ComEd 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

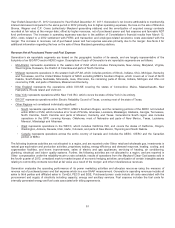

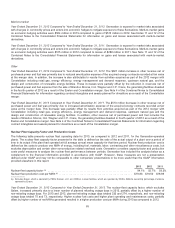

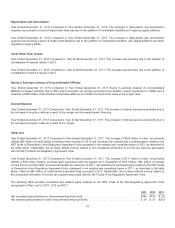

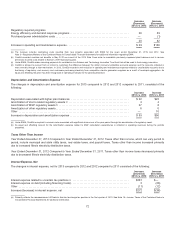

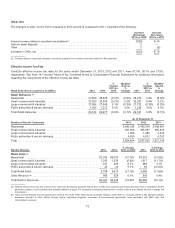

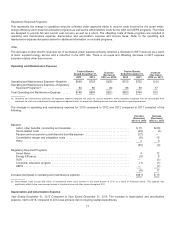

Depreciation and Amortization

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012.Theincreaseindepreciation andamortization

expensewasprimarilyaresult of higher plant balancesdue to theaddition ofConstellation facilitiesandongoingcapital additions.

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011.Theincreaseindepreciation andamortization

expensewasprimarilyaresult of higher plant balancesdue to theaddition ofConstellation facilities; andcapital additionsandother

upgradesto legacy plants.

Taxes Other Than Income

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012.Theincreasewasprimarilydue to theaddition of

Constellation’s financial resultsin 2012.

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011.Theincreasewasprimarilydue to theaddition of

Constellation’s financial resultsin 2012.

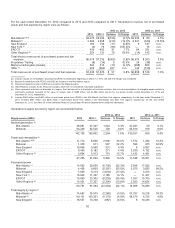

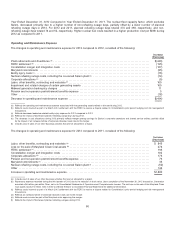

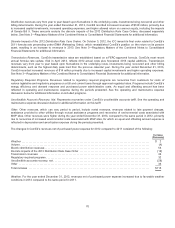

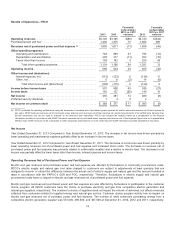

Equity in Earnings (Losses) of Unconsolidated Affiliates

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012.Equityin earnings (losses) ofunconsolidated

affiliatesincreasedprimarilydue to $50million favorable net incomegeneratedfromExelon’s equityinvestment inCENG anda

reduction of $58 million ofamortization ofthebasis differenceinCENG recordedat fairvalue at themerger date.

Interest Expense

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012.Theincreaseininterestexpenseis primarilydue to

theincreasein long-termdebtasaresult ofthemerger andincreasedprojectfinancing.

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011.Theincreaseininterestexpenseis primarilydue to

theincreasein long-termdebtasaresult ofthemerger.

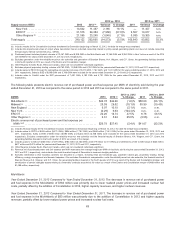

Other, Net

Year Ended December 31, 2013 Compared to Year Ended December 31, 2012.Theincreaseof$129million inother,net primarily

reflects $85 million ofcreditfacilitytermination feesrecordedin 2012 andincreasednet realizedandunrealizedgainsrelatedto the

NDT funds ofGeneration’s Non-RegulatoryAgreement Unitscomparedto net realizedandunrealizedgainsin 2012,asdescribedin

thetable below. Additionally, theincreasereflectsincome relatedto thecontractual elimination ofincometaxexpenseassociated

withtheNDT funds oftheRegulatoryAgreement Units.

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011.Theincreaseof$117million inother,net primarily

reflectsa$36million bargain purchasegainassociatedwiththeAugust 2011 acquisition ofWolfHollow, $32 million ofinterest

incomefroma one-timeNDT fundspecial transfer taxdeduction in 2011,net realizedandunrealizedgainsrelatedto theNDT funds

ofGeneration’s Non-RegulatoryAgreement Unitscomparedto net realizedandunrealizedlossesin 2011,asdescribedinthetable

below, offset by $85 million ofcreditfacilitytermination feesrecordedin 2012.Additionally, theincreasereflectsincome relatedto

thecontractual elimination ofincometaxexpenseassociatedwiththeNDT funds oftheRegulatoryAgreement Units.

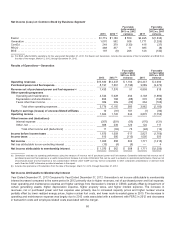

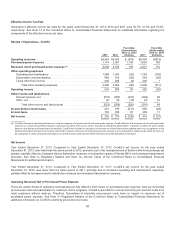

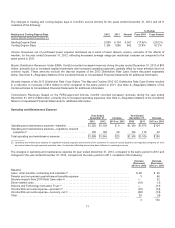

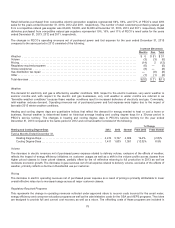

Thefollowingtable providesunrealizedandrealizedgains(losses) on theNDT funds oftheNon-RegulatoryAgreement Units

recognizedinOther,net for 2013,2012 and2011:

2013 2012 2011

Net unrealizedgains(losses) on decommissioningtrustfunds ........................................ $146 $105 $ (4)

Net realizedgains(losses) on sale ofdecommissioningtrustfunds .................................... $ 24$51$(10)

67