ComEd 2013 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

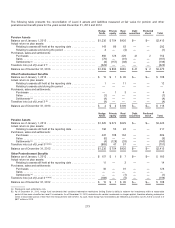

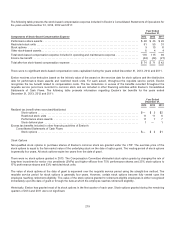

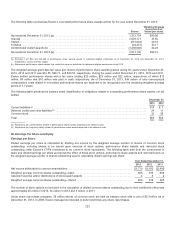

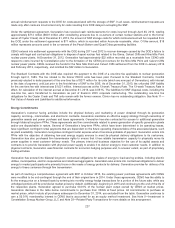

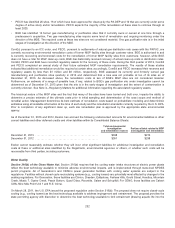

Thefollowingtable summarizesExelon’s nonvestedperformanceshare awards activityfor theyear endedDecember 31,2013:

Shares

Weighted Average

Grant Date Fair

Value (per share)

Nonvestedat December 31,2012 (a).................................................... 1,312,734$40.08

Granted ............................................................................ 2,629,17131.55

Vested ............................................................................. (612,624) 40.13

Forfeited ........................................................................... (24,451)32.17

Undistributedvestedawards(b) ........................................................ (1,290,640)34.28

Nonvestedat December 31,2013 (a).................................................... 2,014,190$32.74

(a) Excludes1,411,824and204,643ofperformanceshare awards issuedto retirement-eligible employeesasofDecember 31,2013 andDecember 31,2012,

respectively, astheyare fullyvested.

(b) Representsperformanceshare awards that vestedbut were not distributedto retirement-eligible employeesduring2013.

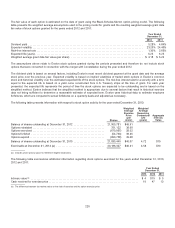

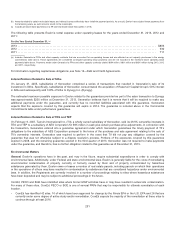

Theweightedaveragegrant date fairvalue (per share)ofperformanceshare awards grantedduringtheyearsendedDecember 31,

2013,2012 and2011 was$31.55, $39.71,and$43.52,respectively. DuringtheyearsendedDecember 31,2013,2012 and2011,

Exelon settledperformanceshareswithafairvalue totaling$26million,$23 million and$22 million,respectively, of which $12

million,$3million and$10 million waspaid incash, respectively. AsofDecember 31,2013,$34million oftotal unrecognized

compensation costsrelatedto nonvestedperformancesharesare expectedto berecognizedover theremainingweighted-average

periodof1.7 years.

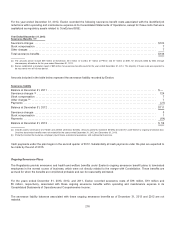

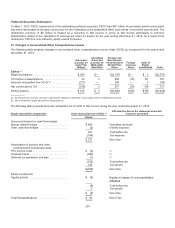

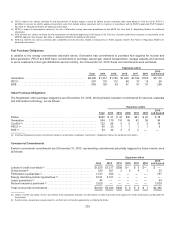

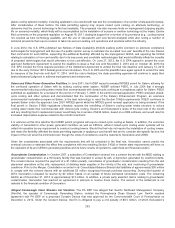

Thefollowingtable presentsthebalancesheet classification ofobligationsrelatedto outstandingperformanceshare awards not yet

settled:

December 31,

2013 2012

Current liabilities(a).................................................................................. $13 $7

Deferredcreditsandother liabilities(b) .................................................................. 2411

Common stock ..................................................................................... 32 35

Total ............................................................................................. $69 $53

(a)Representsthecurrent liabilityrelatedto performanceshare awards expectedto besettledincash.

(b) Representsthe long-termliabilityrelatedto performanceshare awards expectedto besettledincash.

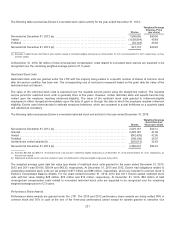

20. Earnings Per Share and Equity

Earnings per Share

Dilutedearnings per share is calculated by dividingnet incomeby theweightedaveragenumber ofsharesofcommon stock

outstanding, includingsharesto beissuedupon exerciseofstock options, performanceshare awards andrestrictedstock

outstandingunder Exelon’s LTIPs consideredto becommon stock equivalents. Thefollowingtable setsforththecomponentsof

basic anddilutedearnings per share andshows theeffectofthesestock options, performanceshare awards andrestrictedstock on

theweightedaveragenumber ofsharesoutstandingusedincalculatingdilutedearnings per share:

Year Ended December 31,

2013 2012 2011

Net income attributable to common shareholders .............................................. $1,719$1,160$2,495

Weightedaveragecommon sharesoutstanding—basic ......................................... 856 816663

Assumedexerciseand/or distributionsofstock-basedawards.................................... 4 32

Weightedaveragecommon sharesoutstanding—diluted ........................................ 860819 665

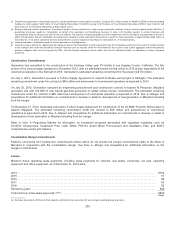

Thenumber ofstock optionsnot includedinthecalculation ofdilutedcommon sharesoutstandingdue to their antidilutiveeffectwas

approximately20 million in 2013,14million in 2012 and9million in 2011.

Under share repurchase programs, 35million sharesofcommon stock are heldastreasurystock withacostof$2.3billion asof

December 31,2013.In 2008, Exelon management decidedto defer indefinitelyanyshare repurchases.

223