Xerox 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.97Xerox 2011 Annual Report

life of the equipment under a cash sale. The service agreements

involve the payment of fees in return for our performance of repairs

and maintenance. As a consequence, we do not have any significant

product warranty obligations, including any obligations under customer

satisfaction programs. In a few circumstances, particularly in certain

cash sales, we may issue a limited product warranty if negotiated by the

customer. We also issue warranties for certain of our entry-level products,

where full-service maintenance agreements are not available. In these

instances, we record warranty obligations at the time of the sale.

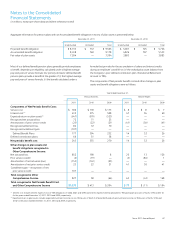

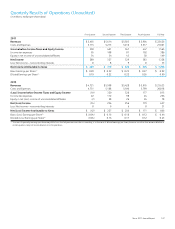

Aggregate product warranty liability expenses for the three years ended

December 31, 2011 were $30, $33 and $34, respectively. Total product

warranty liabilities as of December 31, 2011 and 2010 were

$16 and $18, respectively.

Other Contingencies

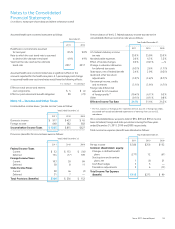

We have issued or provided the following guarantees as of

December 31, 2011:

•$445 for letters of credit issued to i) guarantee our performance under

certain services contracts; ii) support certain insurance programs;

and iii) support our obligations related to the Brazil tax and labor

contingencies.

•$788 for outstanding surety bonds. Certain contracts, primarily those

involving public sector customers, require us to provide a surety bond

as a guarantee of our performance of contractual obligations.

In general, we would only be liable for the amount of these guarantees

in the event of default in our performance of our obligations under

each contract; the probability of which we believe is remote. We believe

that our capacity in the surety markets as well as under various credit

arrangements (including our Credit Facility) is sufficient to allow us to

respond to future requests for proposals that require such credit support.

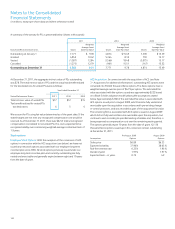

We have service arrangements where we service third-party student

loans in the Federal Family Education Loan program (“FFEL”) on behalf

of various financial institutions. We service these loans for investors

under outsourcing arrangements and do not acquire any servicing rights

that are transferable by us to a third party. At December 31, 2011, we

serviced an FFEL portfolio of approximately 4.0 million loans with an

outstanding principal balance of approximately $56.6 billion. Some

servicing agreements contain provisions that, under certain circumstances,

require us to purchase the loans from the investor if the loan guaranty has

been permanently terminated as a result of a loan default caused by our

servicing error. If defaults caused by us are cured during an initial period,

any obligation we may have to purchase these loans expires. Loans that

we purchase may be subsequently cured, the guaranty reinstated and

the loans repackaged for sale to third parties. We evaluate our exposure

under our purchase obligations on defaulted loans and establish a reserve

for potential losses, or default liability reserve, through a charge to the

provision for loss on defaulted loans purchased. The reserve is evaluated

periodically and adjusted based upon management’s analysis of the

historical performance of the defaulted loans. As of December 31, 2011,

other current liabilities include reserves which we believe to be adequate.

At December 31, 2011, other current liabilities include reserves of

approximately $1.0 for losses on defaulted loans purchased.

•Agreements to indemnify various service providers, trustees and bank

agents from any third-party claims related to their performance on our

behalf, with the exception of claims that result from the third party’s

own willful misconduct or gross negligence.

•Guarantees of our performance in certain sales and services contracts

to our customers and indirectly the performance of third parties

with whom we have subcontracted for their services. This includes

indemnifications to customers for losses that may be sustained as a

result of the use of our equipment at a customer’s location.

In each of these circumstances, our payment is conditioned on the other

party making a claim pursuant to the procedures specified in the particular

contract, which procedures typically allow us to challenge the other party’s

claims. In the case of lease guarantees, we may contest the liabilities

asserted under the lease. Further, our obligations under these agreements

and guarantees may be limited in terms of time and/or amount, and in

some instances, we may have recourse against third parties for certain

payments we made.

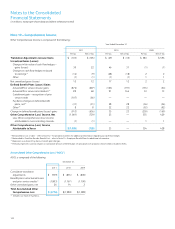

PatentIndemnications

In most sales transactions to resellers of our products, we indemnify

against possible claims of patent infringement caused by our products

or solutions. In addition, we indemnify certain software providers against

claims that may arise as a result of our use or our subsidiaries’, customers’

or resellers’ use of their software in our products and solutions. These

indemnities usually do not include limits on the claims, provided the claim

is made pursuant to the procedures required in the sales contract.

IndemnicationofOfcersandDirectors

Our corporate by-laws require that, except to the extent expressly

prohibited by law, we must indemnify Xerox Corporation’s officers

and directors against judgments, fines, penalties and amounts paid in

settlement, including legal fees and all appeals, incurred in connection

with civil or criminal action or proceedings, as it relates to their services to

Xerox Corporation and our subsidiaries. Although the by-laws provide no

limit on the amount of indemnification, we may have recourse against

our insurance carriers for certain payments made by us. However, certain

indemnification payments (such as those related to “clawback” provisions

in certain compensation arrangements) may not be covered under our

directors’ and officers’ insurance coverage. In addition, we indemnify

certain fiduciaries of our employee benefit plans for liabilities incurred in

their service as fiduciary whether or not they are officers of the Company.

ProductWarrantyLiabilities

In connection with our normal sales of equipment, including those

under sales-type leases, we generally do not issue product warranties.

Our arrangements typically involve a separate full-service maintenance

agreement with the customer. The agreements generally extend

over a period equivalent to the lease term or the expected useful

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)