ComEd 2013 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2013 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

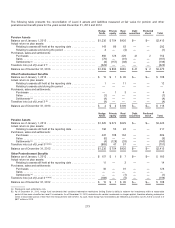

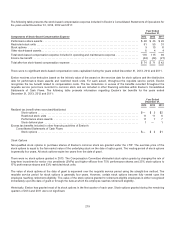

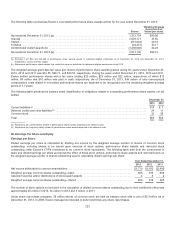

19. Common Stock

Thefollowingtable presentscommon stock authorizedandoutstandingasofDecember 31,2013 and2012:

December 31,

2013 2012

Par Value Shares Authorized Shares Outstanding

Common Stock

Exelon ................................................. no par value 2,000,000,000 857,290,484 854,781,389

ComEd................................................. $12.50250,000,000 127,016,896 127,016,761

PECO ................................................. no par value 500,000,000 170,478,507170,478,507

BGE ................................................... no par value 175,000,000 1,000 1,000

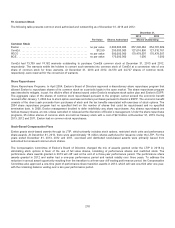

ComEd had73,709and 74,182warrantsoutstandingto purchaseComEd common stock at December 31,2013 and2012,

respectively. Thewarrantsentitle theholdersto convert such warrantsinto common stock ofComEd at a conversion rate ofone

share ofcommon stock for three warrants. At December 31,2013 and2012,24,570and24,727sharesofcommon stock,

respectively, were reservedfor theconversion ofwarrants.

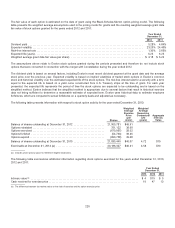

Share Repurchases

Share Repurchase Programs.In April 2004, Exelon’s BoardofDirectorsapprovedadiscretionaryshare repurchase programthat

allowedExelon to repurchasesharesofitscommon stock on a periodic basis inthe open market.Theshare repurchase program

wasintendedto mitigate,in part,thedilutiveeffectofshares issuedunder Exelon’s employee stock option plan andExelon’s ESPP.

Theaggregate value ofthesharesofcommon stock repurchasedpursuant to the programcannot exceedtheeconomic benefit

receivedafter January1,2004due to stock option exercisesandshare purchasespursuant to Exelon’s ESPP. Theeconomic benefit

consistsofthedirectcash proceeds frompurchasesofstock andthetaxbenefitsassociatedwithexercisesofstock options. The

2004share repurchase programhadno specifiedlimitonthenumber ofsharesthat couldbe repurchasedandno specified

termination date.In 2008, Exelon management decidedto defer indefinitelyanyshare repurchases. Anysharesrepurchasedare

heldastreasuryshares, at cost,unless cancelledor reissuedat thediscretion ofExelon’s management.Under theshare repurchase

programs, 35million sharesofcommon stock are heldastreasurystock withacostof$2.3billion at December 31,2013.During

2013,2012 and2011,Exelon hadno common stock repurchases.

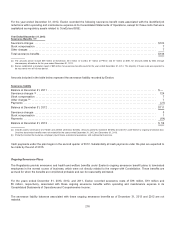

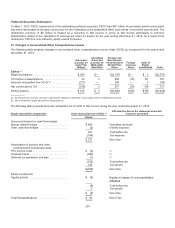

Stock-Based Compensation Plans

Exelon grantsstock-basedawards through its LTIP, which primarilyincludesstock options, restrictedstock unitsandperformance

share awards. At December 31,2013,there were approximately16million sharesauthorizedfor issuanceunder theLTIP. For the

yearsendedDecember 31,2013,2012 and2011,exercisedand distributedstock-basedawards were primarily issuedfrom

authorizedbut unissuedcommon stock shares.

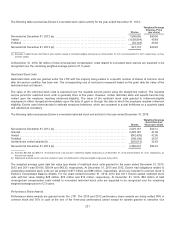

TheCompensation Committee ofExelon’s BoardofDirectorschangedthemix ofawards grantedunder theLTIP in 2013 by

eliminatingstock optionsinfavor oftheuseoffull value shares, consistingofperformancesharesandrestrictedstock. The

performanceshare awards grantedin 2013 will cliff vestattheendofathree-year performance period. The performanceshare

awards grantedin 2012 andearlier hada one-year performance periodandvestedratablyover three years. Toaddress the

reduction in annual awardopportunityresultingfromthe transition to a three-year cliff vestingperformance period, theCompensation

Committee also approveda one-timegrant ofperformanceshare transition awards in 2013, which will vest one-thirdafter one year,

withtheremainingbalancevestingover a two-year performance period.

218