal designwork

157