Xerox 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93Xerox 2011 Annual Report

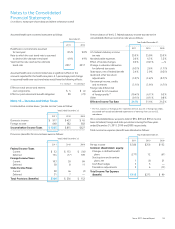

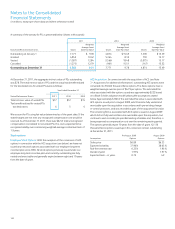

A reconciliation of the U.S. federal statutory income tax rate to the

consolidated effective income tax rate was as follows:

Year Ended December 31,

2011 2010 2009

U.S. federal statutory income

tax rate 35.0% 35.0% 35.0%

Nondeductible expenses 2.0% 6.3% 3.2%

Effect of tax law changes 0.2% (0.2)% —%

Change in valuation allowance

for deferred tax assets (0.3)% 2.6% (1.7)%

State taxes, net of federal benefit 2.4% 2.0% (0.2)%

Audit and other tax return

adjustments (1.0)% (3.6)% (8.7)%

Tax-exempt income, credits

and incentives (3.1)% (3.9)% (4.7)%

Foreign rate differential

adjusted for U.S. taxation

of foreign profits(1) (10.4)% (6.7)% 0.5%

Other (0.1)% (0.1)% 0.8%

Effective Income Tax Rate

24.7% 31.4% 24.2%

(1) The “U.S. taxation of foreign profits” represents the U.S. tax, net of foreign tax credits,

associated with actual and deemed repatriations of earnings from our non-U.S.

subsidiaries.

On a consolidated basis, we paid a total of $94, $49 and $78 in income

taxes to federal, foreign and state jurisdictions during the three years

ended December 31, 2011, 2010 and 2009, respectively.

Total income tax expense (benefit) was allocated as follows:

Year Ended December 31,

2011 2010 2009

Pre-tax income $ 386 $ 256 $ 152

Common shareholders’ equity:

Changes in defined benefit

plans (277) 12 (61)

Stock option and incentive

plans, net 1 (6) 21

Cash flow hedges 3 5 —

Translation adjustments 2 6 (13)

Total Income Tax Expense

(Benefit) $ 115 $ 273 $ 99

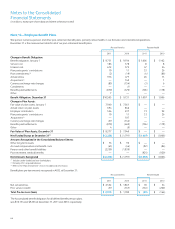

Assumed healthcare cost trend rates were as follows:

December 31,

2011 2010

Healthcare cost trend rate assumed

for next year 8.5% 9.0%

Rate to which the cost trend rate is assumed

to decline (the ultimate trend rate) 4.9% 4.9%

Year that the rate reaches the ultimate

trend rate 2017 2017

Assumed healthcare cost trend rates have a significant effect on the

amounts reported for the healthcare plans. A 1-percentage point change

in assumed healthcare cost trend rates would have the following effects:

1% increase 1% decrease

Effect on total service and interest

cost components $ 5 $ (4)

Effect on post-retirement benefit obligation 89 (72)

Note 15 – Income and Other Taxes

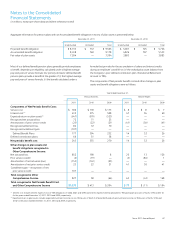

Income before income taxes (“pre-tax income”) was as follows:

Year Ended December 31,

2011 2010 2009

Domestic income $ 917 $ 433 $ 45

Foreign income 648 382 582

Income before Income Taxes $ 1,565 $ 815 $ 627

Provisions (benefits) for income taxes were as follows:

Year Ended December 31,

2011 2010 2009

Federal Income Taxes

Current $ 52 $ 153 $ (50)

Deferred 134 (17) 109

Foreign Income Taxes

Current 103 59 84

Deferred 38 8 11

State Income Taxes

Current 28 46 (2)

Deferred 31 7 —

Total Provisions (Benefits) $ 386 $ 256 $ 152

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)