Xerox 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

recognition of changes in fair value over time (generally two years)

versus immediate recognition of changes in fair value. Our expected

rate of return on plan assets is applied to the calculated asset value to

determine the amount of the expected return on plan assets to be used

in the determination of the net periodic pension cost. The calculated

value approach reduces the volatility in net periodic pension cost that

would result from using the fair market value approach.

The discount rate is used to present value our future anticipated benefit

obligations. In estimating our discount rate, we consider rates of return

on high-quality, fixed-income investments included in various published

bond indexes, adjusted to eliminate the effects of call provisions and

differences in the timing and amounts of cash outflows related to the

bonds, as well as the expected timing of pension and other benefit

payments. In the U.S. and the U.K., which comprise approximately

75% of our projected benefit obligation, we consider the Moody’s

Aa Corporate Bond Index and the International Index Company’s

iBoxx Sterling Corporate AA Cash Bond Index, respectively, in the

determination of the appropriate discount rate assumptions. Refer to

Note 14 – Employee Benefit Plans for further information.

Each year, the difference between the actual return on plan assets and

the expected return on plan assets, as well as increases or decreases in the

benefit obligation as a result of changes in the discount rate, are added to

or subtracted from any cumulative actuarial gain or loss from prior years.

This amount is the net actuarial gain or loss recognized in Accumulated

other comprehensive loss and is subject to subsequent amortization to

net periodic pension cost in future periods over the remaining service

lives of the employees participating in the pension plan. In plans where

substantially all participants are inactive, the amortization period for net

actuarial gains and losses is the average remaining life expectancy of the

plan participants.

ForeignCurrencyTranslationandRe-measurement

The functional currency for most foreign operations is the local currency.

Net assets are translated at current rates of exchange and income,

expense and cash flow items are translated at average exchange rates

for the applicable period. The translation adjustments are recorded in

Accumulated other comprehensive loss.

The U.S. Dollar is used as the functional currency for certain foreign

subsidiaries that conduct their business in U.S. Dollars. A combination of

current and historical exchange rates is used in re-measuring the local

currency transactions of these subsidiaries and the resulting exchange

adjustments are included in income.

Foreign currency losses were $12, $11 and $26 in 2011, 2010 and 2009,

respectively, and are included in Other expenses, net in the accompanying

Consolidated Statements of Income.

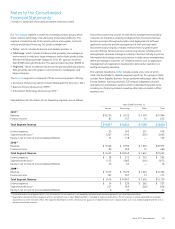

Note 2 – Segment Reporting

Our reportable segments are aligned with how we manage the business

and view the markets we serve. We report our financial performance

based on the following two primary reportable segments – Technology

and Services. Our Technology segment includes the sale and support

of a broad range of document systems from entry level to high-end.

Our Services segment operations involve delivery of a broad range of

outsourcing services including document, business processing and IT

outsourcing services.

Research,DevelopmentandEngineering(“RD&E”)

Research, development and engineering costs are expensed as incurred.

Sustaining engineering costs are incurred with respect to ongoing product

improvements or environmental compliance after initial product launch.

Our RD&E expense was as follows:

Year Ended December 31,

2011 2010 2009

R&D $ 613 $ 653 $ 713

Sustaining engineering 108 128 127

Total RD&E Expense $ 721 $ 781 $ 840

RestructuringCharges

Costs associated with exit or disposal activities, including lease termination

costs and certain employee severance costs associated with restructuring,

plant closing or other activity, are recognized when they are incurred.

In those geographies where we have either a formal severance plan

or a history of consistently providing severance benefits representing

a substantive plan, we recognize severance costs when they are both

probable and reasonably estimable. Refer to Note 9 – Restructuring and

Asset Impairment Charges for further information.

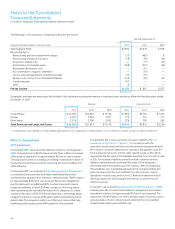

PensionandPost-RetirementBenetObligations

We sponsor defined benefit pension plans in various forms in several

countries covering employees who meet eligibility requirements. Retiree

health benefit plans cover U.S. and Canadian employees for retiree

medical costs. We employ a delayed recognition feature in measuring

the costs of pension and post-retirement benefit plans. This requires

changes in the benefit obligations and changes in the value of assets set

aside to meet those obligations to be recognized not as they occur, but

systematically and gradually over subsequent periods. All changes are

ultimately recognized as components of net periodic benefit cost, except

to the extent they may be offset by subsequent changes. At any point,

changes that have been identified and quantified, but not recognized as

components of net periodic benefit cost, are recognized in Accumulated

Other Comprehensive Loss, net of tax.

Several statistical and other factors that attempt to anticipate future

events are used in calculating the expense, liability and asset values

related to our pension and retiree health benefit plans. These factors

include assumptions we make about the discount rate, expected return

on plan assets, rate of increase in healthcare costs, the rate of future

compensation increases and mortality. Actual returns on plan assets are

not immediately recognized in our income statement, due to the delayed

recognition requirement. In calculating the expected return on the plan

asset component of our net periodic pension cost, we apply our estimate

of the long-term rate of return on the plan assets that support our

pension obligations, after deducting assets that are specifically allocated

to Transitional Retirement Accounts (which are accounted for based on

specific plan terms).

For purposes of determining the expected return on plan assets, we

utilize a calculated value approach in determining the value of the

pension plan assets, rather than a fair market value approach. The

primary difference between the two methods relates to systematic

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)