ComEd 2013 Annual Report Download - page 149

Download and view the complete annual report

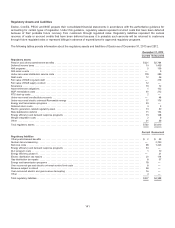

Please find page 149 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Deferred income taxes. Thesecostsrepresent thedifferencebetween themethod by which theregulator allows for therecoveryof

incometaxesandhowincometaxeswouldberecordedunder GAAP. Regulatoryassetsandliabilitiesassociatedwithdeferred

incometaxes, recordedincompliancewiththe authoritativeguidancefor accountingfor certaintypesofregulation andincometaxes,

includethedeferredtaxeffectsassociatedprincipallywithaccelerateddepreciation accountedfor inaccordancewiththe ratemaking

policiesoftheICC, PAPUC and MDPSC, aswell astherevenue impactsthereon,andassumecontinuedrecoveryofthesecostsin

future transmission and distribution rates. For ComEd and BGE, this amount includestheimpactsofareduction inthedeductibility,

for Federal incometaxpurposes, ofcertain retiree healthcare costspursuant to theMarch 2010 HealthCare ReformActs. ComEd

wasgrantedrecoveryoftheseadditional incometaxeson May24, 2011 intheICC’s 2010 Rate Caseorder.Therecoveryperiodfor

thesecostsisthrough May31,2014. For BGE, theseadditional incometaxesare beingamortizedover a 5-year periodthat began in

March 2011 inaccordancewiththeMDPSC’s March 2011 rate order.See Note 14—IncomeTaxesandNote 16—Retirement

Benefitsfor additional information.ComEd, PECO and BGE are not earninga return on theregulatoryasset inbase rates.

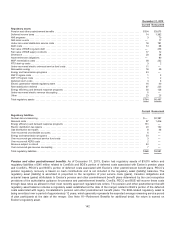

AMI programs. For ComEd, this amount representsoperatingandmaintenanceexpensesandmeter costsassociatedwith

ComEd’s AMI pilot programapprovedintheMay24, 2011, ICC order inComEd’s 2010 rate case.Therecoveryperiods for

operatingandmaintenanceexpensesandmeter costsare through May31,2014, andJanuary1,2020,respectively. Asof

December 31,2013,ComEd hadregulatoryassetsof$35million relatedto accelerateddepreciation costsresultingfromthe early

retirementsofnon-AMI meters, which will beamortizedover an average ten year periodpursuant to theICC approvedAMI

Deployment plan.ComEd is earninga return on themeter costs. For PECO, this amount representsaccelerateddepreciation and

filingandimplementation costsrelatingto thePAPUC-approvedSmart Meter Procurement andInstallation Plan aswell asthe return

on theun-depreciatedinvestment,taxes, andoperatingandmaintenanceexpenses. The approvedplan allows for recoveryoffiling

andimplementation costsincurredthrough December 31,2012.Inaddition,the approvedplan providesfor recoveryofprogram

costs, which includesdepreciation on newequipment placedinservice,beginninginJanuary2011 on full andcurrent basis, which

includesinterestincomeorexpenseontheunder or over recovery. The approvedplan also providesfor recoveryofaccelerated

depreciation on PECO’s non-AMI meter assetsover a 10-year periodendingDecember 31,2020.For BGE, this amount represents

smart grid pilot programcostsaswell astheincremental costsassociatedwithimplementingfull deployment ofasmart grid

program. Pursuant to a MDPSC order,pilot programcostsof$11 million were deferredinaregulatoryasset,and, beginningwiththe

MDPSC’s March 2011 rate order,isearning BGE’s mostcurrent authorizedrate ofreturn.InAugust 2010,theMDPSC approveda

comprehensivesmart grid initiativefor BGE, authorizing BGE to establish aseparate regulatoryasset for incremental costsincurred

to implement theinitiative,includingthe net depreciation andamortization costsassociatedwiththemeters, andan authorizedrate

ofreturn on thesecosts, a portion of which is not recognizedunder GAAPuntilcostrecoverybegins. Additionally, theMDPSC order

requiresthat BGE provethecost-effectiveness ofthe entire smart grid initiativeprior to seekingrecoveryofthecostsdeferredin

theseregulatoryassets. Therefore,thecommencement andtimingoftheamortization ofthesedeferredcostsiscurrentlyunknown.

BGE’s AMI regulatoryasset excludescostsfor non-AMI metersbeingreplacedbyAMI meters, astheMDPSC hasorderedthat the

costrecoveryfor non-AMI meterswill beconsideredinafuture depreciation proceeding.

AMI Meter Events. This amount representstheremainingcostvalue oftheoriginal smart meters, net ofaccumulateddepreciation,

DOE reimbursementsandamountsrecoveredfromthevendor,ofsmart meter deployment that will no longer beused, including

installation andremoval costs. PECO intendedto seekthrough regulatoryrate recoveryinafuture filingwiththePAPUC, any

amountsno recoveredfromthevendor. PECO believedtheamountsincurredfor theoriginal metersandrelatedinstallation and

removal costswere probable ofrecoverybasedon applicable caselawandpast precedent on reasonablyandprudentlyincurred

costs. Assuch, PECO hasdeferredthesecostson Exelon’s and PECO’s ConsolidatedBalanceSheet. PECO will not earn a return

on therecoveryofthesecosts.

Under-recovered distribution services costs. Under EIMA, which becameeffectiveinthefourthquarter of2011,ComEd is

allowedrecoveryof distribution servicescoststhrough aformula rate tariff. Thelegislation providesfor an annual reconciliation ofthe

revenue requirement ineffecttoreflecttheactual coststhat theICC determinesare prudentlyandreasonablyincurredinagiven

year.Theover recoveryassociatedwiththe 2011 reconciliation wasrecoveredthrough ratesover a one-year period, that began in

January2013.Theunder recoveryassociatedwiththe 2012 reconciliation will berecoveredthrough ratesover a one-year period

beginninginJanuary2014. ComEd is earninga return on thesecosts. Theregulatoryasset alsoincludescostsassociatedwith

certain one-timeevents, such aslargestorms, which will berecoveredover a five-year period. AsofDecember 31,2013,the

regulatoryasset wascomprisedof$377 million for the annual reconciliation and $86 million relatedto significant one-timeevents. In

addition to $58 million indeferredstormcosts, net ofamortization,theDecember 31,2013 balance relatedto significant one-time

eventscontains$28million ofmerger andintegration relatedcosts, net ofamortization,incurredasaresult ofthemerger.Asof

December 31,2012,theregulatoryasset wascomprisedof$125million for the annual reconciliation and $84 million relatedto

significant one-timeevents. Inaddition to $58 million indeferredstormcosts, net ofamortization,theDecember 31,2012 balance

relatedto significant one-timeeventscontains$26million ofmerger andintegration relatedcosts, net ofamortization,incurredasa

result ofthemerger.See Note 4—MergersandAcquisitionsfor additional information.

143