Xerox 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

51Xerox 2011 Annual Report

Pro-forma Basis

To better understand the trends in our business, we discuss our 2011 and

2010 operating results by comparing them against adjusted prior-period

results which include ACS historical results for the comparable period. We

acquired ACS on February 5, 2010 and ACS’s results subsequent to that

date are included in our reported results. Accordingly, for the comparison

of our reported 2011 results to 2010, we included ACS’s 2010 estimated

results for the period January 1 through February 5, 2010 in our reported

2010 results (pro-forma 2010). For the comparison of our reported 2010

results to 2009, we included ACS’s 2009 estimated results for the period

February 6 through December 31 in our reported 2009 results (pro-

forma 2009). We refer to these comparisons against adjusted results as

“pro-forma” basis comparisons. ACS’s historical results for these periods

have been adjusted to reflect fair value adjustments related to property,

equipment and computer software as well as customer contract costs. In

addition, adjustments were made for deferred revenue, exited businesses

and other material non-recurring costs associated with the acquisition.

We believe comparisons on a pro-forma basis provide a more enhanced

assessment than the actual comparisons, given the size and nature of

the ACS acquisition. In addition, the acquisition of ACS increased the

proportion of our revenue from services, which has a lower gross margin

and SAG as a percentage of revenue than we historically experienced

when Xerox was primarily a technology company. We believe the pro-

forma basis comparisons provide investors with a better understanding

and additional perspective of the expected trends in our business as well

as the impact of the ACS acquisition on the Company’s operations.

•Acquisition-relatedcosts(2010and2009only): We incurred

significant expenses in connection with our acquisition of ACS

which we generally would not have otherwise incurred in the periods

presented as a part of our continuing operations. Acquisition-related

costs include transaction and integration costs, which represent

external incremental costs directly related to completing the

acquisition and the integration of ACS and Xerox. We believe it is

useful for investors to understand the effects of these costs on our

total operating expenses.

•Otherdiscrete,unusualorinfrequentcostsandexpenses: In

addition, we have also excluded the following additional items given

the discrete, unusual or infrequent nature of the item on our results of

operations for the period: 1) Loss on early extinguishment of liability

(2011 and 2010), 2) Medicare subsidy tax law change (income tax

effect only)(2010), 3) ACS shareholders’ litigation settlement (2010)

and 4) Venezuela devaluation (2010). We believe the exclusion of

these items allows investors to better understand and analyze the

results for the period as compared to prior periods as well as expected

trends in our business.

In addition to the above excluded items, the calculation of operating

income and margin also excludes other expenses, net which is primarily

composed of non-financing interest expense, as well a curtailment gain

in 2011.

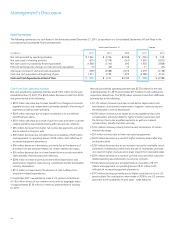

NetIncomeandEPSReconciliation:

Year Ended December 31,

2011(1) 2010

(in millions; except per share amounts) Net Income EPS Net Income EPS

As Reported $ 1,295 $ 0.90 $ 606 $ 0.43

Adjustments:

Amortization of intangible assets 248 0.17 194 0.14

Loss on early extinguishment of liability 20 0.01 10 0.01

Xerox and Fuji Xerox restructuring charges 355 0.26

ACS acquisition-related costs 58 0.04

ACS shareholders’ litigation settlement 36 0.03

Venezuela devaluation costs 21 0.02

Medicare subsidy tax law change 16 0.01

Adjusted $ 1,563 $ 1.08 $ 1,296 $ 0.94

Weighted average shares for adjusted EPS(2) 1,444 1,378

(1) For 2011, we only adjusted for Amortization of intangible assets and the Loss on early extinguishment of liability.

(2) Average shares for the calculation of adjusted EPS for 2011 were 1,444 million and include 27 million of shares associated with the Series A convertible preferred stock and therefore

the related 2011 annual dividend of $24 million is excluded. Year 2010 shares of 1,378 million also include pro-rated portion of the 27 million shares associated with the Series

A convertible preferred stock and therefore the 2010 annual dividend of $21 million associated with those shares was excluded. We evaluate the dilutive effect of the Series A

convertible preferred stock on an “if-converted” basis.