Xerox 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion

41Xerox 2011 Annual Report

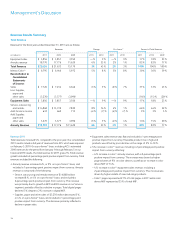

Services segment revenues for the three years ended December 31, 2011 were as follows:

Revenue Change Pro-forma(1) Change

(in millions) 2011 2010 2009 2011 2010 2011 2010

Business Processing Outsourcing $ 6,035 $ 5,112 $ 94 18% * 8% 8%

Document Outsourcing 3,584 3,297 3,382 9% (3)% 9% (3)%

Information Technology

Outsourcing 1,326 1,249 — 6% * (4)% —

Less: Intra-segment Elimination (108) (21) — * * * —

Total Services Revenue $ 10,837 $ 9,637 $ 3,476 12% 177% 6% 3%

* Percentage not meaningful.

Note:The Services segment is discussed on a pro-forma(1) basis. In

2011, for comparison purposes, we adjust our historical 2010 results

to include ACS’s 2010 estimated results for the period from January 1

through February 5, 2010. In 2010, for comparison purposes, we adjust

our historical 2009 results to include ACS’s 2009 estimated results for the

period from February 6 through December 31, 2009. We believe these

pro-forma comparisons provide a perspective on the impact of the ACS

acquisition on our results and trends. Refer to the “Non-GAAP Financial

Measures” section for a further explanation and discussion of this non-

GAAP presentation.

Revenue2011

Services revenue of $10,837 million increased 12%, or 6% on a pro-

forma(1) basis, with no impact from currency.

•BPO revenue had pro-forma(1) revenue growth of 8% and represented

55% of total Services revenue. The growth in BPO was primarily driven

by acquisitions over the past two years consistent with our strategy

to expand our service offerings through “tuck-in” acquisitions. BPO

growth was also driven to a lesser extent by growth in the healthcare

payer, human resources services, business process solutions and

transportation solutions businesses.

•DO revenue increased 9%, including a 2-percentage point positive

impact from currency, and represented 33% of total Services revenue.

The increase reflects an improving growth trend from our partner print

services offerings as well as new signings.

•ITO revenue on a pro-forma(1) basis decreased 4% and represented

12% of total Services revenue. The decrease in ITO revenue was

driven by lower third-party equipment sales as well as the impact

of lower contract renewals, partially offset by growth in new

commercial business.

SegmentMargin2011

Services segment margin of 11.1% decreased 0.6-percentage points, or

0.3-percentage points on a pro-forma(1) basis, from the prior year, as the

gross margin decline, which was driven by the ramping of new services

contracts and the impact of lower contract renewals, more than offset the

lower costs and expenses from restructuring and synergy savings.

Metrics

Pipeline

Our total services sales pipeline at December 31, 2011, including synergy

opportunities, grew 5% over the prior year. We have been able to maintain

a significant pipeline since the ACS acquisition. This sales pipeline includes

the Total Contract Value (“TCV”) of new business opportunities that

potentially could be contracted within the next six months and excludes

business opportunities with estimated annual recurring revenue in excess

of $100 million.

Signings

Signings are defined as estimated future revenues from contracts signed

during the period, including renewals of existing contracts.

TCV represents the estimated future contract revenue for pipeline or

signed contracts for signings, as applicable.

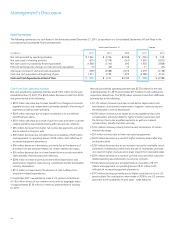

Signings were as follows:

Year Ended December 31,

(in billions) 2011 2010

BPO $ 6.8 $ 10.0

DO 4.4 3.3

ITO 3.4 1.3

Total Signings $ 14.6 $ 14.6

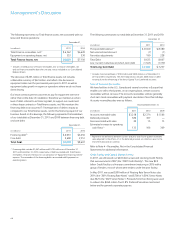

Services signings were an estimated $14.6 billion in TCV for 2011 and were

flat as compared to the prior year and were impacted by the cyclicality of

large deals, particularly the California Medicaid signing in 2010. However,

signings did trend positively in 2011, increasing sequentially for the last

three quarters of the year. Estimated services signings of $14.6 billion in

2010 increased by 13% as compared to the comparable prior-year period,

driven by strong signings in all lines of businesses.