ComEd 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

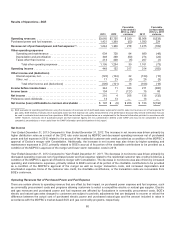

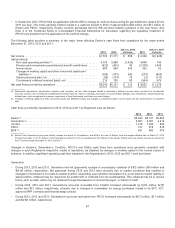

•InSeptember 2012, PECO filedan application withtheIRSto changeitsmethodofaccountingfor gas distribution repairsfor the

2011 taxyear.Thenewlyadoptedmethodresultsinacash taxbenefitin 2012 ofapproximately$38million and$41million at

Exelon and PECO, respectively. Exelon currentlyanticipatesthat theIRSwill issue industryguidanceinthe near future.See

Note 3 oftheCombinedNotesto ConsolidatedFinancial Statementsfor discussion regardingtheregulatorytreatment of

PECO’s taxbenefitsfromthe application ofthemethodchange.

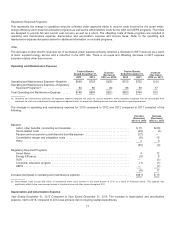

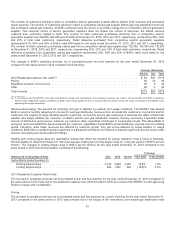

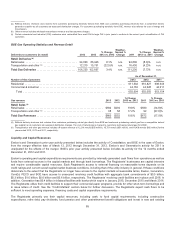

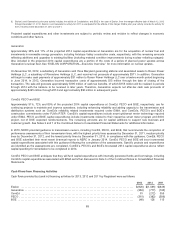

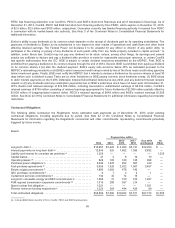

Thefollowingtable providesasummaryofthemajor items affectingExelon’s cash flows fromoperationsfor theyearsended

December 31,2013,2012 and2011:

2013 2012

2013 vs. 2012

Variance 2011

2012 vs. 2011

Variance

Net income.................................................... $1,729$1,171$ 558 $ 2,499 $(1,328)

Add (subtract):

Non-cash operatingactivities(a)................................ 4,159 5,588 (1,429) 4,848 740

Pension andnon-pension postretirement benefitcontributions ...... (422) (462)40(2,360)1,898

Incometaxes............................................... 883544 33949252

Changesinworkingcapital andother noncurrent assetsand

liabilities(b) ............................................... (185) (731) 546 (279) (452)

Option premiums paid, net .................................... (36) (114) 78 (3)(111)

Counterpartycollateral received(paid), net ...................... 21513580(344) 479

Net cash flows providedbyoperations.............................. $6,343$6,131 $212 $ 4,853$1,278

(a)Representsdepreciation,amortization,depletion andaccretion,net fairvalue changesrelatedto derivatives, deferredincometaxes, provision for uncollectible

accounts, pension andnon-pension postretirement benefitexpense,equityin earnings andlossesofunconsolidatedaffiliatesandinvestments, decommissioning-

relateditems, stock compensation expense,impairment oflong-livedassets, andother non-cash charges.

(b) Changesinworkingcapital andother noncurrent assetsandliabilitiesexcludethechangesincommercial paper,incometaxesandthecurrent portion oflong-term

debt.

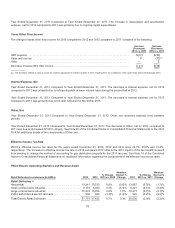

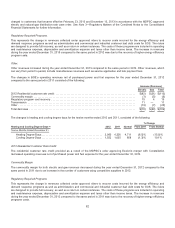

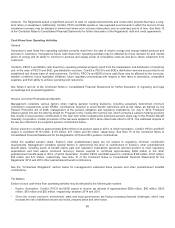

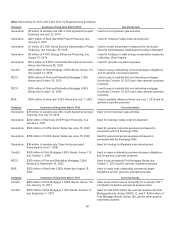

Cash flows providedbyoperationsfor 2013,2012 and2011 by Registrant were asfollows:

2013 2012 2011

Exelon (a)............................................................................... $6,343$6,131 $4,853

Generation (a)............................................................................ 3,887 3,5813,313

ComEd................................................................................. 1,2181,334836

PECO .................................................................................. 747 878 818

BGE (a)................................................................................. 561485 476

(a)Exelon’s andGeneration’s prior year activityincludestheactivityofConstellation,and BGE inthecaseofExelon,fromthemerger effectivedate ofMarch 12,2012

through December 31,2012.Exelon’s andGeneration’s activityfor 2011 is unadjustedfor theeffectsofthemerger. BGE’s prior year activityincludesitsactivityfor

the12months endedDecember 31,2012 and2011.

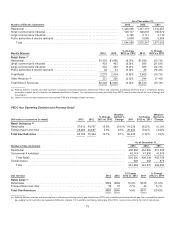

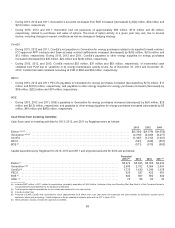

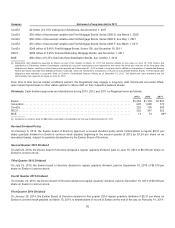

ChangesinExelon’s, Generation’s, ComEd’s, PECO’s and BGE’s cash flows fromoperationswere generallyconsistent with

changesineach Registrant’s respectiveresultsofoperations, asadjustedbychangesinworkingcapital inthe normal courseof

business. Inaddition, significant operatingcash flowimpactsfor theRegistrantsfor 2013,2012 and2011 were asfollows:

Generation

•During2013,2012 and2011,Generation hadnet (payments) receiptsofcounterpartycollateral of$162million, $95 million and

$(410)million,respectively. Net paymentsduring2013 and2012 were primarilydue to market conditionsthat resultedin

changesto Generation’s net mark-to-market position.Dependingupon whether Generation is in a net mark-to-market liabilityor

asset position,collateral mayberequiredto bepostedwithor collectedfromitscounterparties. This collateral maybeinvarious

forms, such ascash, which maybeobtainedthrough theissuanceofcommercial paper,or lettersofcredit.

•During2013,2012 and2011,Generation’s accountsreceivable fromComEd increased(decreased) by $(16) million,$(15)

million and$12 million,respectively, primarilydue to changesinreceivablesfor energy purchasesrelatedto its SFC, ICC-

approvedRFP contractsandfinancial swap contract.

•During2013,2012 and2011,Generation’s accountsreceivable from PECO increased(decreased) by $(17) million,$17million

and$(210)million,respectively.

87