Xerox 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

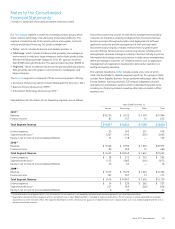

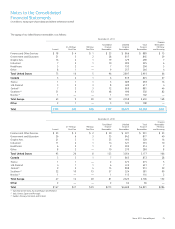

The following table is a rollforward of the allowance for doubtful finance receivables as well as the related investment in finance receivables:

United States Canada Europe Other(3) Total

Allowance for Credit Losses:

Balance at December 31, 2009 $ 99 $ 33 $ 87 $ 3 $ 222

Provision 47 22 59 — 128

Charge-offs (58) (23) (59) — (140)

Recoveries and other(1) 3 5 (6) — 2

Balance at December 31, 2010 91 37 81 3 212

Provision 15 11 74 — 100

Charge-offs (31) (17) (59) (1) (108)

Recoveries and other(1) — 2 (5) — (3)

Balance at December 31, 2011 $ 75 $ 33 $ 91 $ 2 $ 201

Finance Receivables Collectively Evaluated for Impairment:

December 31, 2010(2) $ 3,177 $ 872 $ 2,706 $ 66 $ 6,821

December 31, 2011(2) $ 2,993 $ 825 $ 2,630 $ 108 $ 6,556

(1) Includes the impacts of foreign currency translation and adjustments to reserves necessary to reflect events of non-payment such as customer accommodations and contract

terminations.

(2) Total Finance receivables exclude residual values of $7 and $11, and the allowance for credit losses of $201 and $212 at December 31, 2011 and 2010, respectively.

(3) Includes developing market countries and smaller units.

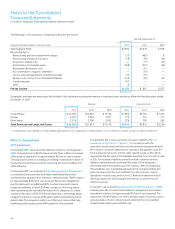

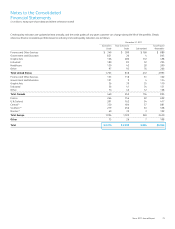

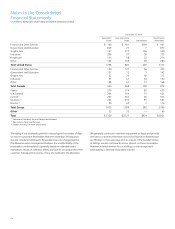

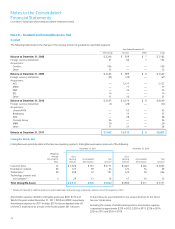

In the U.S. and Canada, customers are further evaluated or segregated by

class based on industry sector. The primary customer classes are Finance

& Other Services, Government & Education; Graphic Arts; Industrial;

Healthcare and Other. In Europe, customers are further grouped by class

based on the country or region of the customer. The primary customer

classes include the U.K./Ireland, France and the following European regions

– Central, Nordic and Southern. These groupings or classes are used to

understand the nature and extent of our exposure to credit risk arising

from finance receivables.

We evaluate our customers based on the following credit quality

indicators:

•Investmentgrade:This rating includes accounts with excellent to

good business credit, asset quality and the capacity to meet financial

obligations. These customers are less susceptible to adverse effects

due to shifts in economic conditions or changes in circumstance.

The rating generally equates to a Standard & Poors (S&P) rating of

BBB- or better. Loss rates in this category are normally minimal at less

than 1%.

•Non-investmentgrade: This rating includes accounts with average

credit risk that are more susceptible to loss in the event of adverse

business or economic conditions. This rating generally equates to a

BB S&P rating. Although we experience higher loss rates associated

with this customer class, we believe the risk is somewhat mitigated

by the fact that our leases are fairly well dispersed across a large and

diverse customer base. In addition, the higher loss rates are largely

offset by the higher rates of return we obtain with such leases. Loss

rates in this category are generally in the range of 2% to 4%.

•Substandard: This rating includes accounts that have marginal

credit risk such that the customer’s ability to make repayment is

impaired or may likely become impaired. We use numerous strategies

to mitigate risk including higher rates of interest, prepayments, personal

guarantees, etc. Accounts in this category include customers who were

downgraded during the term of the lease from investment- and non-

investment-grade evaluation when the lease was originated. Accordingly

there is a distinct possibility for a loss of principal and interest or

customer default. The loss rates in this category are around 10%.

Notes to the Consolidated

Financial Statements

(in millions, except per-share data and where otherwise noted)